Gold gains momentum as US economic slowdown fears grow

-

Weaker labor market data and fears of a US economic slowdown have supported rising gold prices.

-

Weak US PPI data and higher jobless claims contributed to a weakening US dollar, boosting gold's attractiveness.

-

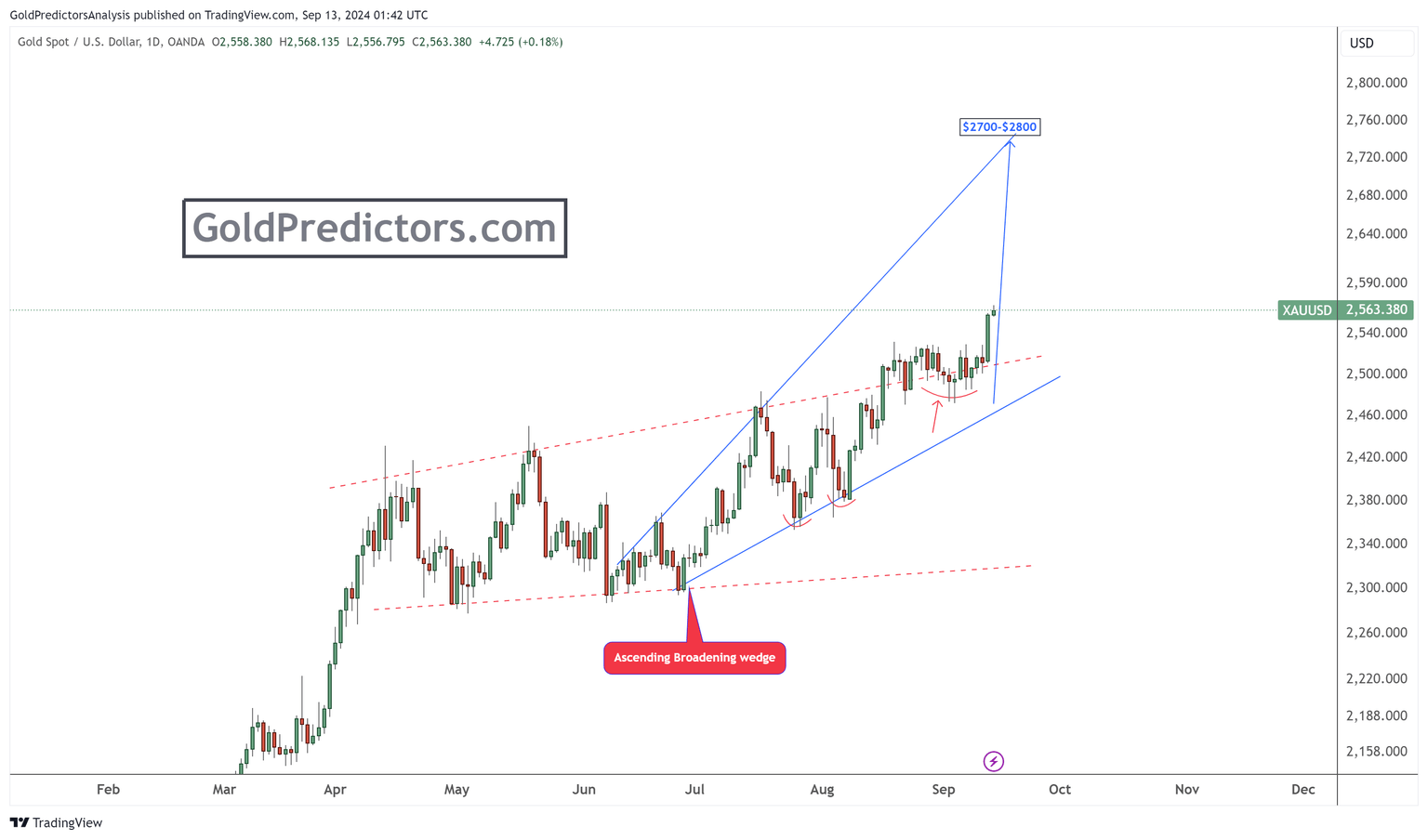

The emergence of ascending broadening wedge signals continued momentum for gold prices.

Fears of a slowdown in the US economy with the weaker labor market data provide a supportive backdrop for gold prices. The unemployment rate is rising to 4.3%, and non-farm payroll growth is slowing significantly. The market expectations have shifted from concerns about high inflation towards more aggressive rate cuts by the Federal Reserve. As the Fed moves towards cutting rates, gold may benefit from lower interest rates and a weaker US dollar, which typically makes the precious metal more attractive to investors. Additionally, the easing inflation pressures and Fed signals of further rate cuts suggest that gold could continue to be seen as a hedge against economic uncertainty. The prospect of a slower but still solid US economic growth trajectory with potential rate reductions could sustain demand for gold as a safe haven asset.

Moreover, gold surged to a new record high following the release of US inflation data, reinforcing its status as a safe-haven asset amid economic uncertainty. The weaker-than-expected US Producer Price Index (PPI) and higher-than-anticipated jobless claims contributed to a broad weakening of the US dollar, boosting gold’s appeal. While the core PPI rose by 0.3% in August, slightly higher than expected, the annual increase of 2.4% fell short of market forecasts. This weaker inflationary pressure and increasing jobless claims has further solidified market expectations of future rate cuts by the Federal Reserve. As lower interest rates tend to diminish the appeal of interest-bearing assets, demand for gold as an inflation hedge and store of value has intensified. The combination of weakening economic indicators and the expectation of an easing monetary policy environment continues to support the upward momentum in gold prices.

The gold surge following the release of the US PPI data has pushed prices to record highs. Support at the ascending broadening wedge, followed by consolidation after the breakout of the blue dotted trend lines, indicates strong bullish momentum in the gold market, which has fuelled this rally. The initial target for this rally is $2,700–$2,800. Any dip in prices presents a potential buying opportunity.

Bottom line

In conclusion, the ongoing economic uncertainties in the US, driven by weaker labor market data and expectations of more aggressive rate cuts by the Federal Reserve, have created a favorable environment for gold. With inflationary pressures easing and the US dollar weakening, gold has surged to new record highs, further solidifying its role as a safe-haven asset. The bullish momentum, supported by the ascending broadening wedge suggests continued strength in the gold market. As investors seek refuge amid economic slowdown fears and policy shifts, gold's potential to reach the $2,700–$2,800 range remains strong, with any price dips offering attractive buying opportunities.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.