Gold outlook: Fed decision tomorrow to wrap up 2024

Gold’s price appears to have had some slight bearish tendencies today. In today’s report, we intend to have a look at the upcoming release of the Fed’s interest rate decision tomorrow and the recent geopolitical developments in Syria. For a rounder view, we conclude the report with a technical analysis of gold’s daily chart.

Fed decision tomorrow

Tomorrow is set to be a key day for many market participants, including gold traders. We are of course referring to the Fed’s interest rate decision, which is due out during the American session on Wednesday. Currently, the majority of market participants are expecting the bank to cut by 25 basis points, with Fed Fund Futures currently implying 96.6% probability for such a scenario to materialize. Hence, with FFF at such high levels, it implies that the majority of market participants consider it a given that the Fed may cut by 25bp in their meeting tomorrow. As such, we would predominantly focus on the Fed’s accompanying statement initially and then shift our focus to Fed Chair Powell’s press conference which is due after the bank’s decision. Starting with the accompanying statement, if Fed policymakers showcase a willingness to resume on their rate-cutting cycle with the new year, it may be perceived as dovish in nature and thus could weigh on the dollar, whilst aiding gold’s price given the inverse relationship between the precious metal and the greenback. On the flip side, should Fed policymakers showcase a willingness to remain on hold for a prolonged period of time it may have the opposite effect. The same scenario could also apply to Fed Chair Powell’s press conference. However, traders are also in for a surprise on Friday, with the US Core PCE rate for November which could upend the sentiment from the Fed’s decision as the year comes to an end. In particular, we have noted above that the majority of market participants are expecting that the Fed may cut by 25bp in their meeting tomorrow. Yet, when looking at the Core PCE rates expectations for November, which are the Fed’s favourite tool for measuring inflationary pressures, a different picture emerges. Specifically, the Core PCE rate on a YoY level for November is expected by economists to accelerate from 2.8% to 2.9%, which could increase pressure on the Fed to keep interest rates steady for a prolonged period of time. In turn, this could weigh on the precious metal’s price given its inverse relationship with the dollar which we referred to previously. In conclusion, in our view we would not be surprised to see a slightly hawkish sentiment emerging from Fed officials in terms of keeping interest rates steady with the new year, as the possibility of the Core PCE rate accelerating from 2.8% to 2.9% could cause concerns that the Fed’s battle against inflation is far from over. Furthermore, should inflation start ticking up once again, the possible concern that the Fed’s inflation target may be slipping through their fingers, could be further aggravated by President-elect Trump’s economic policies. The President-elect’s economic policies could lead to a resurgence of inflationary pressures and thus could increase pressure on the Fed to withhold from cutting rates further, although that remains to be seen.

Geopolitics of the Middle East

In the Middle East continue to monitor the situation in Syria, which tends to remain volatile. In particular, we note that tensions between Turkey and their Rebel group in Syria against the Kurdish forces appear to be on the rise. In particular, with the Assad regime forces now having capitulated, tensions between the two groups appear to be on the rise, with some clashes and air strikes having occurred in the past few days. Yet we should stress that this is not abnormal, although with the Assad regime now out of the picture the situation could be different. Nonetheless, should a significant escalation occur in the region, it may funnel safe-haven inflows into the precious metal’s price, yet we must stress once again that such a scenario does not appear to be in play at the time of this report and thus may have no effect on gold’s price. However, until the dust settles, developments in Syria may warrant closer attention for the time being.

