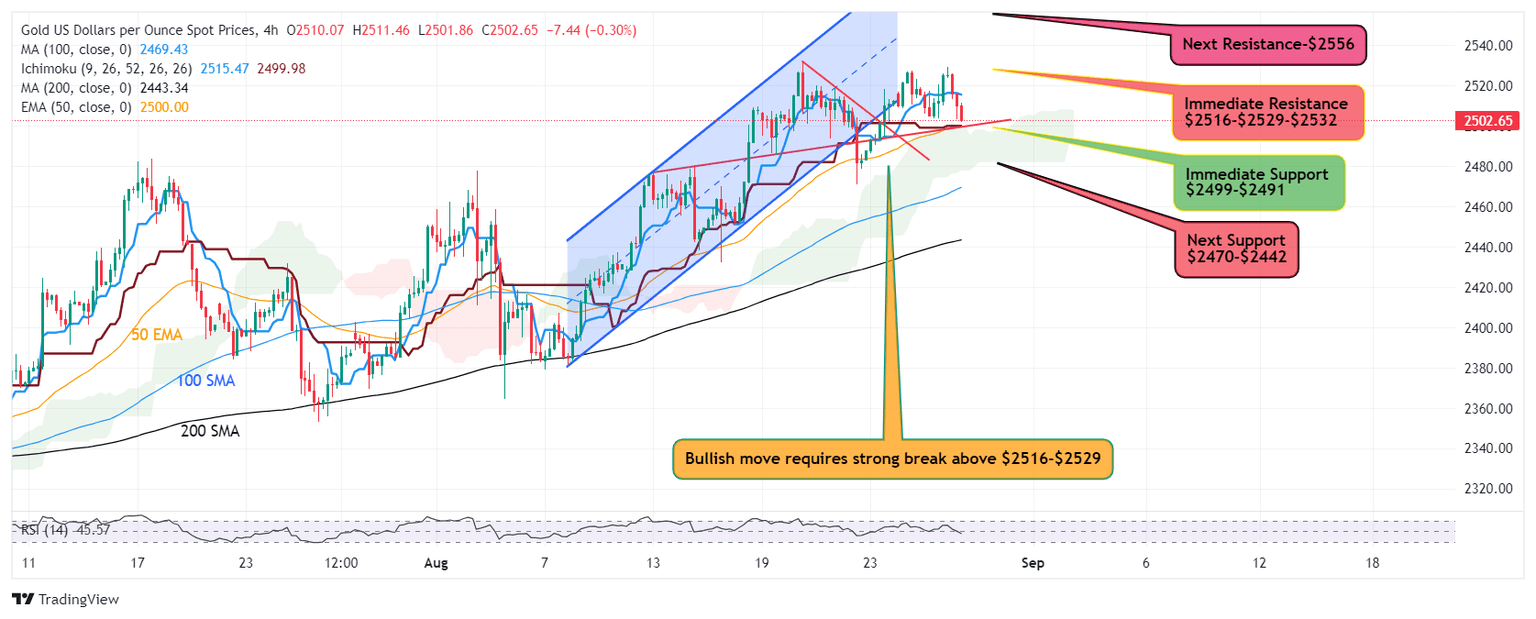

Gold hammered at $2,529 – Will bulls defend $2,500?

-

Gold failed to break the roof as bears hammered the metal at $2529.

-

Profit booking pushes Gold to $2500.

-

$2500-$2490 is immediate support zone which bulls may decide to defend.

Today's early asian session witnessed sharp upmove in Gold which reached $2529 and was quickly followed by profit booking which started downward push to reach $2500 before the US session begins.

Yesterday's improved CB Consumer Confidence has taken its toll on the yellow metal and markets are looking for more clues from tomorrow's upcoming Initial Jobless Claims as well as GDP numbers that may drive some triggers for Gold short term range.

On the other hand, tensions in the middle east keep risk element on the horizon which indicates buyers are on the look out for buying every dip.

There is a possibility that the bulls may resurface at the test of $2500 and on dips around $2490 in anticipation of bullish rally to resume for retest of $2516-$2529.

If $2516-$2529 is cleared, the rally may extend to $2556.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.