Gold falls for the fifth consecutive trading session

On Thursday, the price of a troy ounce of Gold is lower, approaching 2,560.00 USD.

The current value of Gold is at an eight-week low, influenced by the strong US dollar. The market analyses the latest inflation statistics released in the US and draws rather ambitious conclusions.

The inflation statistics came out within expectations. The only thing that might have hurt investors' attention was the three-month inflation numbers, which rose on a year-on-year basis. Even so, the CPI data increases the likelihood of the Federal Reserve cutting interest rates in December. The odds of a rate cut are around 80%, up from less than 60% a couple of days ago.

Since last Friday's sell-off, the gold price has fallen by 4%. The stock exchange opinion is as follows: since Donald Trump will become the new US President, the Fed will be forced to stop the easing cycle sooner or later. This is due to the protectionist policies that Trump and his administration usually pursue, which can stoke inflation.

A strong US dollar will visibly weigh on the value of Gold and force the precious metal to retreat.

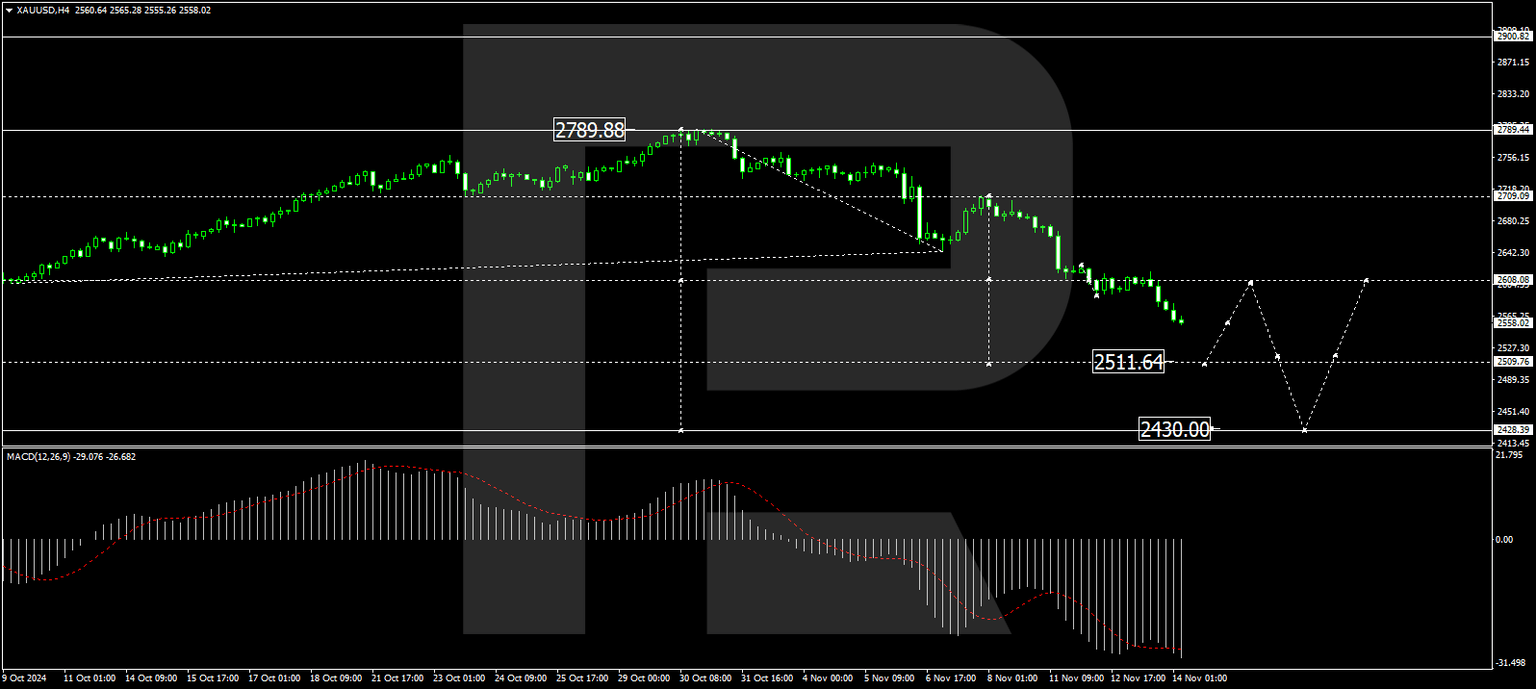

Technical analysis of XAUUSD

On the H4 chart of XAUUSD, the market has formed a consolidation range around the level of 2,608.00 and, with a downside exit, continues the development of the second half of the third wave of the trend to the level of 2511.65. After working off this level, we will consider the probability of the beginning of the correction wave to the level of 2,608.00 (test from below). After the correction is completed, we expect a new wave of decline to 2,430.00. Technically, this scenario is confirmed by the MACD indicator. Its signal line is under the zero level and is directed downwards.

On the H1 chart of XAUUSD, the market broke through the level of 2,590.00 downwards and reached 2,560.00. We expect the development of a compact consolidation range around this level. A correction link to 2,577.00 is possible in case of an upward exit. Conversely, in case of a downward exit, we will consider the continuation of the wave to the local target of 2,511.65. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under 50 and is directed downwards to 20.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.