Gold Price Forecast: $1,961 could emerge as key support for XAUUSD amid firmer USD

- Gold Price is struggling for upside traction amid a stronger US dollar.

- Mixed mood, USD/JPY’s rally spur the dollar’s demand, capping XAUUSD.

- Failure to close Monday above $1,990 hurdle signals caution for gold bulls.

Gold Price failed to sustain at higher levels and retraced sharply, settling Monday modestly in the green zone near the $1,980 neighborhood. In the first half of the day, concerns over elevated inflation levels and mounting recession risks, in the face of a protracted Ukraine crisis and aggressive Fed’s tightening outlook, sparked risk-aversion at full steam. This prompted investors to seek refuge in the ultimate safe haven Gold Price, sending it higher to six-week highs of $1,998.

Gold Price, however, was unable to withstand the relentless US dollar buying, as the Treasury yields continued to cheer the hawkish Fed commentary. In absence of the first-tier US economic data, St. Louis Fed President James Bullard’s speech hogged the limelight, with Easter Monday-induced thin trading adding to the volatility. Bullard said that he doesn’t rule out a 75-bps rate hike but “more than 50 basis points is not my base case at this point.” Bullard’s hawkish tone added to the market's pricing in of a 70% chance of two 50-bps rate increases by June, strengthening the dollar’s bullish momentum.

Also read: Gold Price Forecast: XAUUSD needs to crack this level to take on the $2,000 mark

Gold Price is defending the previous gains, although remains on the back foot amid notable US dollar demand. Despite the retreat in the US Treasury yields from three-year highs, the greenback is finding the strength from the unstoppable rally in the USD/JPY pair. The cautious market mood, with full markets returning and persistent tensions over the Russia-Ukraine war, keep the sentiment buoyed around the dollar. Ukrainian President Volodymyr Zelenskyy said Russian forces had begun a new campaign to conquer the Donbas region in the east of his country after attacking the Southern port city of Mariupol. In response to the Russian aggression, the US is looking to re-establish a diplomatic presence in Ukraine as soon as possible.

Next of relevance for Gold Price remains the speech from the Chicago Fed President Charles Evans, as a data-dry spell continues for the second straight day this Tuesday. The Fed sentiment will keep the dollar afloat amid incoming updates on the Ukraine crisis.

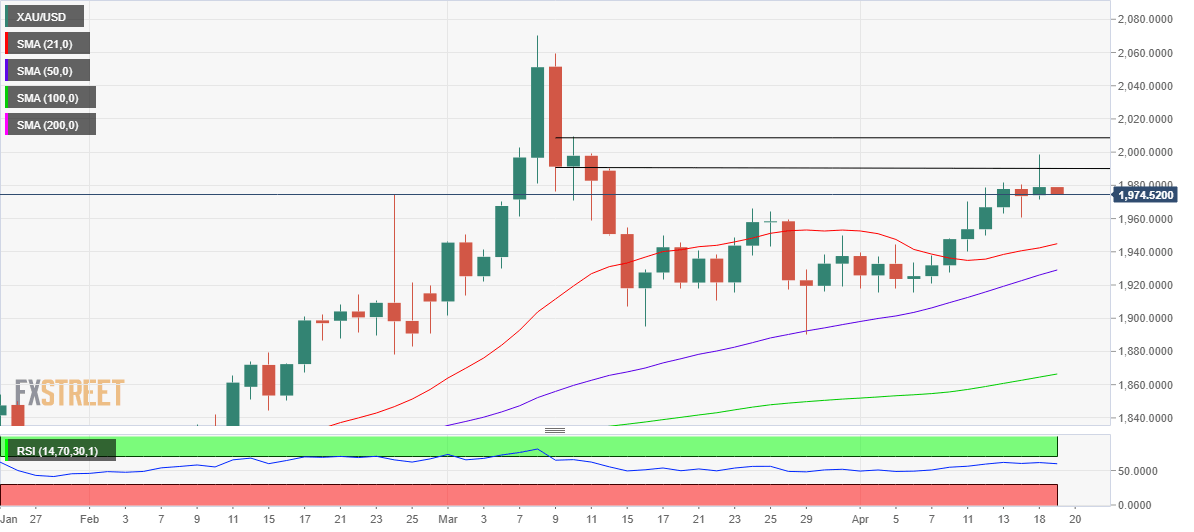

Gold: Daily chart

Gold’s daily chart shows that the price failed to find acceptance above the March 14 highs of $1,990.

Therefore, unless bulls clear that upside hurdle, gold bears could remain hopeful, with Friday’s low of $1,961 in sight.

The bullish 21-Daily Moving Average (DMA) at $1,945 will be the next line of defense should the correction gather steam.

The 14-day Relative Strength Index (RSI) is turning lower while holding above the midline, suggesting that any pullback could be quickly bought into.

In such a case, Gold Price could retest the key $1,990 hurdle, a sustained break above which would expose the $2,000 level.

The March 10 highs at $2,009 will then challenge the bearish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.