Gold outlook: Gold’s bearish movement halted

Gold’s price regained its confidence yesterday as it rose after being for two weeks in the reds. In today’s report we intend to have a look at the revival of the negative correlation of the USD with gold’s price, geopolitical issues that could affect gold’s price and the Fed’s stance, all on a fundamental level for the gold market. For a rounder view conclude the report with a technical analysis of gold’s daily chart.

The negative correlation of Gold with the USD in full swing

Gold’s negative correlation with the USD seems to be in full swing over the past week, as gold’s price practically retreat until Friday, while as the current week started gold’s price seems to have regained its confidence to climb higher. On the flip side USD bulls dominated the greenback’s direction over the past week, while they took a break as the week begun allowing for gold’s price to rise. Overall we see the case for the negative correlation of the two trading instruments to be maintained over the coming week, hence should the USD retreat further we may see gold’s price edging higher. We note that there are very few high impact financial releases on the calendar in the coming days, hence we expect fundamentals to lead the way for golds’ price. On a fundamental level, we note the Trump presidency as a factor which has to be priced in by traders, in an effort to expect the unexpected, given the US President elect’s character. Also we note that the rise of gold’s price was escorted by a drop of US bond yields, in a signal that the attractiveness of US bond as an alternative safe haven investment to gold may drop, thus allowing for funds to be diverted towards investments in the precious metal.

Fed’s stance could weigh on Gold’s price

Over the past week, we saw the chances of the Fed’s stance affecting gold’s price increasing. On a monetary level, we note that Fed Chairman Powell and a number of other Fed policymakers made the case for an easing of the Fed’s rate cutting path and the market’s expectations for a 25 basis points rate in the December meeting eased over the week with Fed Fund Futures implying a 52% probability for such a scenario materialising. The Fed’s cautiousness towards cutting rates is understandable given that October inflation data showed a persistence of inflationary pressures in the US economy, while on a fiscal level, the Trump economic policies and intentions of imposing trade tariffs, tightening immigration and deepening the deficit hence also raising national debt possibly, may rejuvenate inflationary pressures in the US economy. Should more Fed policymakers highlight or imply the need to slow down the reduction of the interest rates, we may see the USD being supported on a monetary level which in turn could weigh on the precious metal.

Escalating geopolitical tensions could support Gold’s price

The war in Ukraine may be the main geopolitical issue that could create shockwaves for gold’s price. The war has completed 1000 days and in the past few days has escalated. The first move was the green light of the US Government under incumbent President Biden to allow Kyiv to use US made long range missiles ATACMS. Russia had repeatedly warned that such a move would constitute a major escalation in the war. It should be noted that Russia proceeded with a massive air strike hitting the Ukrainian power grid, yesterday. Its characteristic that according to Associated Press, Russian President Vladimir Putin today signed a revised nuclear doctrine declaring that a conventional attack on Russia by any nation that is supported by a nuclear power will be considered a joint attack on his country. In the big picture, Russia has now lowered the threshold at which it would use its nuclear arsenal and thus the possibility of a nuclear strike tends to increase in general. Please be advised that according to Ukrainian media reports, Ukraine did use ATACMS to hit Russia for the first time today. Overall we see the case for further escalation ahead, which in turn could intensify market uncertainty for the possible effects of the war in Ukraine and where such an escalation could lead to. Gold may experience further safe haven inflows in such a scenario as more investors may allocate a larger part of their investment portfolio in safe havens such as gold.

Technical analysis

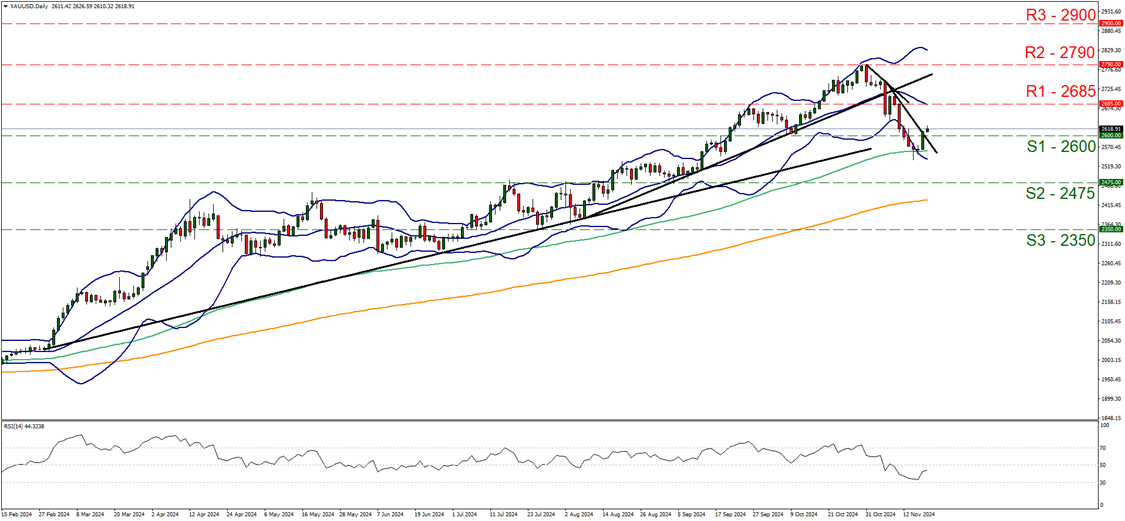

XAU/USD daily chart

-

Support: 2600 (S1), 2475 (S2), 2350 (S3).

-

Resistance: 2685 (R1), 2790 (R2), 2900 (R3).

On a technical level, gold’s price rose yesterday and in today’s Asian session, clearly breaking the 2600 (S1) resistance line, now turned to support. Given that the price action in its upward movement broke the downward trendline guiding the precious metal’s price since the 31st of October, we switch our bearish outlook, in favour of a sideways motion bias initially. Please note that the RSI indicator has corrected higher aiming for the reading of 50, implying that the bearish market sentiment has eased. For a bullish outlook we would require gold’s price to break the 2685 (R1) resistance line, thus paving the way for the 2790 (R2) resistance level which is practically the record high level for the precious metal’s price. Should the bears renew their dominance over gold’s direction, we may see the precious metal’s price falling and clearly breaking the 2600 (S1) support line, forming a lower trough than the one formed on the 14th of the month, aiming for the 2475 (S2) support level.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.