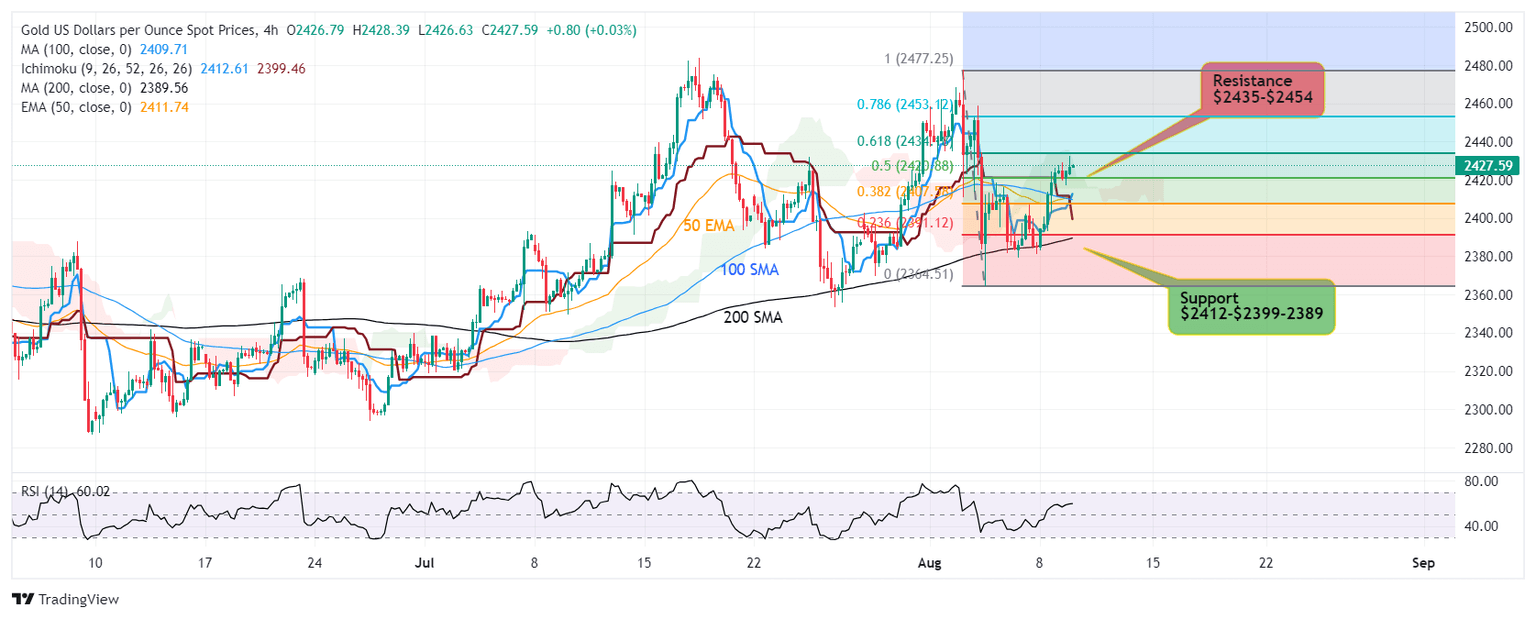

Gold jumps to $2,432 – Markets cautious before the week ends

-

Gold shows strong recovery, climbs to $2432.

-

Strong recovery from recent drop to $2379.

-

Traders cautious at 61.8% fibo level $2434.

-

Next Resistance sits at 71.8% fibo level $2453.

-

Rejection may push Gold to $2412-$2390.

Despite enough reasons for bullish upward momentum in Gold, there have been several phases of downward movements and prices dipped below $2400, recent dip came at $2364 which was followed by a higher low at $2379 and today Gold managed to negate the downward shift when recovery reached $2432, at striking distance from key 61.8% fibo level $2434

Currently we are witnessing some consolidation below $2432 as Gold trades around $2423-$2428, further break below $2420 will extend decline to next leg lower $2412-$2407 while next support is seen located at $2400 below which way opens to further drop to $2390

If bears dominate, we expect to witness a deeper sell off once $2390 is breached followed by day/week close below the zone and this will turn short term trend bearish.

On the flip side, strong break above $2435 will usher in further bullish momentum which will target immediate resistance which aligns with premium zone 78.6% fibo level $2453

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.