Gold Price Forecast: Broad dollar’s weakness makes gold shine

XAU/USD Current price: $1,834.29

- US Treasury yields retreated from their recent highs, putting pressure on the dollar.

- The market’s attention now shifts to US inflation data to be out on Thursday.

- XAU/USD has room to extend gains to January monthly high at $1,853.83 a troy ounce.

Gold is up for a fourth consecutive trading day, changing hands at fresh weekly highs above $1,834.00 a troy ounce. The bright metal benefited from the greenback's softer tone, the latter triggered by retreating US government bond yields alongside persistent strength in equities markets.

The yield on the 10-year Treasury note retreated from its weekly high of 1.97% and currently stands at around 1.93%. Global stocks, on the other hand, are on the run, with Wall Street firmly up well into the American session amid solid earnings reports and a bounce in the tech sector.

Elsewhere, the macroeconomic calendar remained empty of relevant figures that could affect the USD price. That situation will change on Thursday, as the country will release January inflation figures. The Consumer Price Index is foreseen raising to 7.3% YoY from a multi-decade high of 7% in December, while the core reading is expected at 5.9%.

Gold price short-term technical outlook

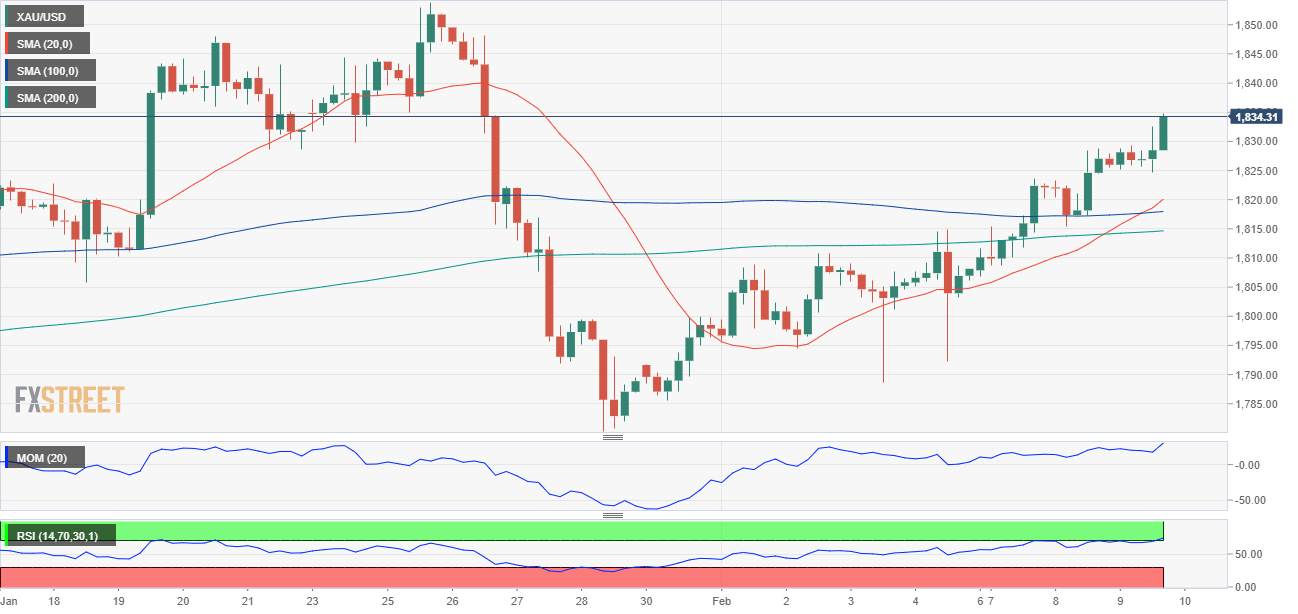

The XAU/USD pair has broken above the 61.8% retracement of its latest daily decline, which opens the door for an extension towards the year high at $1,853.83. The daily chart hints at an increased bullish potential, as the bright metal keeps advancing above directionless moving averages, while the RSI indicator extends its advance at around 58. The Momentum indicator, however, remains directionless around its midline.

The 4-hour chart supports a bullish continuation, as gold trades above all of its moving averages and as the 20 SMA crosses above the longer ones. Meanwhile, technical indicators turned back north near overbought readings, reflecting stronger buying interest. The immediate resistance level is 1,842.90, with little in the way towards the 1,853.80 price zone.

Support levels: 1,825.60 1,818.50 1,808.10

Resistance levels: 1,842.90 1,853.85 1,865.70

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.