Technical analysis

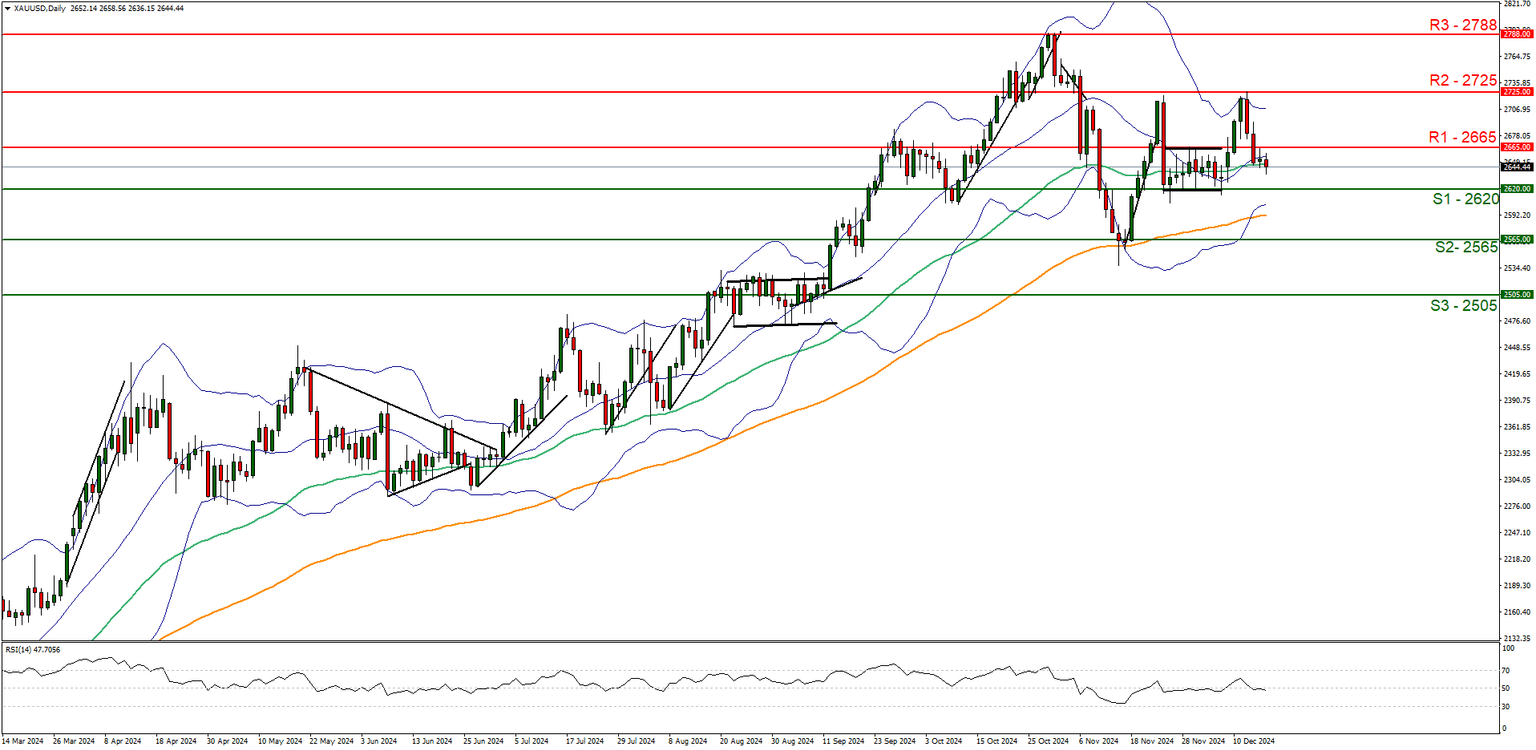

XAUUSD daily chart

Support: 2620 (S1), 2565 (S2), 2505 (S3).

Resistance: 2665 (R1), 2725 (R2), 2788 (R3).

On a technical level, gold’s price appears to have re-entered the sideways-moving territory that had confined the precious metal’s price between the 26th of November and the 10th of December. We opt for a sideways bias for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. Yet, we must stress that the Fed’s decision tomorrow and the release of the Core PCE rate on Friday could easily alter gold’s price. Nonetheless, for our sideways bias to continue we would require the precious metal’s price to remain confined between the 2620 (S1) support level and the 2655 (R1) resistance line. On the flip side, for a bearish outlook we would require a clear break below the 2620 (S1) support level, with the next possible target for the bears being the 2565 (S2) support line. Lastly, for a bullish outlook, we would require a clear break above the 2665 (R1) resistance line with the next possible target for the bulls being the 2725 (R2) resistance level.

Author

Phaedros Pantelides

IronFX

Mr Pantelides has graduated from the University of Reading with a degree in BSc Business Economics, where he discovered his passion for trading and analyzing global geopolitics.