Gold Price Forecast: Bears pressuring, but bulls not giving up

XAU/USD Current price: $1,791.72

- Demand for the greenback overshadows that of gold in risk-averse scenarios.

- The Bank of Canada maintained its monetary policy unchanged as expected.

- XAU/USD trades sub-1,800 and has room to extend its slump.

Spot gold bottomed for the day at 1,782.09 and currently trades at around 1,792. The bright metal accelerated its slump during US trading hours and following the Bank of Canada´s monetary policy announcement. The American currency was already advancing but got a short-lived boost from the BOC as it retained the status quo, keeping its monetary policy unchanged as expected.

Additionally, European indexes closed in the red although off intraday lows. Wall Street also trades in the red, but trimmed most of its early losses. Meanwhile, US Treasury yields eased from their recent highs, with that on the 10-Year note currently around 1.35%.

Gold price short-term technical outlook

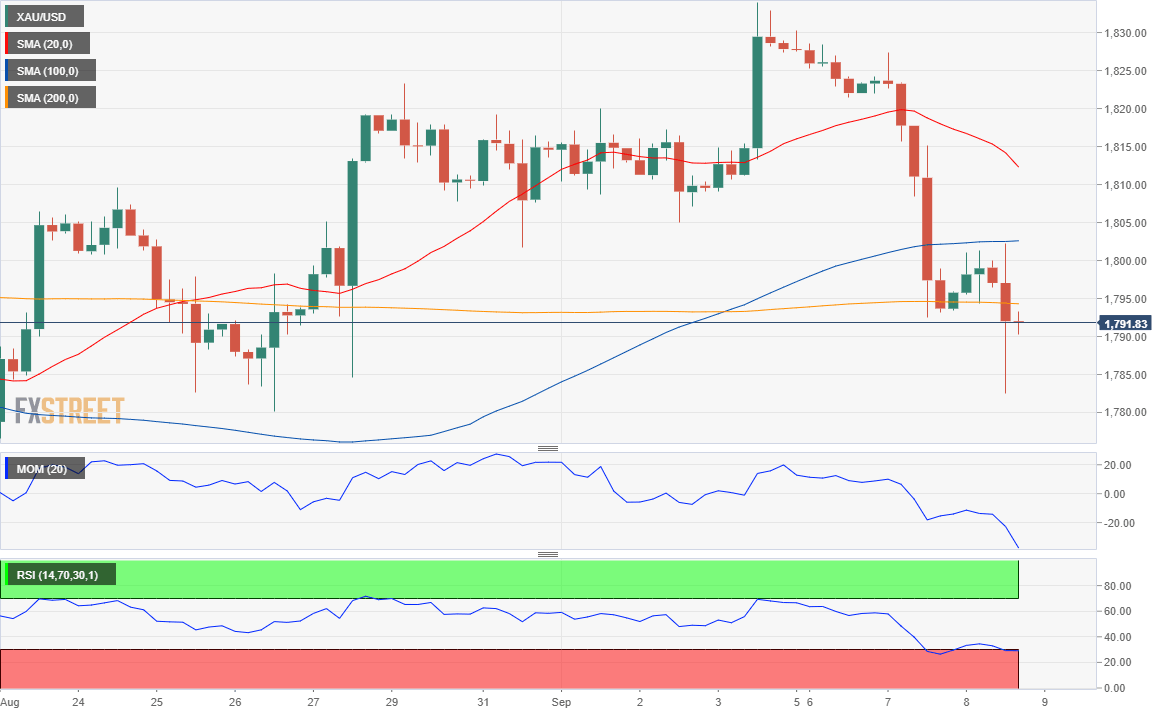

XAU/USD has fallen for three days in a row and has room to extend its slump. The daily chart shows that it has broken below all of its moving averages, with the 20 SMA maintaining its bullish slope and converging with a Fibonacci resistance, the 50% retracement of the March/June advance at 1,769.10, the immediate resistance level. Meanwhile, technical indicators have partially lost their bearish strength, the Momentum around its 100 level and the RSI at 46, the latter skewing the risk to the downside.

The 4-hour chart shows that the pair is also trading below all of its moving averages, while technical indicators consolidate at weekly lows and near oversold readings. The slump could gather momentum on a break below 1,769.10, the 61.8% retracement of the mentioned rally.

Support levels: 1,787.55 1,769.10 1,760.00

Resistance levels: 1,796.70 1,810.40 1,825.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.