Gold keeps bulls in control

Gold, Silver, WTI Crude

Gold Spot bottomed exactly at best support at 1764/61. Longs worked perfectly onthe 20 point bounce to 1784 & as far as minor resistance at 1792/96 yesterday. We topped exactly here but outlook remains positive.

Silver Spot still holding the next target of 2610/20 as we trade sideways all through April.

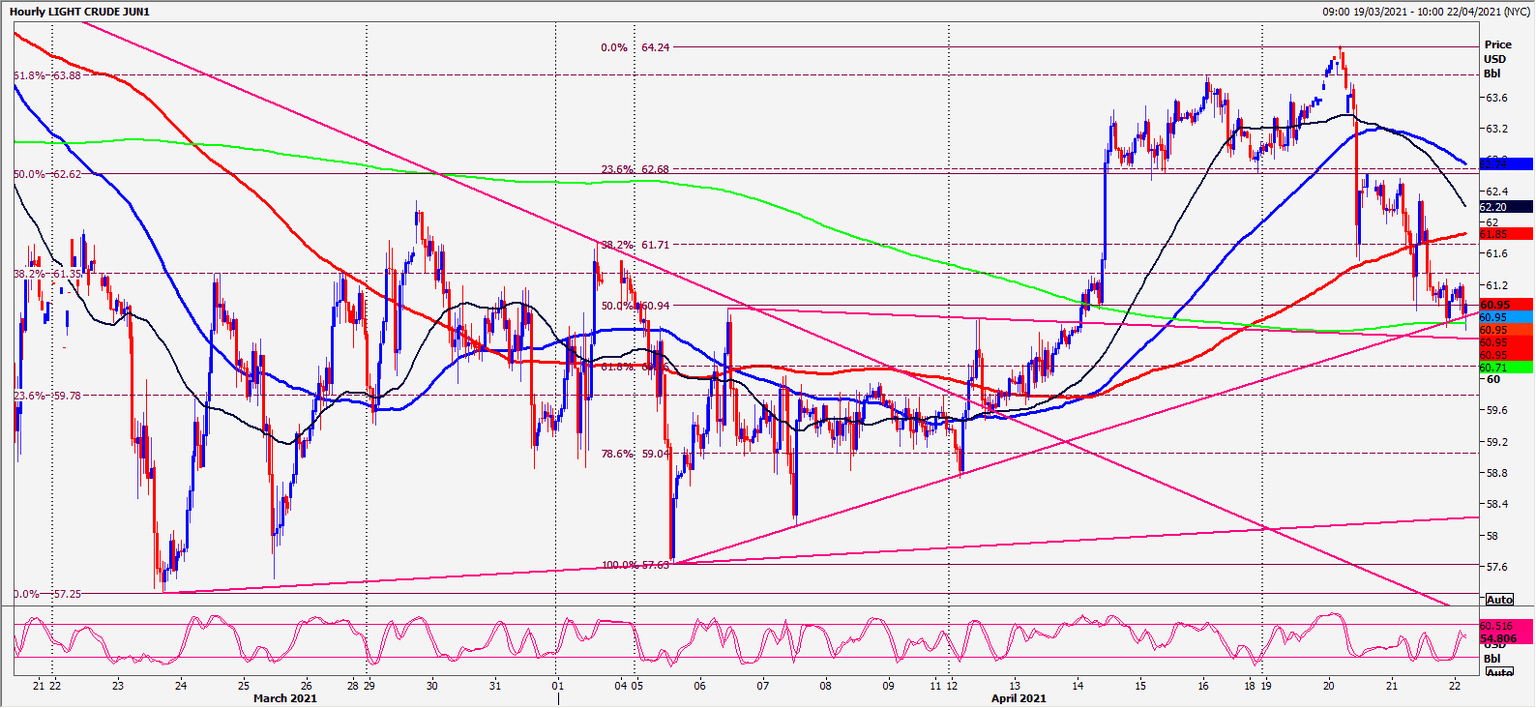

WTI Crude JUNE Future broke first support at 6185/65 to hit the next downside target& support at 6075/65. As I write we bottomed exactly here.

Daily analysis

Gold holding first support at 1790/88 keeps bulls in control. We held minor resistance at 1792/96 yesterday but eventually we should test strong 100 day moving average resistance at 1803/05. A high for the week could be seen here so itis worth profit taking on longs. However a break above 1806 signals further gains to1815.

First support at 1790/88 but expect better support at 1781/78. Longs need stops below 1775. Next downside target & buying opportunity at 1765/61. Longs need stops below 1757.

Silver finally beats 2610/20 to hit the next target of 2650/60, perhaps as far as2685/95 today. A break above 2705 is the next buy signal.

Strong support at 2620/10 but below 2600 can target strong support at 2575/65. Longs need stops below 2755.

WTI Crude breaks 6185/65 to hit support at 6075/65. If we continue lower look for6020/00.

Minor resistance at 61.70/90 but above here can target strong resistance at 6265/75.Strong resistance again at 6380/6400. A break above 6435 targets 6480/85 with strong resistance at 6535/65.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk