Gold Price Forecast: 21DMA appears a tough nut to crack for XAU/USD bulls, focus on weekly close

- Gold price remains capped by 21DMA despite renewed US dollar weakness.

- The US dollar, yields return to the red, as the Q3 GDP beat fails to impress.

- XAU/USD is set for the second straight weekly gain, will it close above 21DMA?

Gold price is making a minor recovery attempt while hovering around $1,670 on the final trading day of the week. Despite the renewed uptick, the bright metal remains confined within a familiar trading range amid a risk-off market environment. Investors digest a string of US corporate earnings reports from tech and retail titans while hopes for a Fed shifting gears down remain alive and kicking, which has revived this week’s selling pressure around the dollar and the Treasury yields. The benchmark 10-year US rates meander near two-week troughs below 3.90%, with market pricing increased odds of a 50 bps December Fed rate hike after the world’s most powerful central bank raised rates by 75 bps next week. Expectations of global central banks slowing down their pace of tightening have been cushioning the downside in the non-interest-bearing gold so far this week.

All eyes now remain on the preliminary growth and inflation figures from Europe’s no. 1 economy, Germany, which could see a contraction in the third quarter. Recession fears could intensify the risk-off sentiment and revive the dollar’s safe-haven demand. Therefore, the gold price rebound could once again face headwinds while investors await the US PCE inflation and preliminary UoM Consumer Sentiment data. The end-of-the-week, as well as month-end flows, will also dominate the dollar trades, having a significant influence on the yellow metal price.

Also read: A recession is coming, but gold feeds on fear

On Thursday, XAU/USD price ended marginally lower around $1,664, having recovered from daily lows at $1,655 The US advance Q3 GDP outpaced expectations, rebounding 2.6% YoY vs. 2.4% estimates. The metal slumped in an immediate reaction to the data release, as the dollar staged a solid recovery. Gold bears were also helped by the ECB’s expected 75 bps rate hike announcement. The central bank, however, stuck to its stance that more tightening is needed while maintaining that they will remain data-dependent. The ECB policy announcements knocked down the EUR/USD pair, triggering a sharp rebound in the US dollar index. However, the renewed dollar upside failed to sustain amid a mixed perforrmance on Wall Street, as investors took note of earnings results.

Gold price technical outlook: Daily chart

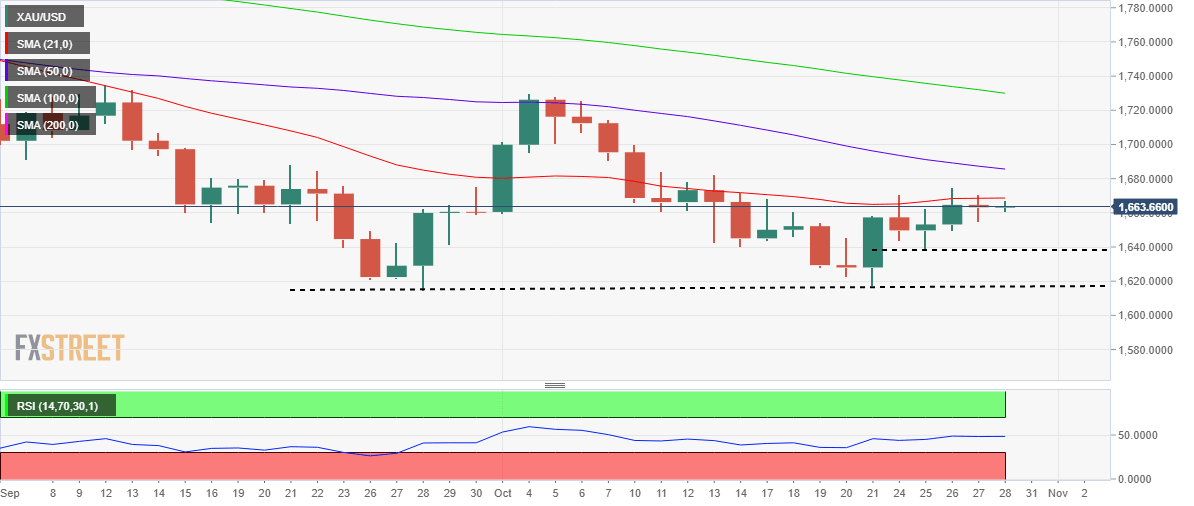

Nothing seems to have changed technically for Gold price, as it continues to extend its struggle below the 21-Daily Moving Average (DMA) at $1,669.

The 14-day Relative Strength Index (RSI) remains flatlined below the 50.00 level, suggesting that bears will likely retain control.

Bulls need a weekly close above the 21DMA to revive the recovery momentum from monthly troughs. Monday’s high at $1,671 will then come into play.

The next relevant barriers are seen at the October 13 high of $1,683 and the $1,700 mark.

Rejection at 21DMA once again will reopen the downside towards Wednesday’s low at $1,650, below which the weekly low at $1,638 will be retested.

The last line of defense for buyers is envisioned at the monthly low of $1,617.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.