Gold price eyes CPI data as inflation risks boost sentiment

Gold (XAUUSD) prices increased on Tuesday after data from the United States (US) showed that prices paid by producers cooled off. This kept traders hopeful for additional monetary policy easing by the US Federal Reserve (Fed). The gold price trades around $2,675 and shows positive momentum within the ascending channel.

The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index (PPI) increased but missed estimates for a higher print. This exacerbated Gold's jump as traders grew optimistic that if the Consumer Price Index (CPI) report on Wednesday comes cooler than foreseen, it could increase the Fed's chances of easing policy during the year.

Gold price analysis: Trends amid inflation risks

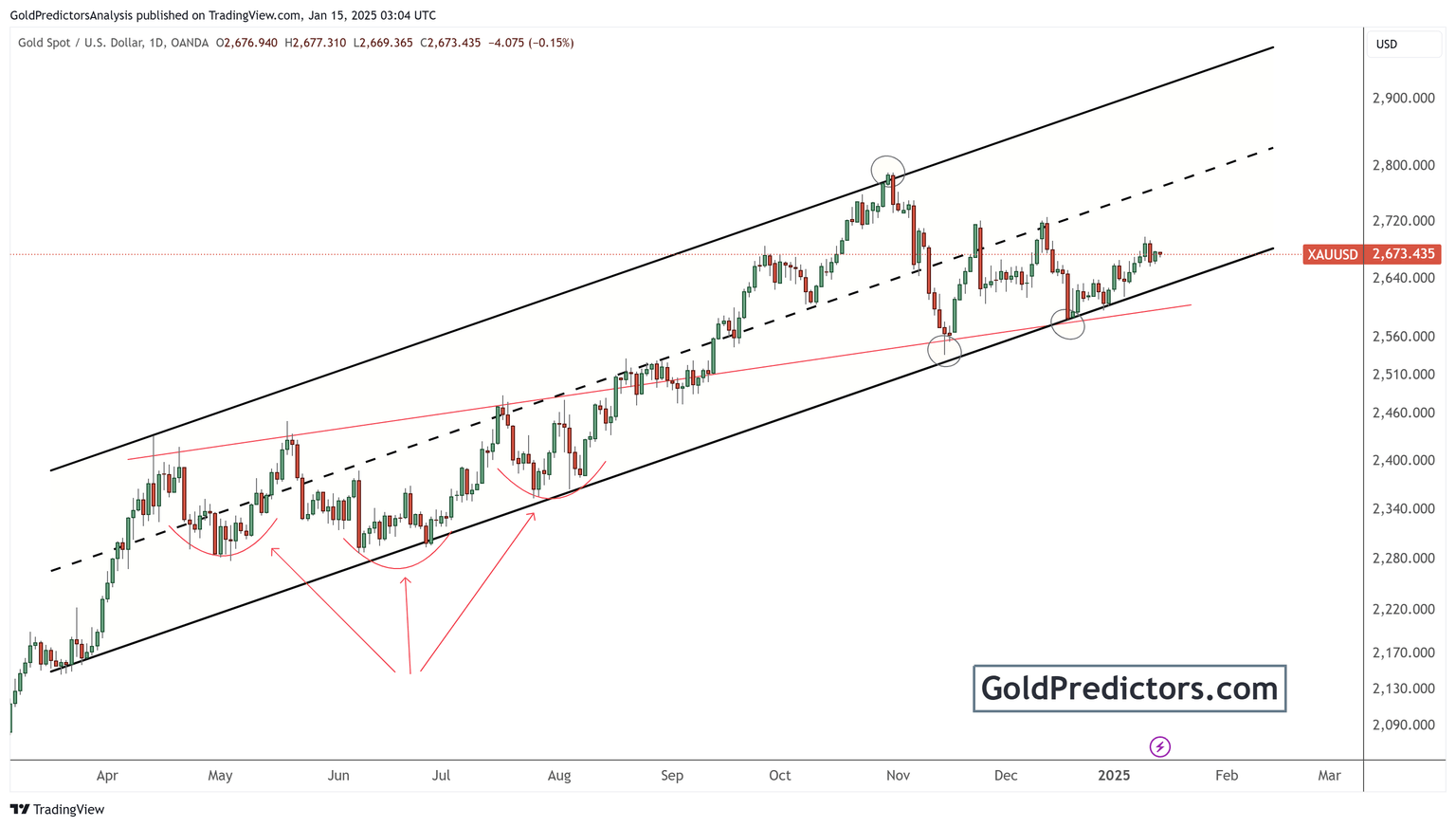

The daily chart reveals that Gold remains within a defined ascending channel, as shown below. Recent price action saw a rebound from the channel's lower boundary near $2,640, aligning with the trendline support. This recovery indicates sustained bullish momentum despite recent headwinds.

The key patterns observed include a series of higher lows, reinforcing the uptrend. The red line highlights a neckline from previous rounded bottom formations, acting as a support-turned-resistance zone. Any break above $2,720 could pave the way for further gains, potentially targeting the channel's upper boundary near $2,800.

Conversely, a failure to hold above $2,640 may see prices retesting the $2,600 psychological level. This aligns with the Fed's monetary policy expectations and the upcoming CPI data release.

Market participants should also monitor the dashed midline of the ascending channel. This zone often acts as a dynamic resistance or support during bullish rallies or corrective pullbacks.

Conclusion

Gold prices are poised at a critical juncture as traders await key economic data and geopolitical developments. A cooler-than-expected CPI report could strengthen the case for Fed easing, boosting bullion further. However, the potential inflationary impact of proposed Trump tariffs remains a wildcard, with the possibility of reigniting price volatility. Gold's trajectory remains closely tied to the interplay between inflation data and Federal Reserve policy expectations.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.