Gold nears key support following CPI data release

The US Bureau of Labor Statistics reported that the headline Consumer Price Index (CPI) rose by 0.2% in October. Over the past year, it increased by 2.6%. On the other hand, the core CPI increased by 0.3% monthly and 3.3% annually. This data strengthened market expectations of the US Federal Reserve's potential third interest rate cut in December. According to CME Group’s FedWatch Tool, the likelihood of a 25-basis-point rate cut at the next FOMC meeting surged to over 80%. This is up from less than 60% just a day prior.

In response to the data, Dallas Fed President Lorie Logan noted the progress made on inflation but urged caution. St. Louis Fed President Alberto Musalem expressed concern that inflation risks may be rising, making it harder for the Fed to ease rates. Kansas Fed President Jeffrey Schmid added that it’s uncertain how much further the Fed will cut rates. Meanwhile, President-elect Donald Trump’s plans for tax cuts and import tariffs could fuel inflation. This may potentially restrict the Fed’s ability to reduce rates. Optimism surrounding the "Trump trade" has pushed the 10-year US bond yield to multi-month highs. This has lifted the US Dollar to levels not seen since November 2023.

Gold approaches key support after CPI data

The gold market correction began from the strong resistance of the red-dotted trend line on the daily chart. This correction has now reached the support area of the black trend line, suggesting a potential rebound. However, the short-term trend remains highly bearish. The price is consolidating at lower levels, indicating that the upcoming US PPI data release will be crucial in triggering the next move.

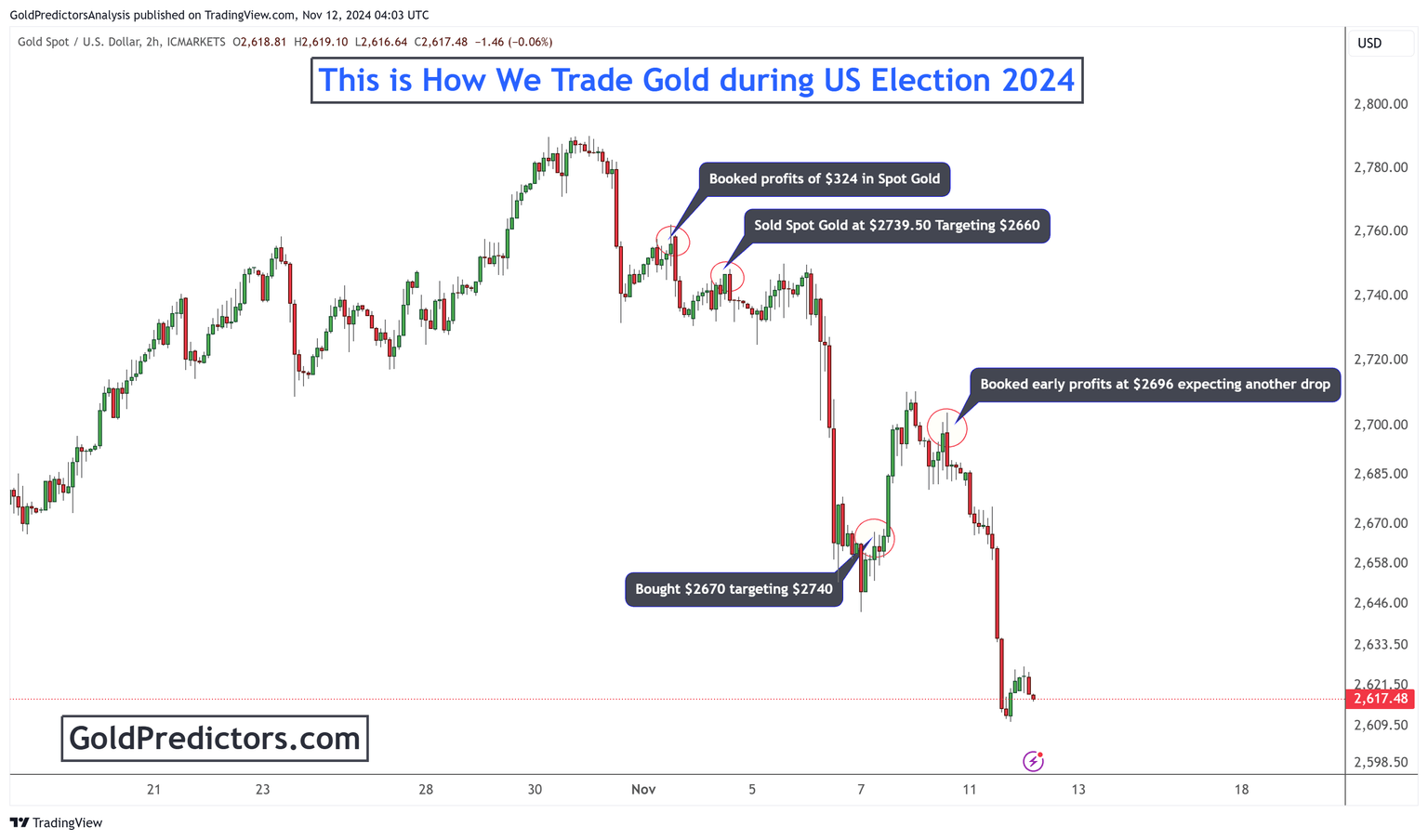

Trading gold during political uncertainty is challenging. The simplest approach is to follow the trend and identify trend reversals using cycle analysis. For example, Gold Predictor executed trades and shared them with members via email and WhatsApp. These trades were based on technical and cycle analysis. Gold Predictors anticipated a strong correction from $2800, and the price is now moving downward toward the correction targets.

Bottom line

In conclusion, the current economic indicators and political landscape continue to shape the outlook for gold and the US dollar. Rising inflation and the potential for another Fed rate cut in December have heightened market anticipation. Meanwhile, Fed officials remain cautious about further easing amid persistent inflation risks. The gold market may see a rebound near the support level. This is especially likely with the upcoming US PPI data release, which could influence the next move. Trading gold in these uncertain times requires strategic analysis. Gold Predictor’s use of trend and cycle analysis helps to anticipate price movements. Investors may find opportunities by closely monitoring economic data and adjusting positions in this complex environment.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.