Gold outlook: Bounces as bulls regain traction after recent fall

Gold

Gold regained traction and bounced on Thursday, following a sharp fall in past few days.

Fresh strength signals that the situation is stabilizing after a turbulent period and broader bulls are about to re-take control.

The yellow metal benefited from growing signals that the Fed will start cutting interest rates as from September, with US policy easing cycle about to start and deteriorating conditions of the US economy, fueling speculations about stronger than expected initial rate cut (0.5% vs 0.25%).

Economic slowdown and growing US debt concerns are likely to continue to boost gold price, contributing to overall bullish picture.

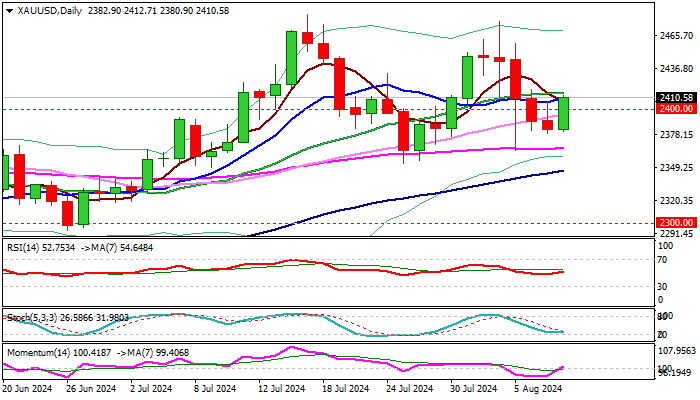

Technical picture on daily chart is firming, as momentum emerges into positive territory and RSI turns north above neutrality zone, with close above pivots at $2407/14 (Fibo 38.2% of $2477/$2364 / 20DMA) to boost positive signals and open way for further recovery.

Near-term action is expected to remain biased higher while holding above psychological $2400 level.

Res: 2414; 2420; 2434; 2450.

Sup: 2400; 2391; 2379; 2364.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.