Gold hit the $2,586 target

Gold

-

Gold finally made a break above 2533 for a buy signal targeting 2539/43, 2554/56, 2565, 2578/82 & 2586. A high for the day & new all time high exactly at 2586. I can't see how I could have been more accurate!!

-

Further gains are expected to 2599/2602 this week & 2620/22 is even possible.

-

I am a buyer if we dip to support at 2561/57 & longs need stops below 2554.

-

If we continue lower look for a buying opportunity at 2544/40 & longs need stops below 2535.

Silver

-

Silver shot higher through 2911/18 towards the August high at 3010/3018 & on to 3055/59 as expected, reaching 4 month 3080/90 on Friday.

-

Bulls now need a break above trend line resistance at 3110 for the next buy signal targeting the July high at 3150/75.

-

Support at 3015/3005 & longs need stops below 2980.

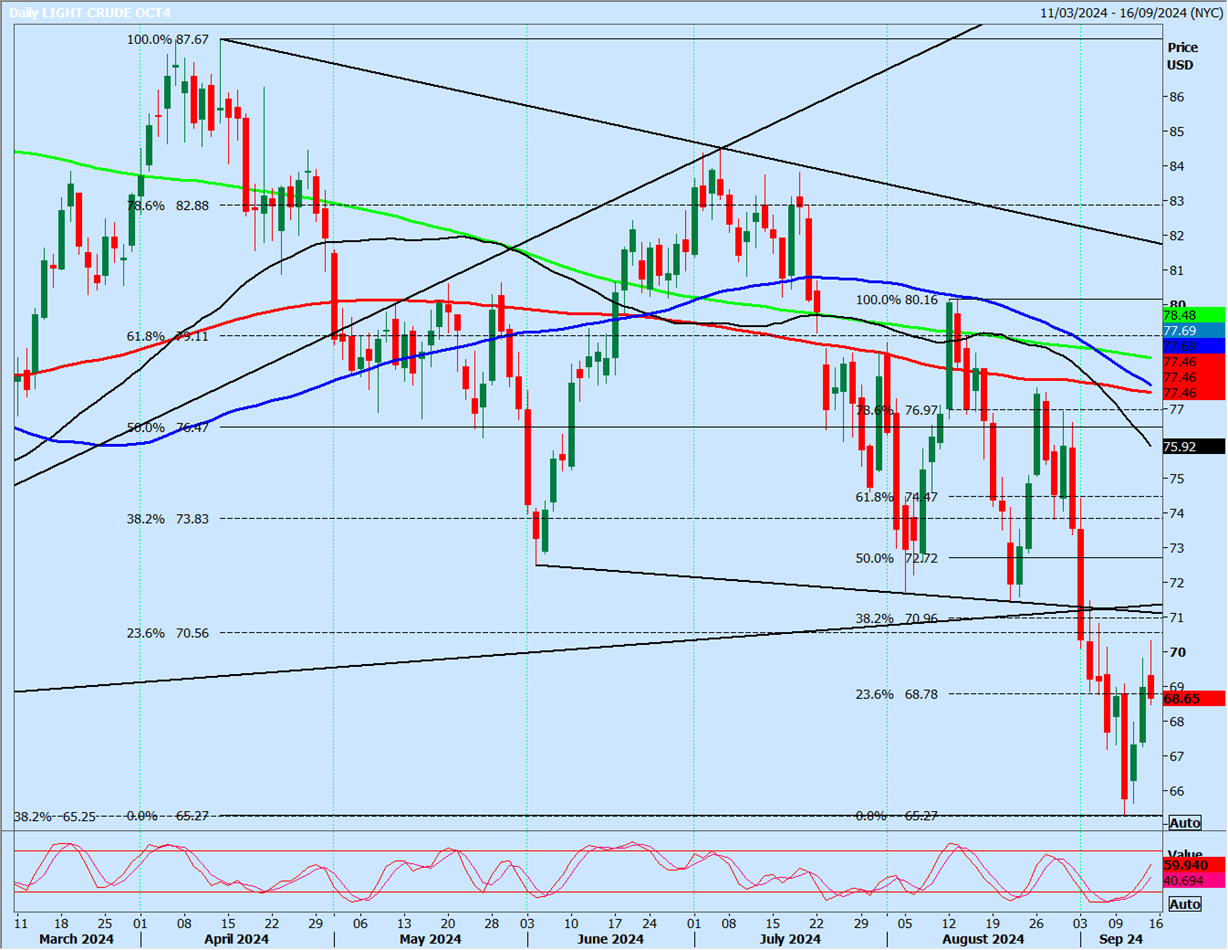

WTI Crude October future

Last session low & high for the October contract: 6847 - 7032. (To compare the spread with the contract that you trade).

-

WTI Crude did not make it back to the break point of the longer term 18 month trend line at 7110/50 yet with a high for the day at 7032.

-

I hope to sell at 7110/50 & stop above 7200. HOWEVER after Friday's reversal we may not get that far. It may be worth selling on a break below 6840 to target 6800, 6730/20 & perhaps as far as 6660.

-

Try longs at 6550/6500 if we get a chance today with stops below 6400. Targets: 6690/6720, 6800/6820, perhaps as far as 6870/6900.

-

A break below 6400 signal further losses which could be as far as the 500 week moving average at 6200.

Author

Jason Sen

DayTradeIdeas.co.uk