Gold Price Forecast: Bearish technical structure suggests more pain ahead

- Gold Price smashed amid the upsurge in the Treasury yields, the US dollar.

- Recession fears return, spooking global markets and boosting the USD.

- XAU/USD challenges bullish commitments below 200-DMA once again.

Amidst two-way business witnessed at the start of the week on Monday, Gold Price suffered heavily, extending its retreat from three-week highs of $1,874. The sell-off in the metal saw the price hitting the lowest level in three days at $1,842, where the critical horizontal 200-Daily Moving Average (DMA) aligns. Fundamentally, the bright metal traded on the front foot in the first half of the day, as bulls looked to recoup Friday’s upbeat US NFP-led losses. The dollar retreated across the board in tandem with the Treasury yields, as investors cheered the covid easing optimism and a slowing pace of services sector contraction in the world’s second-largest economy – China. Risk flows returned and curbed the haven demand for the buck.

The rebound in XAUUSD soon vapored out, as concerns over the Fed’s aggressive monetary policy rekindled recessionary fears and revived the demand for the US dollar as a safe haven. The US yields rebounded firmly in American trading, with the benchmark 10-year rates surpassing the critical 3% level. The bright metal came under renewed selling pressure and dropped below the $1,850 level once again. The firmer yields-driven decline in the Wall Street stocks failed to offer any relief to XAU bulls.

Gold Price is licking its wounds near the $1,840 region in the Asian session this Tuesday, as the dollar is sitting close to the monthly top amid a cautious market mood. The US yields have entered an upside consolidative mode, as gold sellers catch a breather. The greenback remains at the mercy of the broader market sentiment and the dynamics of the yields, in absence of any relevant US economic data due later in the day.

Full markets will return, bringing in some volatility, which could exacerbate the downside in the metal. The buck may continue to benefit from the renewed upsurge in the USD/JPY pair, as the yen sets a fresh 10-year low.

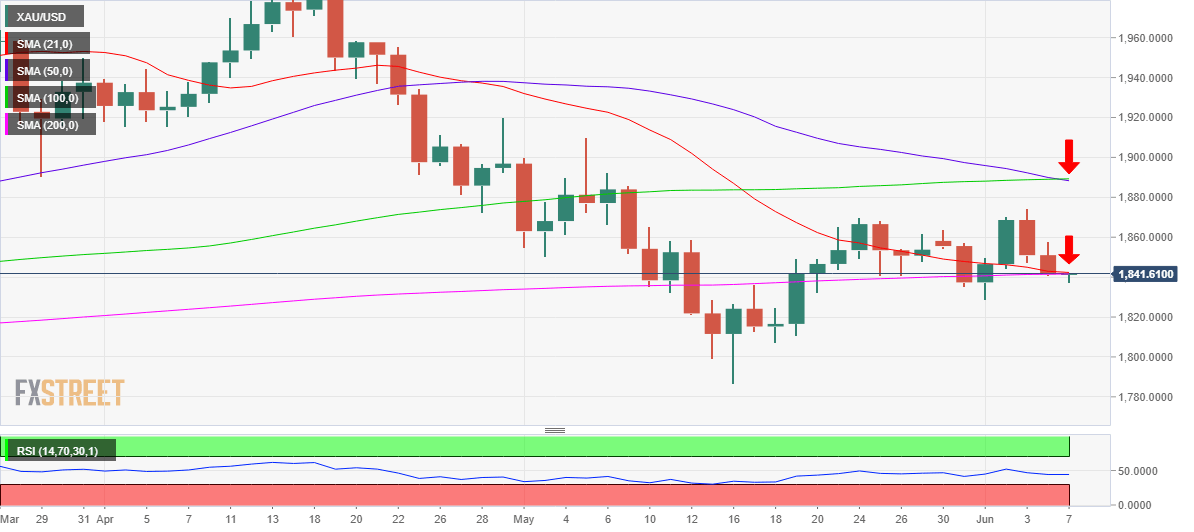

Gold Price Chart: Daily chart

As observed on the daily chart, the bearish 50-Daily Moving Average (DMA) crossed the horizontal 100-DMA for the downside on Monday, confirming a bear cross, as the selling interest revived in the metal.

Bears breached the $1842 key support, the confluence of the bearish 21-DMA and horizontal 200-DMA.

Traders are now poised for a fresh downswing in XAUUSD once the 21 and 200-DMA bearish crossover gets validated on the said timeframe.

A a test of the previous week’s low of $1,829 remains well on the table should the bearish pressures intensify. Further south, the $1,820 round figure will come to the rescue of gold bulls.

The 14-day Relative Strength Index (RSI) remains below the midline, suggesting that the downside remains more compelling in the near term.

On the flip side, any recovery will need acceptance above the aforesaid strong support now turned resistance at $1,842.

The next upside target could be the $1,850 psychological barrier, above which Monday’s high of $1,858 could be challenged.

Buyers will seek fresh opportunities above the latter to initiate a fresh upswing towards the previous week’s high of $1,870.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.