Gold-miners-based RSI says “buy”

No market moves up or down in a straight line. And the time for the “up” in miners is here.

S&P 500: A rebound in the making?

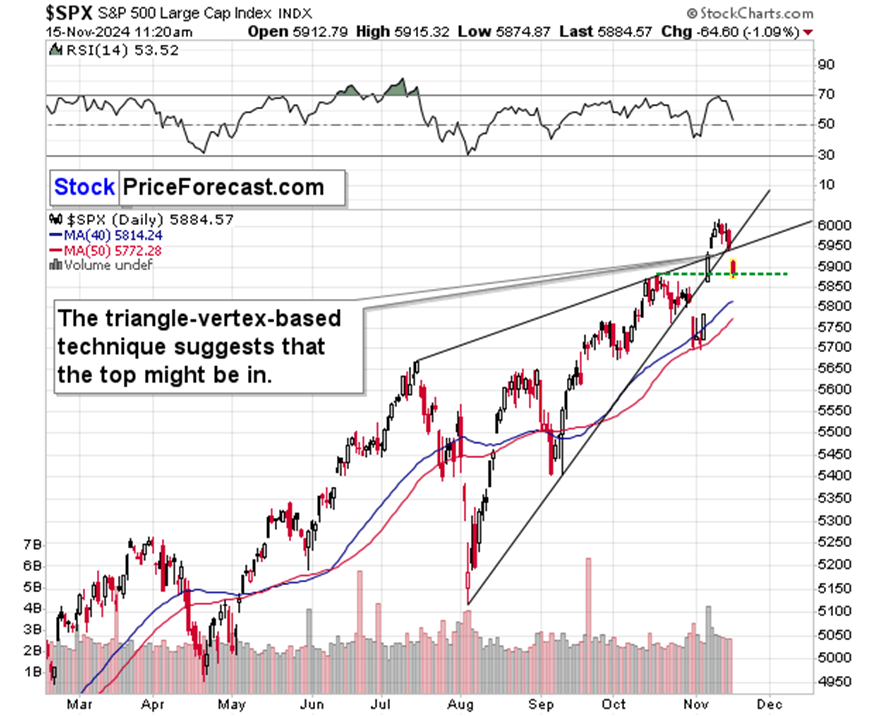

There’s not much going on today in the markets, with the exception of the general stock market, which finally declined after invalidating its move above 6,000. This might have a profound impact on many other markets. But… Even if stocks formed THE top here, they could easily rally in the very near term.

Here’s why:

In my Wednesday’s Gold Trading Alert, I wrote the following:

People got bullish on stocks. I get it. There’s a political change coming, and many investors might be excited about that while I don’t think that others would be willing to sell given this sentiment.

However, I have to point out that tops are formed when the sentiment is extremely bullish. While this doesn’t have to be the final top for this rally (I admit, I thought that we saw a top already and stocks kept on rallying), I do want to stress that this is one of the moments where at least a local top becomes likely.

There are two reasons for it.

First, we have a triangle-vertex-based reversal point right now. The last move has definitely been to the upside, which means that it has bearish implications.

Second, the S&P 500 just invalidated the move above the very round (so, important from the psychological point of view) 6,000 level. This invalidation happened in terms of the closing prices, which makes it even more important than if we saw it just in intraday terms.

IF this is THE top, then the declines in silver and mining stocks (and – in particular – in junior mining stocks are about to accelerate).

The same goes for the decline in the FCX – which is a producer of both: copper and gold.

Indeed, the invalidation of the move above 6,000 and the triangle-vertex-based reversal triggered declines. And this might be the tipping point for the decline in the precious metals market and commodities. However, even if THE top was formed, we might still get a rebound as tops in stocks tend to be rather flat, with more than one smaller top creating them.

And since the S&P 500 just moved to its previous high, we have a good reason to expect the rebound to take place right now.

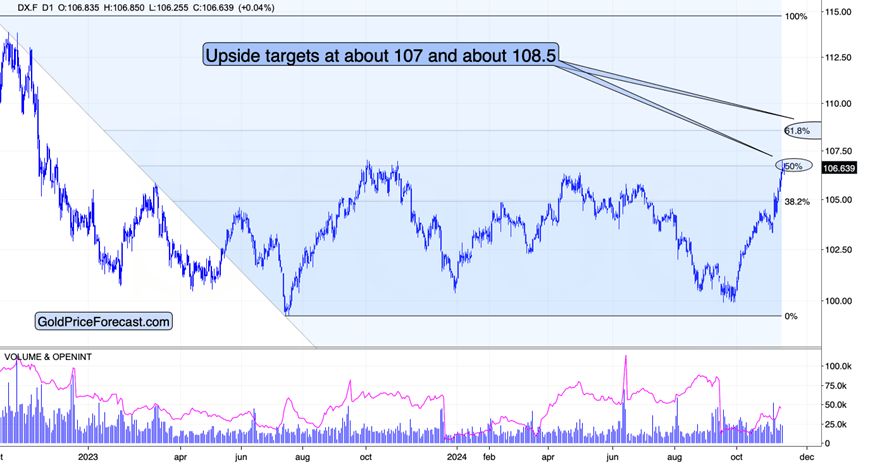

Meanwhile, the USD Index is once again testing the previous high, but since it didn’t move above it, the resistance remains intact, and a corrective decline is likely to follow.

