Gold Price Forecast: Bulls looking to seize control above $1,720 pivot

- A combination of factors pushed gold to two-week tops on Tuesday.

- Sliding US bond yields undermined the USD and remained supportive.

- A softer risk tone further drove flows towards the safe-haven XAU/USD.

Gold built on its recent bounce from multi-month lows, around the $1,677-76 region and edged higher during the first part of the trading action on Tuesday. The momentum was sponsored by a combination of factors and pushed the XAU/USD to two-week tops during the Asian session. The US dollar languished near one-week lows, which, in turn, extended some support to the dollar-denominated commodity. Despite Friday's stellar US monthly jobs report, the USD bulls opted to take some profits off the table amid declining US Treasury bond yields. This, in turn, was seen as another factor that benefitted the non-yielding yellow metal. Apart from this, a softer tone around the US equity markets further drove some flows towards the safe-haven XAU/USD.

That said, the upbeat outlook for the US economy might keep a lid on any further gains for the precious metal. Investors remain hopeful about the prospects for a relatively faster US economic recovery from the pandemic amid the impressive pace of coronavirus vaccinations. This, along with the Biden administration's planned stimulus of more than $2 trillion, has been fueling speculations about a possible uptick in US inflation and raised doubts that the Fed would retain ultra-low interest rates for a longer period. This should help limit any meaningful decline in the US bond yields and further collaborate to cap the upside for the metal. Hence, the key focus will remain on the release of the FOMC meeting minutes on Wednesday.

Apart from this, investors will also take cues from a scheduled speech by Fed Chair Jerome Powell on Thursday. This will play a key role in influencing the USD in the near term and provide a fresh directional impetus to the commodity. In the meantime, the broader market risk sentiment, the US bond yields and the USD price dynamics will be looked upon for some meaningful trading opportunities amid absent relevant market-moving economic releases on Tuesday.

Short-term technical outlook

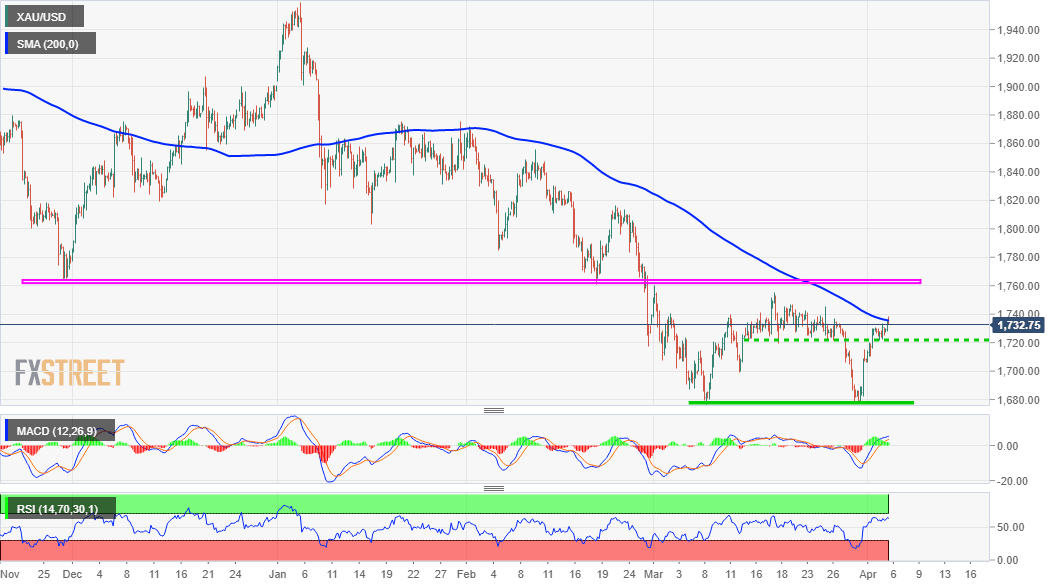

From a technical perspective, the ongoing positive move validates the formation of a bullish double-bottom near the $1,677-76 area. The pattern, however, will be confirmed once the metal breakthrough a previous strong support breakpoint, now turned resistance near the $1,760-65 region. In the meantime, the $1,742-44 supply zone could act as an intermediate barrier.

On the flip side, the $1,720 horizontal level now becomes immediate strong support to defend. This is followed by the $1,700 mark, which if broken decisively will negate any positive bias and turn the commodity vulnerable to retest the $1,677-76 region. Some follow-through selling will be seen as a fresh trigger for bearish traders and pave the way for an extension of the recent downward trajectory towards the next relevant support near the $1625 level. The metal could eventually drop to the $1600 round-figure mark in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.