- A combination of factors dragged gold to over two-week lows on Tuesday.

- The upbeat US economic outlook continued underpinning the greenback.

- Rising US bond yields added to the selling bias surrounding the commodity.

Gold added to the previous day's losses and lost some additional ground for the second consecutive session on Tuesday. The momentum dragged the commodity to its lowest level in more than two weeks and was sponsored by a combination of factors. The prospects for a relatively faster US economic recovery from the pandemic continued underpinning the US dollar. This, in turn, was seen as a key factor weighing on the dollar-denominated commodity.

Investors remained optimistic about the outlook for the US economy amid the impressive pace of coronavirus vaccinations and the passage of a massive stimulus package. Further fueling the expectations were the US President Joe Biden's ambitious pledge of administering 200 million vaccine shots in 100 days and hopes for an additional $3.0 trillion to $4 trillion infrastructure spending plan from the Biden Administration.

The reflation trade has raised doubts that the Fed would retain ultra-low interest rates for a longer period. This, along with a fresh leg up in the US Treasury bond yields, further collaborated to drive flows away from the non-yielding yellow metal. Apart from this, a generally positive mood around the equity markets exerted some additional pressure and dragged the safe-haven XAU/USD back closer to the $1700 mark.

Market participants now look forward to the US economic docket, highlighting the release of the Conference Board's Consumer Confidence Index. The data might influence the USD price dynamics and provide some impetus to the metal. Traders will further take cues from the US bond yields and the broader market risk sentiment. The key focus, however, will remain on Friday's release of the closely-watched US monthly jobs report (NFP).

Short-term technical outlook

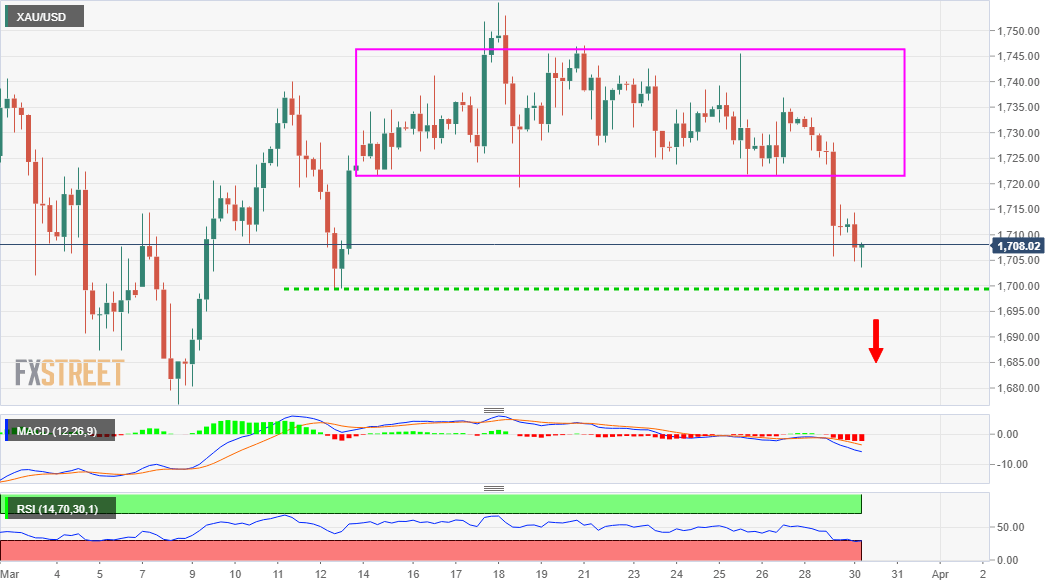

From a technical perspective, the overnight slide confirmed a near-term bearish breakdown through a two-week-old trading range and might have already set the stage for further losses. Some follow-through selling below the $1700 mark will reaffirm the negative outlook and turn the commodity vulnerable to accelerate the fall back towards challenging multi-month lows, around the $1677-76 region touched earlier this month.

On the flip side, the trading range support breakpoint, around the $1720 region, now seems to act as immediate strong resistance. Any further recovery move will now be seen as a selling opportunity and remain capped near the $1732-33 supply zone. That said, a sustained move beyond might trigger a short-covering move and push the metal back towards challenging the $1745-47 strong horizontal resistance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD battles 1.3200 after UK jobs data

GBP/USD is defending minor bids near the 1.3200 mark in the early European session on Tuesday. The latest data from the UK showed that Unemployment Rate steadied at 4% in the quarter to February while Average Earnings disappointed, weighing negatively on the Pound Sterling.

EUR/USD trades near 1.1350, stays silent as US Dollar seeks to recover stability

EUR/USD continues to slide for the second consecutive session, trading near 1.1350 during Asian hours on Tuesday. The pair weakens as the US Dollar attempts to regain stability amid growing concerns over stagflation.

Gold price holds above $3,200; bullish bias remains amid trade uncertainty

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair. Trump's temporary tariff reprieve improves global risk sentiment and might cap the commodity.

Funding rates decrease indicate weakness in Dogecoin and Bitcoin Cash

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.