Gold is on a tear

On track to end the week up +3.0%, spot gold (ticker: XAU/USD) has outperformed versus the US dollar (USD), underpinned by lower moves in US Treasury yields and the deterioration of the USD ahead of next week’s rate announcement from the US Federal Reserve.

Breakout higher

In the latest edition of The Pattern Pulse, the FP Markets Research Team noted the following on the daily timeframe:

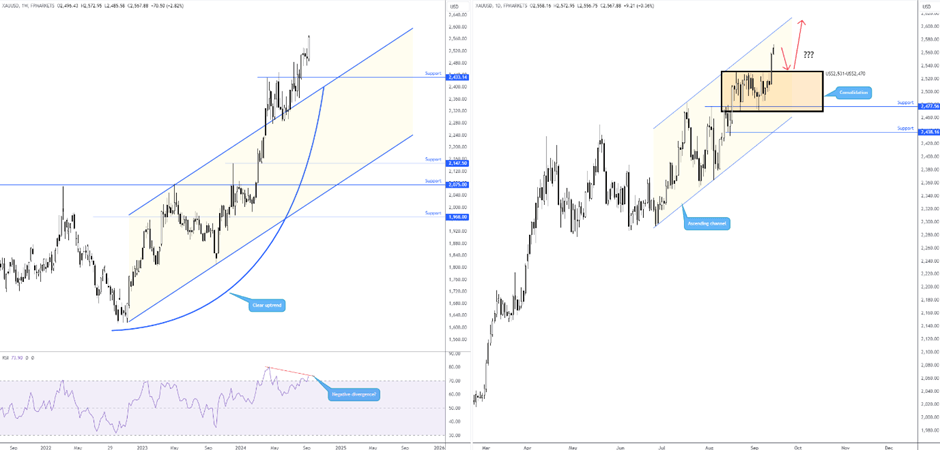

‘Since forming an all-time high of US$2,531 in late August, gold has been rangebound versus the USD (ticker: XAU/USD) between the said high and US$2,470. Ultimately, although momentum to the upside has slowed in recent months, the trend still favours buyers. Coupled with this trend, and daily price action testing the upper boundary of the noted range, a breakout higher could attract strong buying pressure. Conservative traders often filter breakouts using simple techniques like waiting for a retest of the breached area to form before committing’.

Dip-buying?

As you can see from the latest price movement, the yellow metal has broken out to the upside, venturing into unchartered territory and refreshing all-time highs of US$2,572.

According to the daily timeframe, price action is fast approaching channel resistance, extended from the high of US$2,483. This follows the breakout above range resistance from US$2,531. Given the Relative Strength Index (RSI) registering overbought conditions on the weekly chart and on the verge of recording negative divergence, the question is whether the yellow metal pencils in a correction before reaching daily channel resistance and prompting a retest of the breached range resistance (red arrows). In light of the clear-cut uptrend, this would likely tempt dip-buyers to enter the fight.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,