Gold Is Looking Bright

Chaos Clinic for 12/6/2019

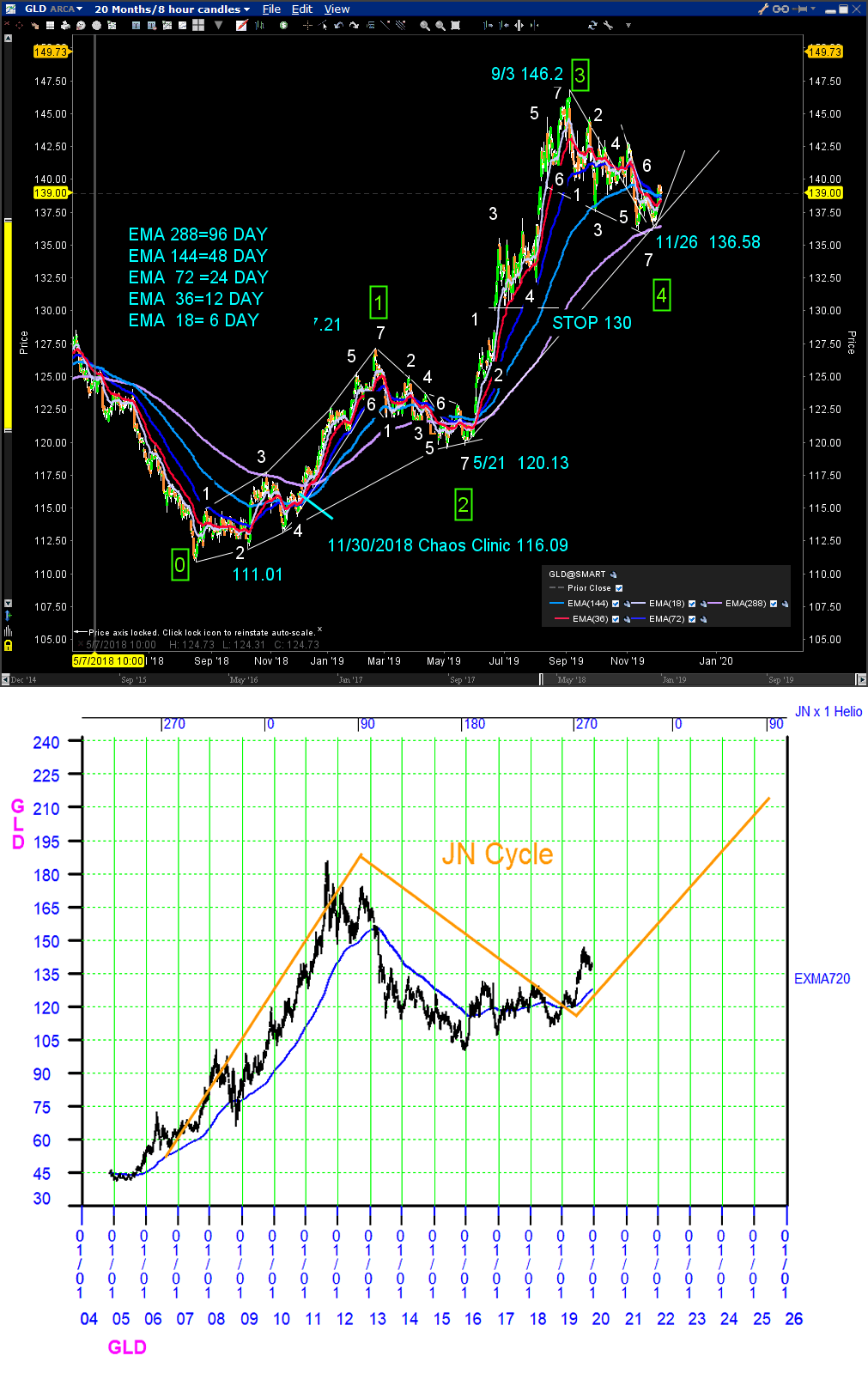

My 11/30/2018 Chaos Clinic pointed out that the gold Exchange Traded Fund GLD looked like it was going to rally. Now, a year later, it is poised to rally more.

The top chart shows an 8 hour bar chart covering 20 months. For the move starting at point 0, prices have traced out moves 1, 2,3, and now 4 of 7 in an up Chaos Clamshell. Inside each of these moves are smaller 7 move fractals.

A rainbow of exponential moving averages helps indentify moves. On this chart the 288 bar EMA filters a 96 day cycle. At move 2, this average was penetrated slightly, but at 4, prices have held above the 96 day EMA. This helps confirm move 4, and also indicates that the move is gaining strength.

The second chart is a multi-year daily chart of GLD. Overlaid on it is the 12.8 year Jupiter-Neptune astro cycle.That cycle shows up as a square in the US gold futures natal chart. The turns are on the squares of the cycle. That this is a valid cycle is shown by the behavior of the 720 calendar day tracking EXMA.

Traders should proceed at their own risk. Stops should always be used. The EXMAs provide stop guidance. On the top chart, a stop under the 96 day EXMA should work,and on the second chart, one under the 720 day is advised.

This content was published on Dr. Al Larson's Chaos Clinic which you can attend each Friday for free.

Dr. Al Larson has developed a complete Chaos Model of Markets, four unique courses that let you become a Certified Chaos Trader, some very unique eMylar fractal pattern overlays, and tools that permit forecasting individual stocks and markets years in advance. You can also sign up for a free weekly email, and attend a free Chaos Clinic on Fridays. To learn more, click on the author's profile.

Be sure to sign up for the free weekly email!

Author

Dr. Al Larson, PhD

MoneyTide.com

Dr. Al Larson holds a Ph.D. in Electrical and Computer Engineering from the University of Wisconsin. He is a 1964 Distinguished Graduate of the U. S. Air Force Academy.