Gold: near term buy zone comes in at $1568/$1575 [Video]

![Gold: near term buy zone comes in at $1568/$1575 [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/hand-full-of-gold-nuggets-53773200_XtraLarge.jpg)

Gold

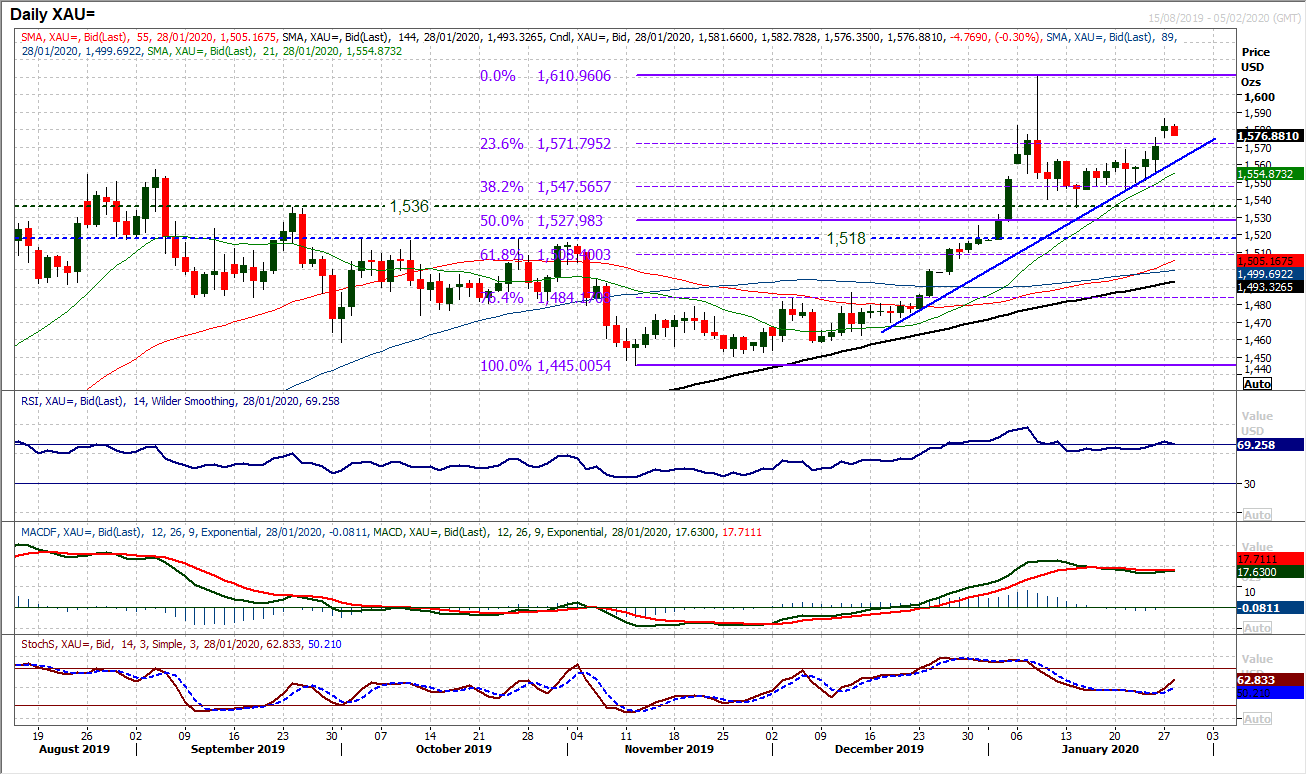

The breakout on gold is consolidating. Having closed above resistance at $1568 on Friday, yesterday’s gap higher was bullishly filled to continue to see gold close at its highest level since 2013. However, the immediate upside impetus I beginning to stall slightly. The move that has been running up the support of a now six week uptrend (which comes in at $1558 today) so there is room to buy into weakness. With momentum indicators now beginning to find traction in moves higher, this is a market finally finding its legs. The RSI is into the 70s again (having reached the mid-80s in early January) and even the sluggish Stochastics finally picking up. The hourly chart has just got a marginal unwind to take hold, but there is an ongoing positive momentum configuration. A near term buy zone comes in at $1568/$1575 now. A move above $1586 would re-open the multi-year high from early January at $1611 again.

Author

Richard Perry

Independent Analyst