Gold ETF momentum eased in may with modest outflows

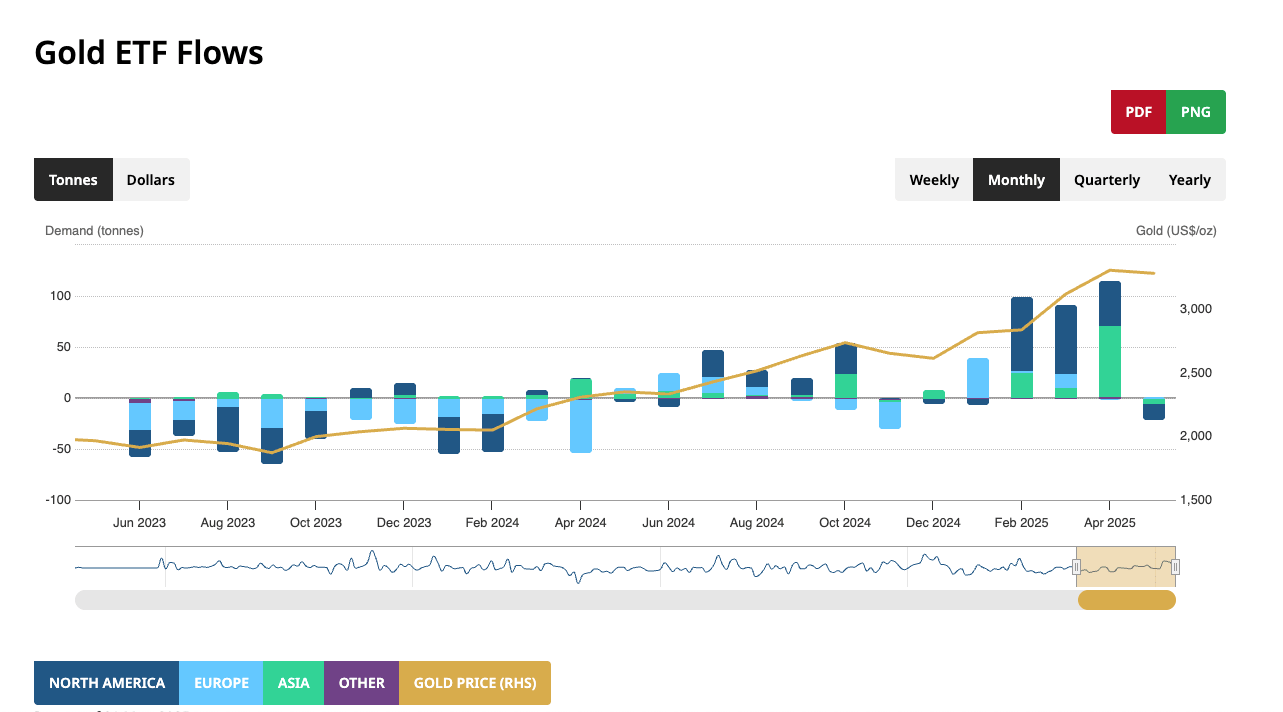

For the first time in five months, gold-backed ETFs globally reported modest outflows in May as investors took profits.

After charting the largest inflows of gold since August 2022 in April, gold-backed ETFs globally reported modest outflows of 19 tonnes totaling $1.8 billion last month.

A combination of gold outflows and a moderating gold price pushed total assets under management (AUM) by ETFs to fall 1 percent to $347 billion.

After setting a record of $3,500 an ounce in April, gold prices consolidated last month, and many investors took the opportunity to book profits. An easing in trade war tensions also increased risk appetite, driving a pivot out of haven assets.

Despite the outflows in May, flows of metal into gold-backed funds remain positive for the year at 322 tonnes.

U.S funds drove global gold outflows, decreasing their holdings by 15.6 tonnes. According to the World Gold Council, “The better-than-expected temporary easing of tariffs between the U.S. and China improved investor risk appetite, which led to a strong rebound in equities, but lower safe-haven demand for gold.”

WGC analysts said that the recent trend of gold outflows from U.S. funds could be short-lived as stagflation worries grow.

"The newly proposed ‘One Big Beautiful Bill Act (OBBBA)’ and Moody’s recent U.S. sovereign credit downgrade have reignited investor concerns about U.S. debt sustainability. And while this lifts U.S. Treasury yields via rising term premiums, it could also benefit demand for gold as investors search for alternative safe havens."

European ETFs reported gold inflows of 1.6 tonnes. Gold accumulation by French funds offset outflows from funds based in Germany and the UK.

The World Gold Council cites three factors driving increased gold demand in Europe...

- Sluggish economic growth and weakening consumer sentiment.

- The Trump administration’s escalation of tariff threats attracted gold ETF inflows across Europe in late May.

- Intensifying fiscal concerns and political instability.

In April, Asian funds upped their AUM by $7.3 billion, the highest monthly increase on record. Last month, they gave some of that back with gold outflows totaling $489 million.

As in other regions, cooling trade tensions diminished safe haven demand and investors took profits.

In tonnage terms, Asian funds reported outflows of -4.8 tonnes.

China led outflows, but Japanese funds reported modest inflows as their bond market went into meltdown mode.

Funds in other regions, including Australia and Africa, reported modest outflows of -0.4 tonnes.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

ETFs are relatively liquid. You can buy or sell an ETF with a couple of mouse clicks. You don’t have to worry about transporting or storing metal. In a nutshell, it allows investors to play the gold market without buying full ounces of metal at the spot price.

Since you are just buying a number in a computer, you can easily trade your ETF shares for another stock or cash whenever you want, even multiple times on the same day. Many speculative investors take advantage of this liquidity.

But while a gold ETF is a convenient way to play the price of gold on the market, you don’t actually possess any gold. You have paper. And you don’t know for sure that the fund has all the gold either, especially when the fund sees inflows. In such a scenario, there have been difficulties or delays in obtaining physical metal.

Gold market trading volumes averaged $363 billion per day last month, 18 percent lower month-on-month, but significantly higher than the 2024 average of $233 billion per day.

Total COMEX gold futures net longs reached 551 tonnes at the end of May, representing a mild 3 percent decline month-on-month. However, money manager net longs saw a mild 1 percent monthly rebound to 365 tonnes, driven mainly by a larger decline in total shorts compared to longs.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.