Gold powers towards record high, NEM closed last gap, what's ahead?

Fundamentally and technically there is plenty of upside in gold and miners. Here are a few charts to consider.

Gold chart courtesy of StockCharts.Com annotations by Mish

Gold has been on a tear. No, it's not due to Russia. It's best thought of as a measure of faith in central banks, especially the Fed.

Technically speaking, gold broke out of a nearly two-year correction. The price of gold in US dollars is now higher than it's been except for about 10 days in August of 2020.

Newmont Mining at Record High

Newmont Mining (NEM) chart courtesy of StockCharts.Com annotations by Mish

Newmont Mining closed the last two of its unfilled gaps then powered to a new record high, blasting through resistance at the peak.

Gaps occur when a stock opens below the lowest point of the preceding day or above the highest point of the previous day, then stays there for the day.

I expected those gaps on NEM to close and now it's what many consider "blue skies", that is no above resistance.

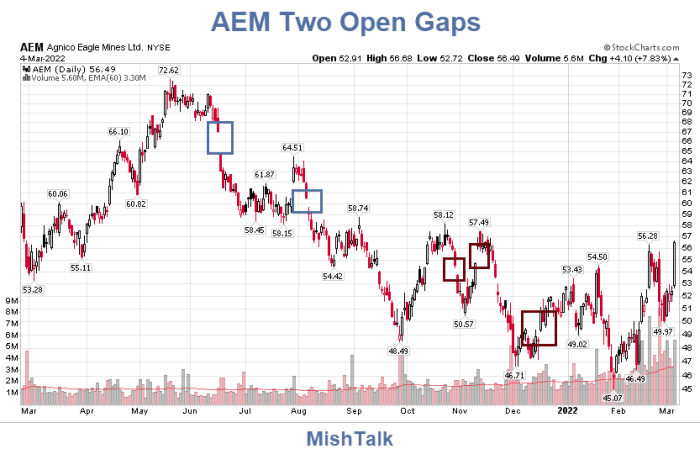

AEM Two Open Gaps

Agnico Eagle (AEM) chart courtesy of StockCharts.Com annotations by Mish

AEM another major tier mining company has two unfilled gaps. If gold continues higher, those gaps will fill.

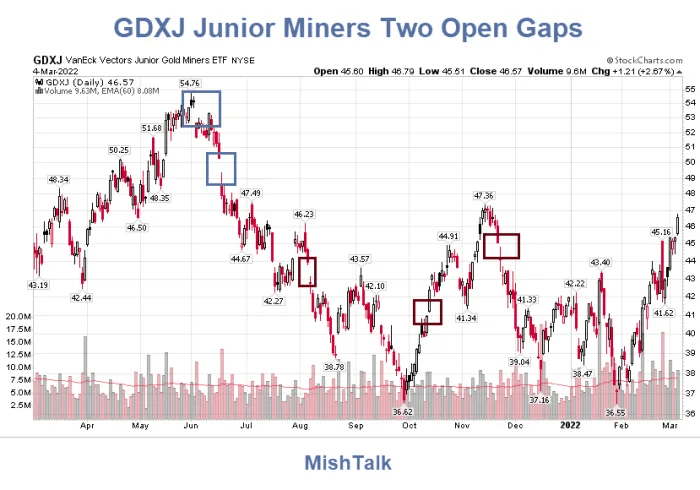

GDXJ Junior Miners Two Open Gaps

GDXJ junior miners chart courtesy of StockCharts.Com annotations by Mish

Junior miners have lagged Newmont and the price of gold. They offer a higher risk-reward profile than a company like NEM.

However, if gold continues higher, those gaps will fill too.

What About the Dollar?

GDXJ junior miners chart courtesy of StockCharts.Com annotations by Mish

It's an old wives tale, widely believe but false, that gold follows the US dollar. In the very short term, gold frequently does. However, the idea is noticeably wrong on a long-term basis.

More About Gaps

- Feb 7, 2022: Newmont Mining Looks Poised to Close Two Open Gaps

- Feb 17, 2022: Newmont Mining Corporation, One Gap Left to Fill, And it Will.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc