Gold may be on verge of another selloff because of this bearish pattern [Video]

![Gold may be on verge of another selloff because of this bearish pattern [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/safe-investment-gm147311616-17537479_XtraLarge.jpg)

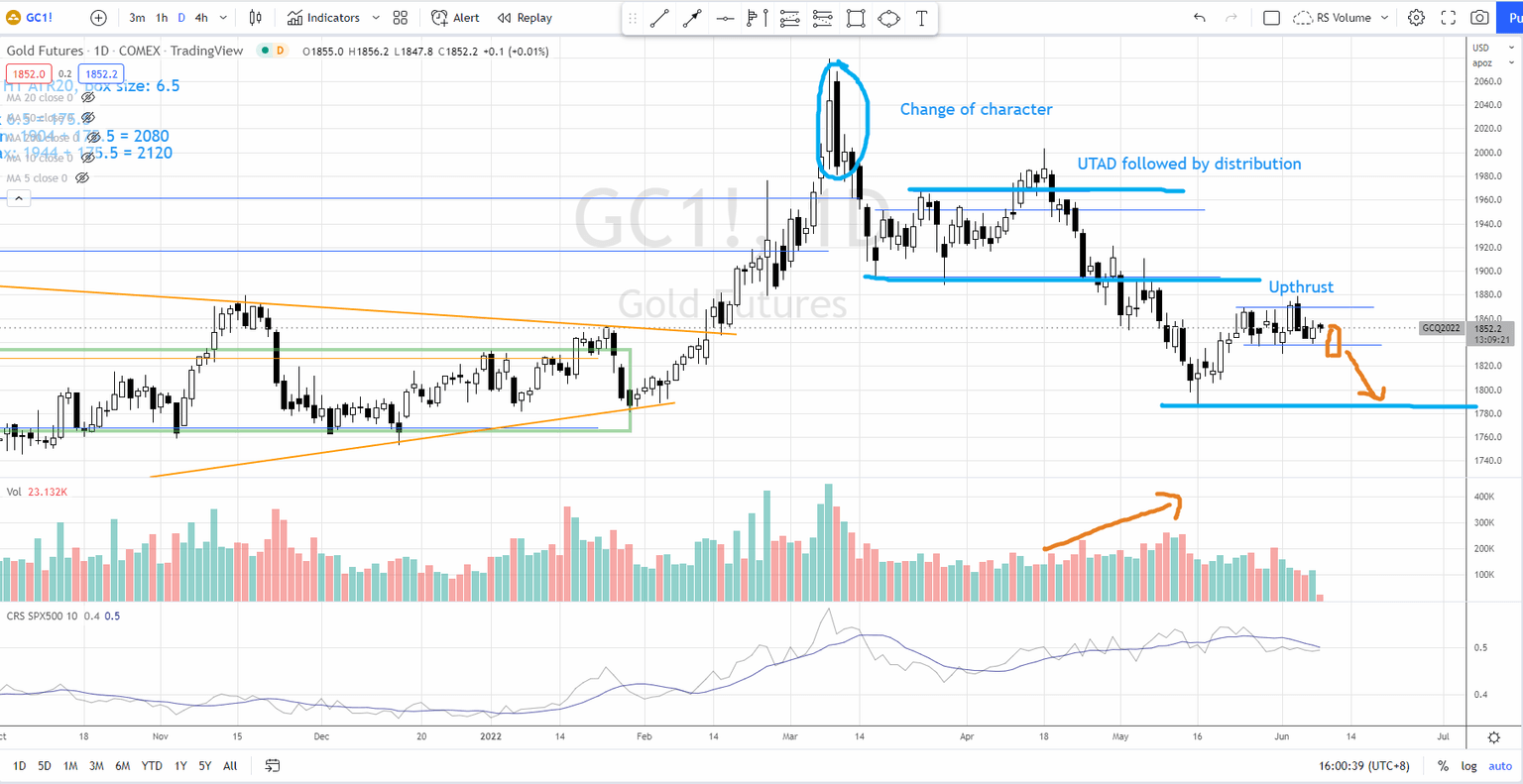

The uptrend of Gold has ended since a Wyckoff change of character bar showed up on 9 May 2022 after a climactic run-up, as explained in my video earlier. This is a key concept of the Wyckoff method to identify a change of the trading environment, which is applicable to all instruments like Gold, stocks, indices futures, crude oil, etc…Watch the video below.

Since then, Gold has been consolidating between 1900-1960 for slightly more than a month. Sign of weakness showed up after confirmation of a Wyckoff upthrust on 19 April 2022 followed by a break below the support at 1900 with a selloff tested 1800 with increasing of volume.

After an automatic rally off the low at 1800, Gold has been consolidating between 1838 and 1870 as shown in the chart below.

On 3 Jun 2022 a Wyckoff upthrust showed up in Gold followed by a reaction tested the support at 1837. Although the upthrust was not accompanied by high volume suggested non-threatening supply, poor demand could also cause Gold to break below the support.

Since Gold broke below the support at 1900 in May 2022 comes with increasing of supply (as annotated in the volume pane), it is likely to be tested.

Should Gold break below the immediate support at 1837, a test of 1800 can be expected (as annotated in orange). Gold is expected to consolidate between 1800-1870 in the short-term.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.