Gold Price Forecast: Bears eye a daily close below 100-DMA amid dollar’s upsurge

- Gold flirts with six-week lows as King dollar holds the reigns.

- Coronavirus resurgence fed concerns over global growth boost the USD.

- A daily closing below 100-DMA could offer fresh zest to the bears.

Gold (XAU/USD) finally breached the August low of $1863 on Wednesday, as the sell-off continued amid persistent US dollar strength against its higher-yielding rivals. The yellow shed another 2% to reach the lowest levels in six weeks at $1856 before settling the day at $1863. Concerns over the economic recovery in the US and Europe resurfaced, amid intensifying second-wave of the coronavirus, which further fuelled the dollar’s demand as a safe-haven. Dismal Markit Business PMI reports from both continents combined with the US Federal Reserve’s (Fed) reluctance over additional stimulus dampened the market mood, as gold tumbled alongside US equities. Further, Congress’ failure to pass an additional fiscal stimulus also weighed on the sentiment.

Looking ahead, the dollar’s haven demand is likely to remain in vogue, as coronavirus fears mount. However, should the sentiment on the global markets turn upbeat, the greenback could see some corrective move lower, offering some reprieve to the gold bulls. The US Jobless Claims and Day 3 of the Fed Chair Jerome Powell’s testimony will be closely watched for some near-term trading opportunities.

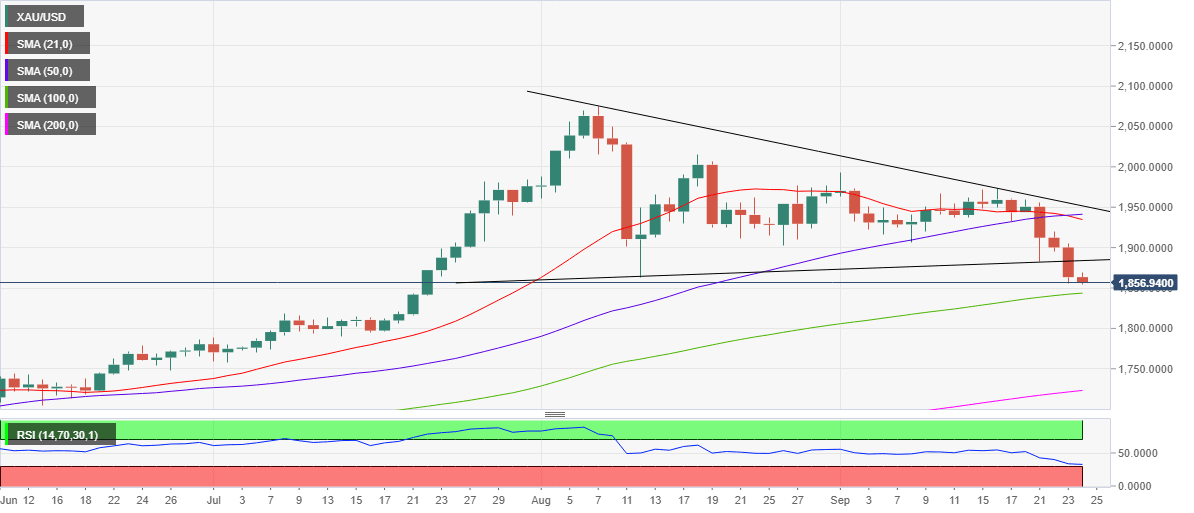

Gold: Short-tern technical outlook

Daily chart

The wedge support now turned resistance at $1884 could cap the immediate pullback from multi-week troughs.

The next upside barrier is seen at $1900/05, the round figure and Wednesday’s high. The bears are likely to remain in control so long as the price holds below the powerful resistance around $1935/40 region, the confluence of the 21 and 50-day Simple Moving Average (DMA).

To the downside, the sellers will test the 100-DMA support at $1844. A daily closing below the latter is critical for further declines towards the $1800 support area.

The 14-day Relative Strength Index (RSI) has turned flat (at 32.64) just above the oversold territory, suggesting that there is more room to the downside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.