- A pickup in the US bond yields dragged gold lower for the second straight session on Friday.

- Sustained USD selling bias assisted the metal to regain traction on the first day of a new week.

- Investors eye US Durable Goods Orders for some impetus ahead of the FOMC policy meeting.

Gold witnessed an intraday turnaround from the vicinity of the $1,800 mark and finally settled in the red for the second consecutive session on Friday. Upbeat US economic data was enough to push the US bond yields higher, which turned out to be a key factor that drove flows away from the non-yielding yellow metal. The US Census Bureau reported that New Home Sales rose at a seasonally-adjusted annual rate of 1.021 million in March – the fastest pace since 2006. Adding to this, the IHS Markit revealed that the economic activity in the US private sector expanded at a record pace in April. This comes amid a generally positive tone around the equity markets that exerted some additional downward pressure on the safe-haven XAU/USD.

The negative factors, to a larger extent, were offset by the prevalent US dollar selling bias, which continues to be weighed down by diminishing odds for an earlier than anticipated Fed lift-off. Investors now seem convinced with the view that any spike in inflation is likely to be transitory and that the Fed will keep interest rates lower for a longer period. This, in turn, extended some support to the dollar-denominated commodity and helped limit any deeper losses, rather assisted to regain some positive traction on the first day of a new trading week. That said, the upside is likely to remain capped as investors might prefer to wait on the sidelines ahead of the latest FOMC monetary policy update, scheduled to be announced on Wednesday.

In the meantime, Monday's release of the US Durable Goods Orders might influence the USD price dynamics and provide some impetus later during the early North American session. Apart from this, the US bond yields and the broader market risk sentiment might also contribute to produce some meaningful opportunities around the XAU/USD.

Short-term technical outlook

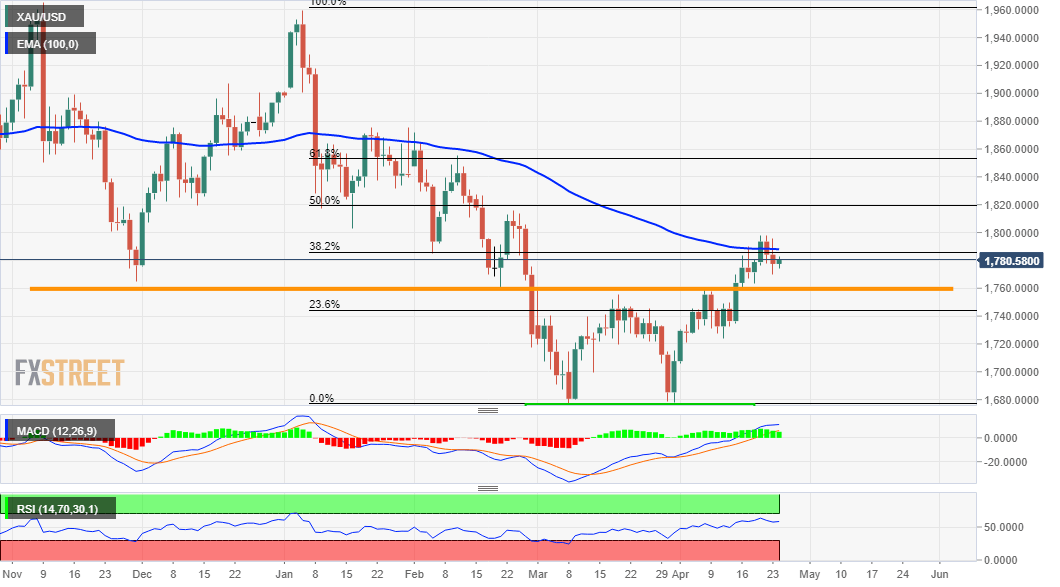

From a technical perspective, gold formed a bullish double-bottom in March and has been gradually recovering since then. A subsequent move back above the $1,760-65 resistance validated the bullish chart pattern, though repeated failures near the $1,800 mark warrant some caution before positioning for any further appreciating move. Hence, it will be prudent to wait for a sustained move beyond mentioned handle before placing fresh bullish bets. The commodity might then accelerate the move towards the $1,815-16 resistance, marking the 50% Fibonacci level of the $1,959-$1,676 downfall. Some follow-through buying will set the stage for an extension of the upward momentum towards the 61.8% Fibo. level, around the $1,852-55 region, en-route the $1,874-75 supply zone.

On the flip side, the double-bottom neckline resistance breakpoint, around the $1,765-60 region now seems to protect the immediate downside. This is followed by the 23.6% Fibo. level, around the $1,745-44 area and the $1,730 level, which if broken decisively might negate the positive outlook. The XAU/USD might then turn vulnerable and accelerate the fall towards challenging the $1,700 round-figure mark. The downward trajectory could further get extended and expose the double-bottom support, around the $1,677-76 region, or multi-month lows touched in March.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.