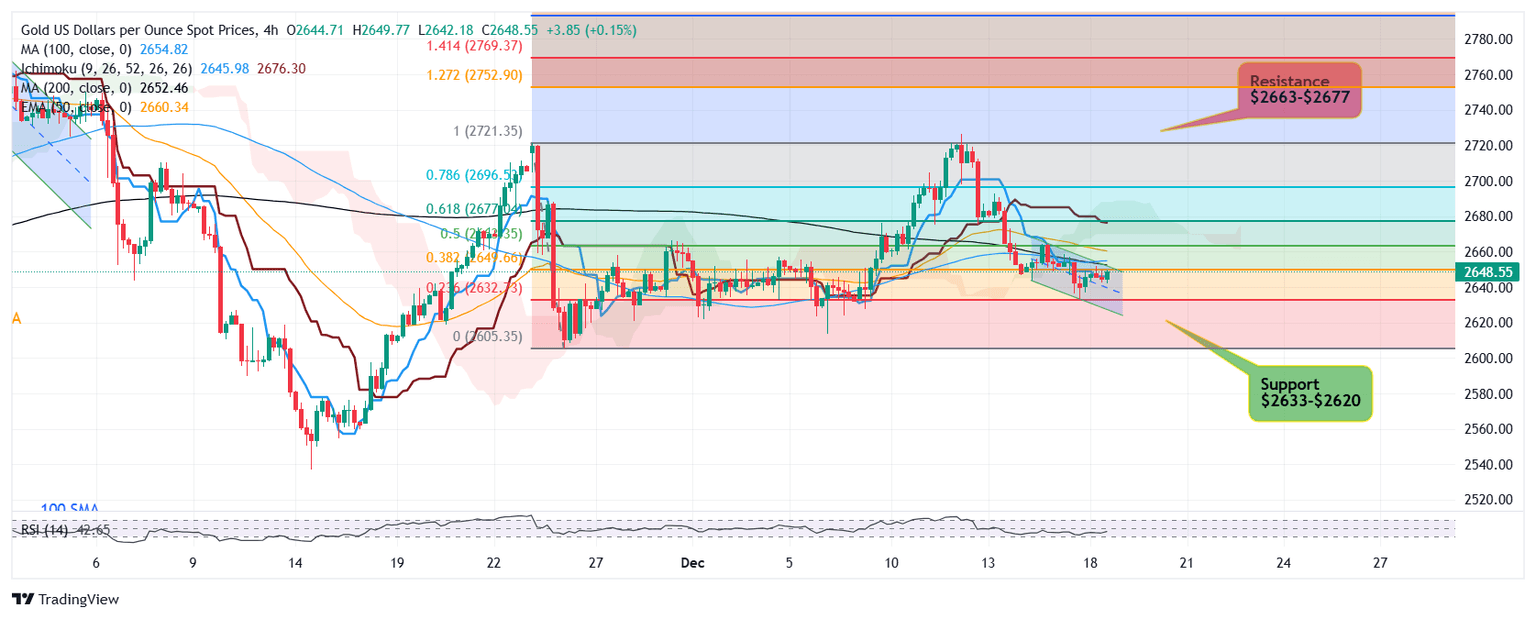

Gold finds support at $2,633 and awaits break above $2,652

Yesterday's decline to $2633 attracted some buying and today's trading witnesses recovery attempts currently facing resistance at $2652 which bulls need to clear through in order to extend recovery towards next hurdle $2663

If there is enough buying momentum above $2663, expect rebound extending to turning point $2677 where sellers are likely to resurface.

On the flip side, if immediate support $2643-$2641 is breached, the metal is likely to retest $2633 below which sellers will try to push lower for $2620

Meanwhile, markets are likely to remain sideways with relative volatility on Fed's rate announcement that will give further clues to Dollar direction.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.