Gold Price Forecast: Bullish, resilient to dollar’s strength

- Gold prices got unexpected support from rallying oil.

- US economy in better shape than that of their counterparts.

- Spot gold has room to extend its recovery at the beginning of the upcoming week.

Gold prices are heading into the close with modest weekly losses, with spot gold steady above $1,600 a troy ounce. The commodity eased throughout the first half of the week, amid persistent demand for the greenback and the better performance of equities. This last could be attributed to easing panic, but by no means to a sudden spike in optimism, as investors have nothing to cheer.

The bright metal fell as low as 1,565.04, getting unexpected support on Thursday from resurgent oil prices, these last, triggered by comments from US President Trump. Trump tweeted that he had talks with Russian President and Saudi Crown Prince, urging them to resume talks. The OPEC+ called for an emergency meeting that would take place this next week, to discuss production cuts. The good news also lifted equities, although the coronavirus pandemic continues to overshadow it all.

US in better shape despite the crisis

The crisis that keeps the world on pause gives no sign of receding. The number of global cases is above 1M with roughly a quarter of those in the US. The death toll has surpassed 55,000, with Italy and Spain reporting almost 50% deaths of such total. For sure, numbers are tricky as not every country is testing the same but clearly shows that the end is not yet clear. The only positive news is that the contagion curve seems to be flattening in Italy and Spain, although the number of daily deaths is shocking.

US data released these days were mixed, as the March official ISM Manufacturing PMI surprised to the upside with 49.1, while the ISM Services PMI came in at 52.5, much better than the 44 expected. Somehow, such numbers indicate that the US is still in better shape than its counterparts, further backing the dollar’s gains.

The US Nonfarm Payroll report didn’t add much to the picture, despite the horrid numbers published this Friday The US economy lost 701K positions in March, while the unemployment claim jumped from 3.4% to 4.4%. And that does not fully reflect the situation, as data were collected at least 10 days ahead of the month-end, not reflecting the outrageous surge in weekly unemployment claims. Even further, almost all data were collected before the US issued the stay at home orders.

For the upcoming days, the focus will remain on the pandemic developments, while some extra attention will fall on the FOMC Meeting Minutes, amid possible clues on whether is next in the easing front.

Spot Gold Technical Outlook

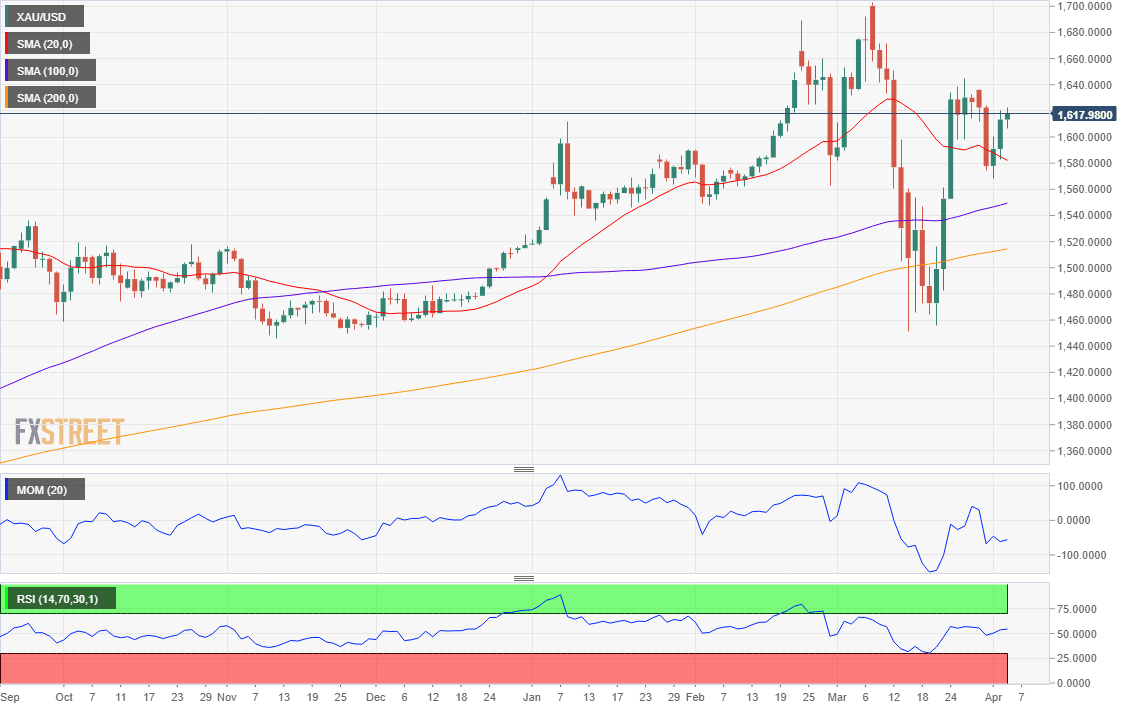

Spot gold is ending the week again above the 61.8% retracement of its March slump at 1,606.60. The weekly chart shows that it trimmed most of its losses, while the decline stalled above a still bullish 20 SMA. This last, converges with the 38.2% retracement of the same decline, reinforcing the strength of the level, at 1,547.20. Technical indicators have turned lower but hold within positive levels, limiting the chances of a bearish extension.

In the daily chart, the metal has settled above all of its moving averages, although the shorter one keeps heading south. The Momentum indicator maintains its bullish slope, entering overbought territory, although the RSI is flat at around 55.

Overall, the risk remains skewed to the upside, with 1,643.90, the high from the last week of March being the immediate resistance ahead of 1,660.00. Above this last, there’s room for an extension toward 1,703.19. Supports for the upcoming days are at 1,606.60, followed by 1,565 and them by the mentioned Fibonacci level at 1,547.20.

Gold Sentiment Poll

The FXStreet Forecast Poll indicates that bulls retain control of the metal, seen advancing in the three time-frame under study, although no fireworks are to be expected. Gold is seen on average between the 1,625 and 1,645 in the upcoming weeks.

The Overview chart suggests that bulls are beginning to hesitate, as the moving averages are losing their bullish momentum, particularly in the weekly and quarterly perspectives. Still, there are no clear signs of upward exhaustion just yet, neither of increasing downward strength.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.