Gold Price Forecast: 21 DMA holds the fort, what’s next for XAU/USD?

- Gold price attempts a tepid bounce as the US Dollar consolidates previous gains.

- Traders weigh progress in the United States debt ceiling talks, downbeat US data.

- Gold price manage to close the week above 21-Day Moving Average support, as RSI stays bullish.

Gold price is attempting a tepid bounce at the start of the week on Monday, snapping a three-day downtrend. The United States Dollar (USD) has paused its upside momentum as bulls take a breather after hitting weekly highs last Friday.

United States Dollar consolidates last week’s upsurge

The US Dollar is consolidating the recent gains, struggling for a renewed uptick amid sluggish performance in the US Treasury bond yields so far this Monday. The Greenback extended its recovery rally on Friday, helped by a dip in the US Consumer Sentiment data, fuelling economic slowdown concerns amidst an extended stand-off on the US government’s debt ceiling issue.

The University of Michigan (UoM) Preliminary Consumer Sentiment index slid to 57.7, the lowest since November and weaker than forecast, from 63.5 last month. Reuters noted that the dip in the sentiment is due to “worries that political haggling over raising the federal government's borrowing cap could trigger a recession.”

The US stocks slipped while the US Dollar surged in tandem with the US Treasury bond yields, as the benchmark 10-year US Treasury bond yields closed in on the 3.50% key level, weighing negatively on the non-yielding Gold price.

Focus shifts to Tuesday’s United States Retail Sales and debt ceiling meeting

With the preliminary Consumer Sentiment and Inflation Expectations data out of the way, the focus now shifts toward the next top-tier economic data from the United States, the Retail Sales report, which will be published on Tuesday. US Retails Sales are likely to have rebounded in April, foreseen at 0.7% on a monthly basis. The Core Retail Sales data is expected to jump 0.5% in the same period, compared with a 0.4% drop registered in March.

Any big miss in the US data would rekindle worries over a potential US recession, bolstering the market’s expectations of rate cuts by the Federal Reserve in the second half of this year. Currently, markets are pricing in an 82% chance of the US Federal Reserve (Fed) holding rates at the current level in June while maintaining a 33% chance of a rate cut in July.

Also in focus remains the meeting of US President Joe Biden and congressional leaders on Tuesday for talks on a plan to raise the nation's debt limit and avoid a catastrophic default.

In the meantime, developments around the US debt ceiling talks combined with broader market sentiment will influence the US Dollar valuations, eventually impacting the USD-denominated Gold price.

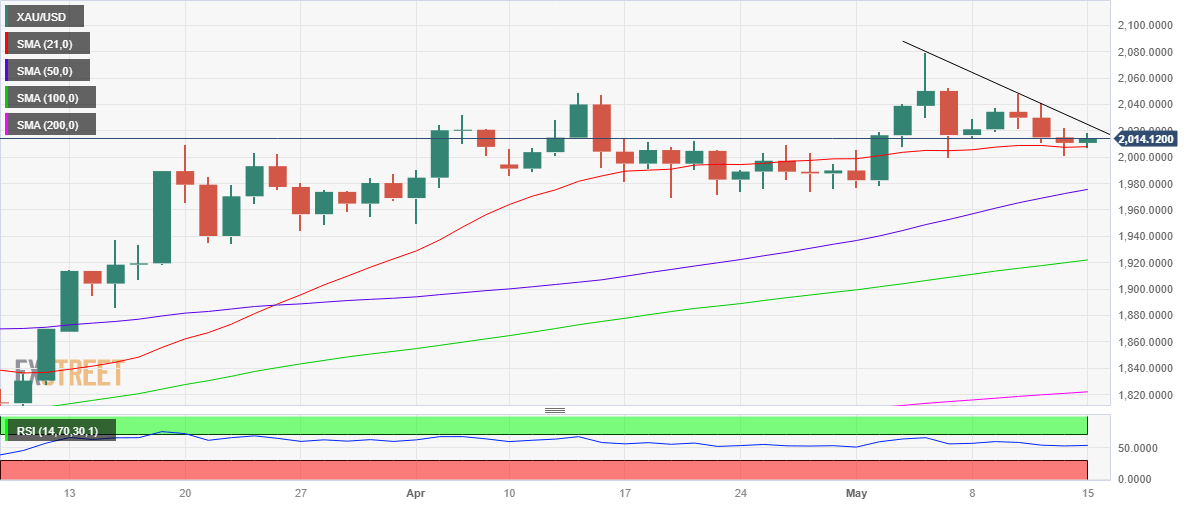

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price managed to defend the flattish 21-Daily Moving Average (DMA) at $2,008 weekly closing, motivating Gold buyers to kick off the week on the front foot.

The 14-day Relative Strength Index (RSI) stays above the 50 level, justifying traders' dip-buying trading strategy.

On the upside, immediate resistance is seen at the descending trendline resistance at $2,025, above which Gold buyers will attempt the $2,030 round figure.

The next relevant upside hurdle is seen at Thursday’s high of $2,041.

Conversely, a sustained move below the 21 DMA support will restart the correction toward $1,977, the confluence of the bullish 50 DMA and the May 1 low.

Ahead of that, the $2,000 psychological level will challenge bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.