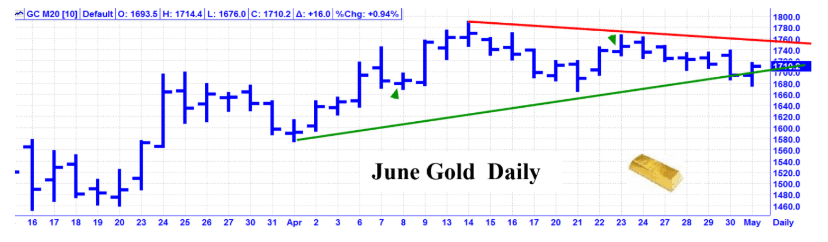

Gold is coming to the apex of a triangular pattern

SILVER

April Review Only – “Silver had a March meltdown, reaching the lowest low, since January 2009. Following a good rebound, the market is now trading sideways. Key Dates – 4/2, 4/8, 4/23, 4/30”

Results – 4/2 was very close in price and one day past the low of the month. 4/8 was a good pullback low. 4/23 was a good high. 4/30 was a very good high. Score – 4 out of 4 good dates = 100%.

GOLD

April Review – “During March, Gold made its high of the month near the 3/9 Full Moon at Perigee, then plunged more than $200, into a mid-month low. From that low, Gold rallied to near its mid-month high, for a wild roller coaster ride. Key Dates – 4/8, 4/23”

Results – 4/8 was a good pullback low. 4/23 was a good high. Score – 2 out of 2 good dates = 100%.

May Update – The Gold chart looks like Gold is coming to an inflexion point or apex for a wedge or triangle pattern. Whichever way it breaks out, it should be soon, and should generate a substantial move.

Key Dates – 5/5, 5/7, 5/11, 5/22

This is an excerpt from the Astro Trend newsletter. Astro-Trend covers about thirty futures related markets including the major Financial Markets, such as the Stock Market, T-Bonds, Currencies, and most major commodities. We also offer intra day data which identifies potential change in trend points to the minute.

Author

Norm Winski

Independent Analyst

www.astro-trend.com