Gold narrow range after yearly pivot of $2,075

Gold price was range-bound for the second day in a row on Thursday as it continued to struggle to establish any momentum. While trading in a tight range during Europe’s morning session, the gold price was trading slightly below the $1,925 mark, almost unchanged from earlier in the day. There was a growing consensus among policymakers at the March 15-16 FOMC meeting that inflation had expanded across the economy and that monetary policy should be tightened. Based on the decision of participants, they were prepared to raise interest rates by 50 basis points at future meetings and lower the central bank’s large balance sheet to improve financial stability. For this reason, the yellow metal was seen to be facing an uphill battle.

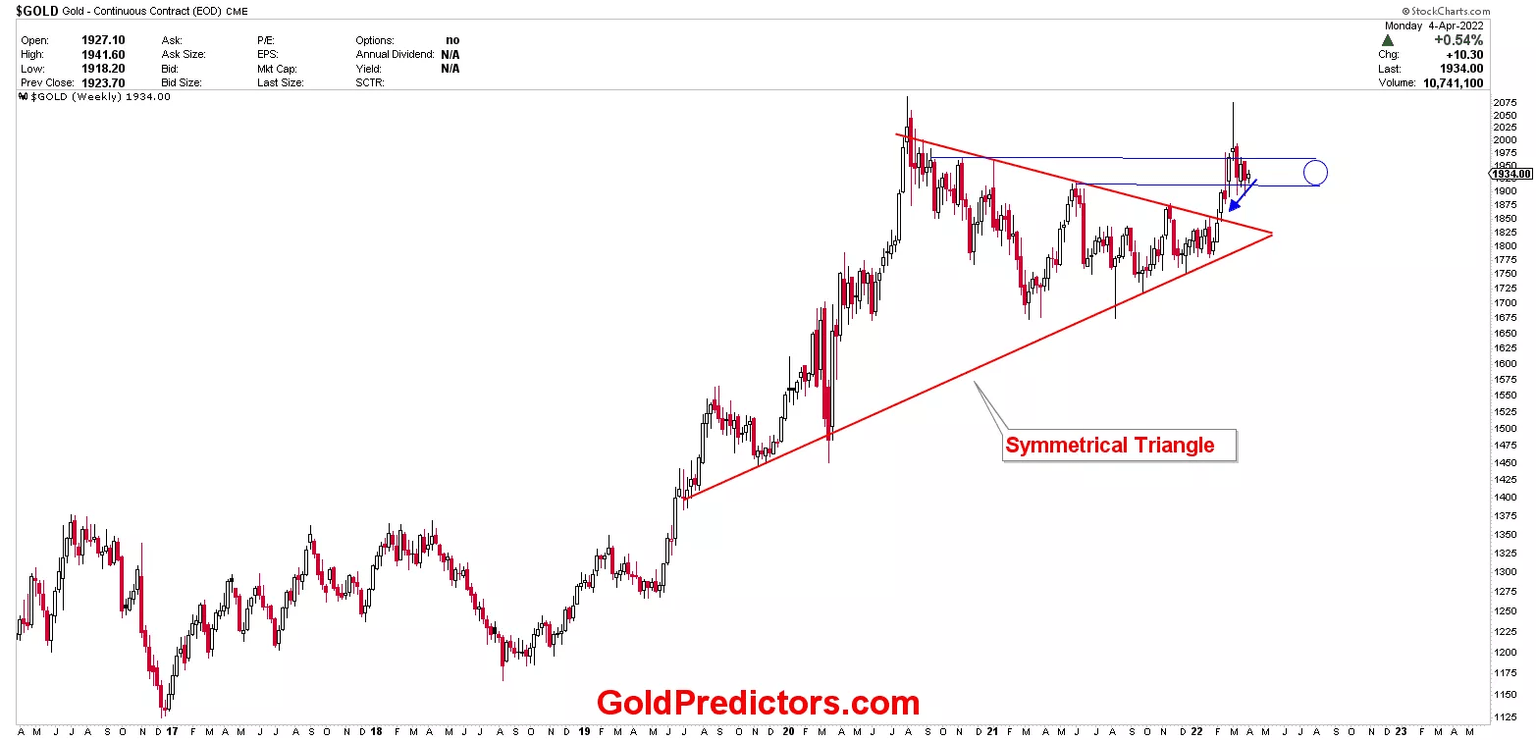

Looking at the technical chart, prices have broken through the symmetrical triangle to reach the $1,970s resistance zone. As previously discussed in premium updates, the yearly pivot is $2,075 and this would be the entry point to all-time highs. The high for spot gold was $2,070, and prices have since dipped below $1,920 to consolidate gains. Prices have recently been fluctuating in the blue circular zones in narrow ranges. This article will go over the technical charts to understand the next move in precious metals.

Anxieties about a political settlement to the Ukraine conflict and the Fed’s plans dampened global risk sentiment. This was obvious from a generally worse tone in the equity markets, which bolstered the gold price. Due in part to a little decline in US Treasury bond rates, anti-risk flows were further bolstered and helped limit the downside for dollar-denominated commodity prices. Technical analysis shows that the spot gold has been fluctuating for the last one-and-a-half weeks or so in an oscillating range. Aggressive traders should exercise care in light of this and prepare for a clear direction.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.