Gold market awaits US CPI data: Will Gold rebound or decline further?

Gold price consolidated after making new record highs of $2943 and struggled below $2900 before the release of US CPI data. This data will provide the next move for the US dollar and gold market.

Gold pressured by USD strength, US CPI data in focus

In remarks before the Senate Banking Committee on Tuesday, Federal Reserve Chair Jerome Powell called the economy strong overall with a solid labour market. He stated that inflation is easing but remains above the 2% goal. This suggests that the Fed will likely be cautious about rate cuts.

Last Friday's upbeat US employment data further reinforced the view that the economy remains resilient. Additionally, expectations that former US President Donald Trump’s policies would reignite inflationary pressures could allow the Fed to stick to its hawkish stance. This sentiment supports the US Dollar (USD) and weighs on gold prices.

The USD gained traction on rising bets that the Fed would hold interest rates steady. This exerted pressure on gold for the second consecutive day on Wednesday. The strength in the USD reduces gold’s appeal as a safe-haven asset.

Meanwhile, Trump signed executive orders imposing 25% tariffs on steel and aluminium imports into the US. He also promised broader reciprocal tariffs to counter levies other governments impose on US products. This move fueled fears of a global trade war, boosting demand for gold as a safe-haven asset.

Trump further signalled his intention to impose additional tariffs on automobiles, pharmaceuticals, and computer chips. The escalating trade tensions have cushioned gold’s losses, limiting its downside despite USD strength.

Investors now focus on the latest US consumer inflation figures. The data will provide fresh clues about the Fed’s rate-cut trajectory. It will also help determine the near-term movement for both the USD and the non-yielding yellow metal.

Gold bullish trend amid inflation outlook

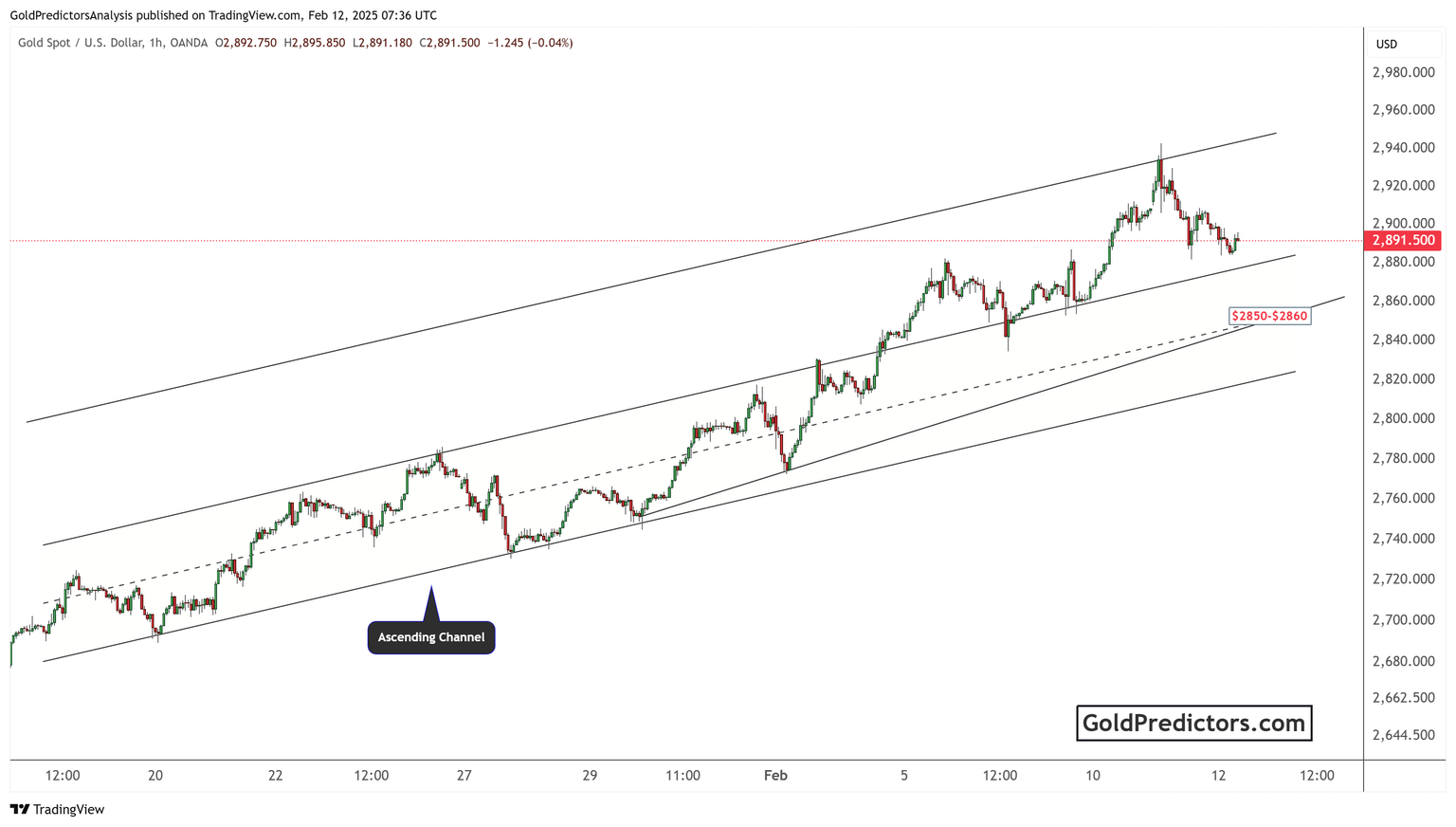

The technical chart below shows that gold price moves within an ascending channel. The price tested the channel's upper boundary before pulling back below $2,900. Despite this retreat, gold remains supported by the lower trendline.

The key support zone lies between $2,850 and $2,860. If the price dips toward this level, buying interest may emerge. A break below this region could signal further downside pressure.

On the upside, resistance is near the $2,920-$2,930 zone. A break above this area could trigger a fresh rally toward record highs near $2,943. However, sustained trading below $2,900 could encourage more downside movement soon.

Conclusion

Gold remains under pressure due to a stronger USD, but trade war fears support its safe-haven demand. The market awaits US CPI data for fresh signals on the Fed’s policy outlook. The ascending channel provides key levels to watch, with $2,850-$2,860 as crucial support and $2,920-$2,930 as resistance. Traders should monitor price action around these levels for potential breakouts or reversals.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.