Gold Price Forecast: Aiming for $1,800 as US Dollar weakness continues

XAU/USD Current price: $1,790.01

- The better tone of US indexes weighs on the American Dollar on a quiet day.

- Uncertainty about what central banks will do next week spurs caution.

- XAU/USD biased higher in the near term, although speculative interest stands in side-lines.

The US Dollar trades with a sour tone on Thursday, down against most major rivals. XAU/USD hovers around $1,790 a troy ounce, up for a third consecutive day but still in the red on a weekly basis. The better tone of US equities weighs on the American currency, despite the absence of a fresh catalyst.

US government bonds also reflect the better market mood, as easing demand for Treasuries is pushing yields higher. Gains there, however, are limited with the 10-year Treasury note currently yielding 3.47%, still below the weekly opening.

Market players await the US Federal Reserve and the European Central Bank monetary policy decisions next week, as there’s no clarity about what central banks may do. The US Federal Reserve is expected to hike by just 50 bps, although the latest macroeconomic data leaves the door open for another aggressive hike of 75 points. The ECB, on the other hand, has been quite conservative, but maybe is time for European policymakers to grab the bull by the horns.

XAU/USD price short-term technical outlook

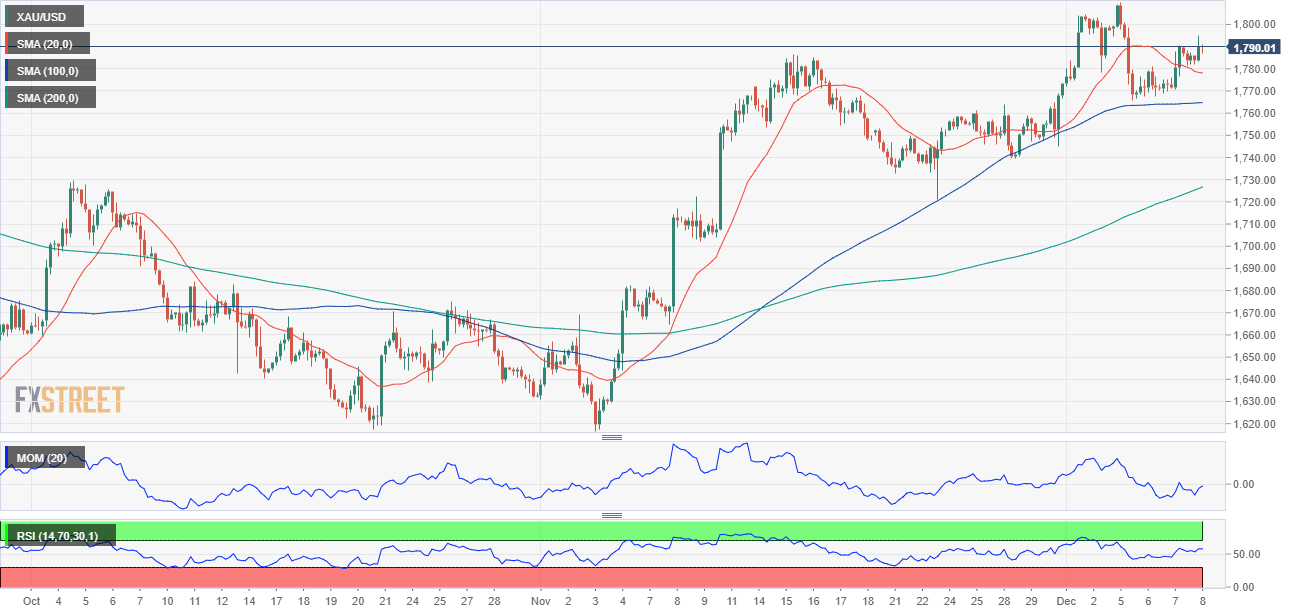

The XAU/USD pair holds on to modest intraday gains after peaking at $1,794.83. The daily chart shows that the risk remains skewed to the upside, as the pair keeps developing above a bullish 20 SMA, which advances above a flat 100 SMA. A directionless 200 SMA, in the meantime, provides dynamic resistance at around the daily high. Finally, technical indicators remain within positive levels, the Momentum heading higher, but the RSI is flat at around 62.

In the near term, and according to the 4-hour chart, the risk skews to the upside, although technical readings suggest decreasing buying interest. XAU/USD trades above all of its moving averages, although the 20 and 100 SMAs lack directional strength. Technical indicators, in the meantime, eased modestly from their daily highs, holding above their midlines.

Support levels: 1,775.15 1,762.70 1,749.10

Resistance levels: 1,794.35 1,807.30 1,818.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.