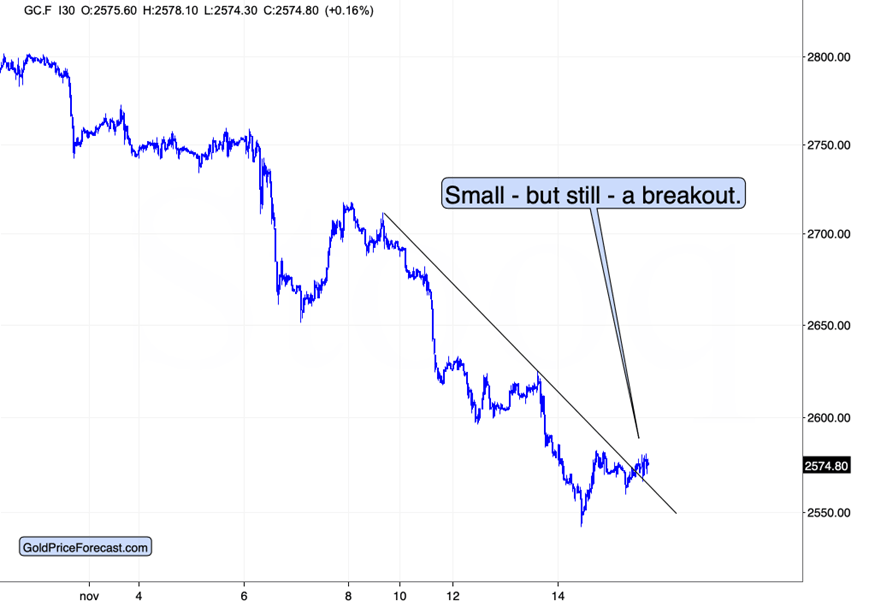

Gold hasn’t done anything meaningful since it moved to its 50% Fibonacci retracement level yesterday. It moved back up somewhat, but not significantly so.

On an immediate-term basis (the above chart is based on 30-minute candlesticks), we see a small breakout, which is a small bullish sign, confirming the points that I made yesterday about the USD Index’s likely top and gold’s likely bottom. This might be a good time for one to establish their core insurance position in gold (using their IRA account).

And since gold is not doing much, and the USD Index is not doing much, one would expect miners not to be doing much, and… Indeed, nothing major is going on.

Resilience amid stock weakness

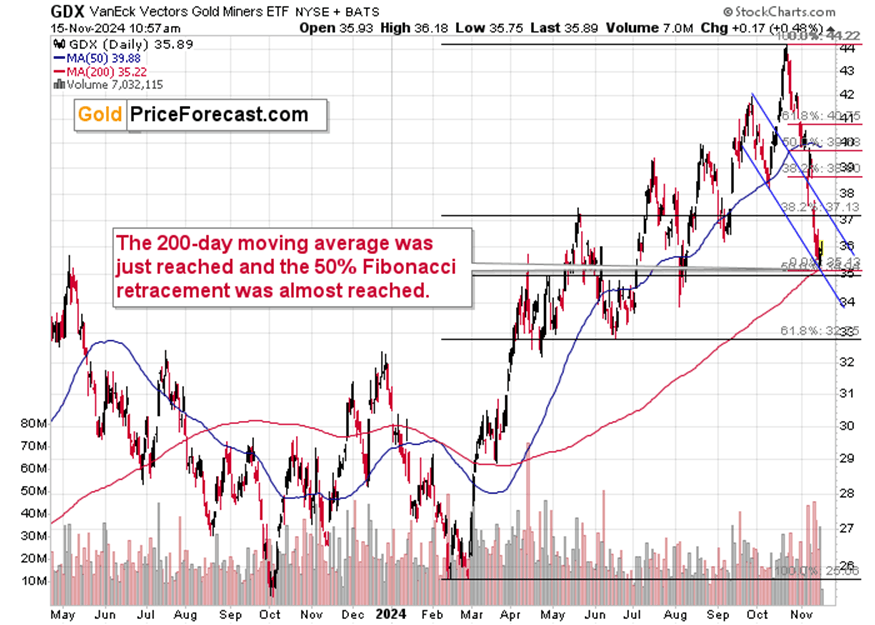

However, I wouldn’t say that it doesn’t have any implications. After all, mining stocks are stocks, and in the near-term price moves in stocks often influence price moves in miners. Given the stock market’s daily decline, it would be natural to see a move lower in the mining stocks – which is something that we don’t have. This means that miners are actually not neutral – they are showing strength here.

This further confirms point made yesterday – that mining stocks might rally here in the following few – ten trading days.

The GDX ETF rallied right after (precisely) touching its 200-day moving average. That’s what also triggered the rally in March and also in early and mid- 2023.

The additional thing that I’d like to add here is a note about the current position of the RSI indicator based on the GDX ETF.

Namely, it moved below 30, which – in all recent cases – marked at least short-term buying opportunities. As history tends to rhyme, we’re likely to experience a rebound also in the near-term future.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any