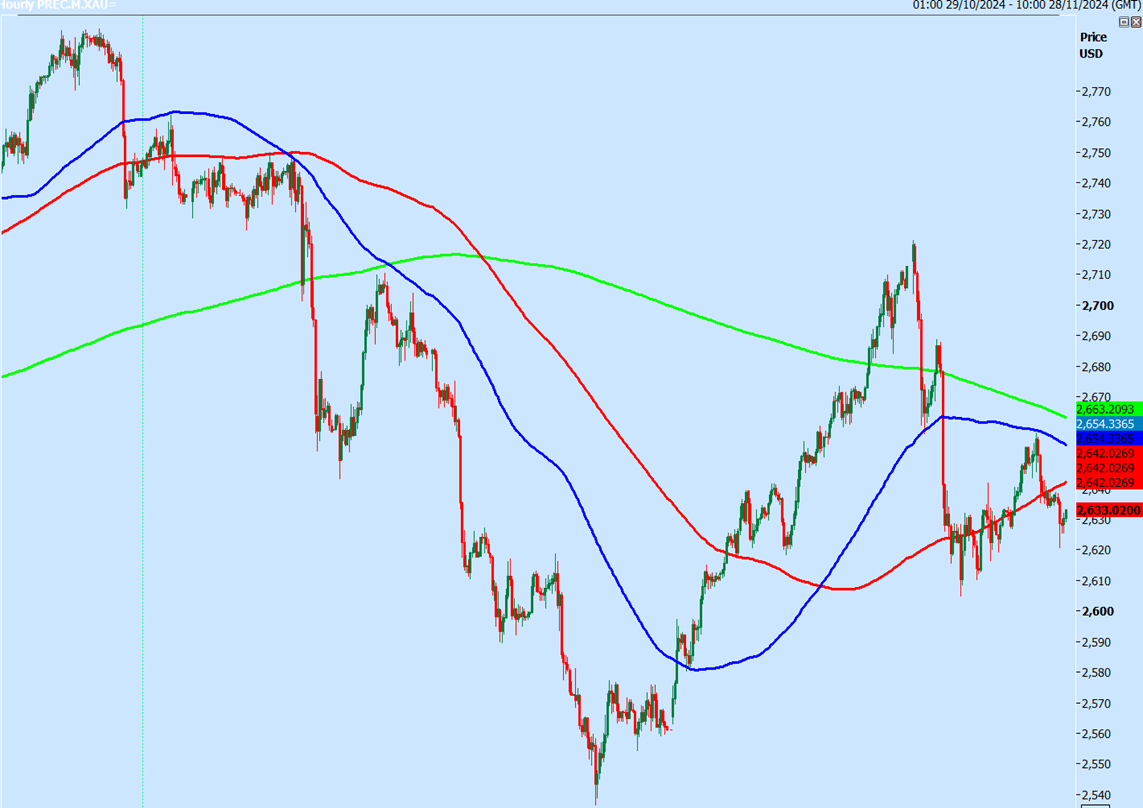

Gold establishing a short term bear trend

Gold

-

Gold headed higher as predicted to strong resistance at 2648/52 & shorts needed stops above 2657.

-

This was tricky as Gold hit 2658 on the release of the inflation data in the US.

-

I hope that you managed to hold the short position!!

-

Gold crashed immediately after we hit 2658 & hit 2620.

-

I think we have completed the bear flag pattern & Gold will continue lower towards 2617/15 & eventually we will probably retest the November low at 2610/05.

-

A break below 2602 is a sell signal targeting 2595/94 & 2580/75, perhaps as far as 2565.

-

Gains are likely to be limited again today as we transition to a medium term bear market.

-

I expect strong resistance again at 2648/52 & shorts needed stops above 2658.

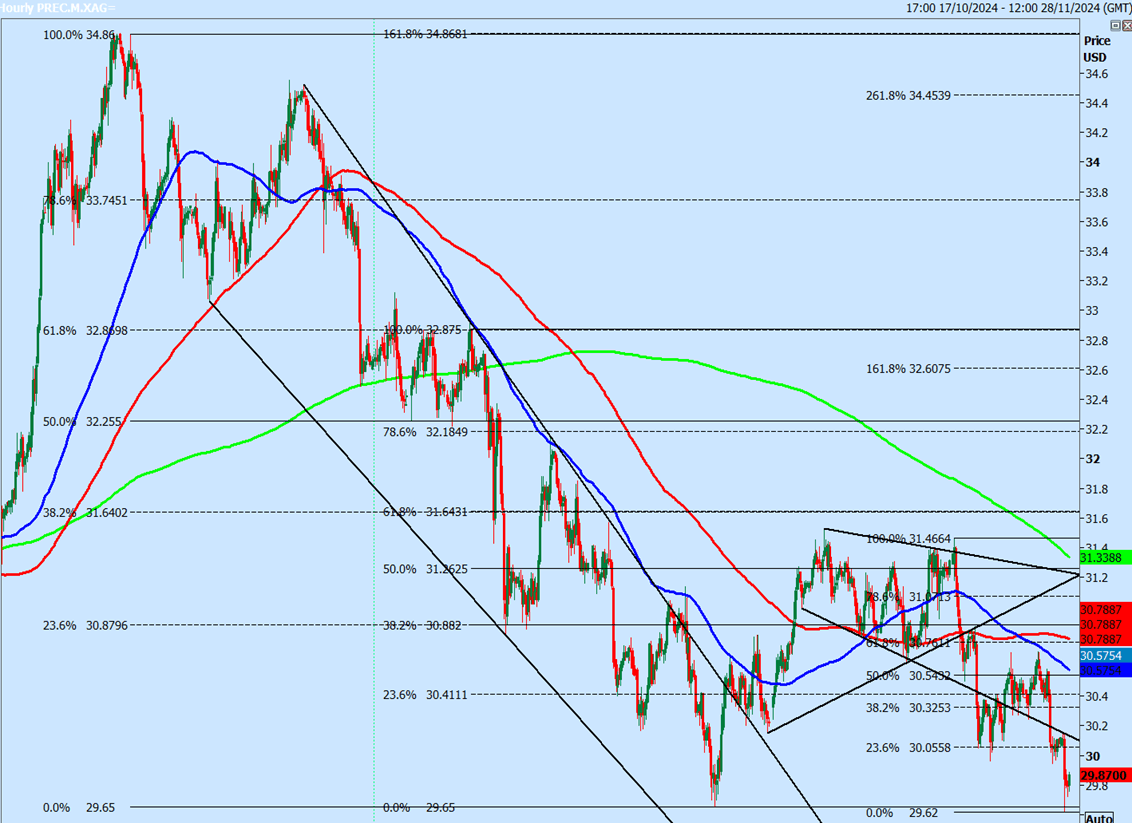

Silver

-

We wrote: Silver looks likely we will retest the November low at 2675/65.

-

As I write we are testing this level as predicted.

-

Unfortunately we missed the sell opportunity at 3080/90 by just 10 ticks.

-

WE HAVE THE NECK LINE TO A HEAD & SHOULDERS AT 2955/45.

-

This is obviously the key level for today.

-

A BREAK BELOW HERE IS AN IMPORTANT MEDIUM TERM SELL SIGNAL INITIALLY TARGETING THE 200 day moving average at 2905/00.

-

However just be aware that the measured target for the move is down towards the 500 day moving average at 2670/60.

-

Gains are likely to be limited after the bull trap with strong resistance at 3030/40 - here shorts need stops above 3060.

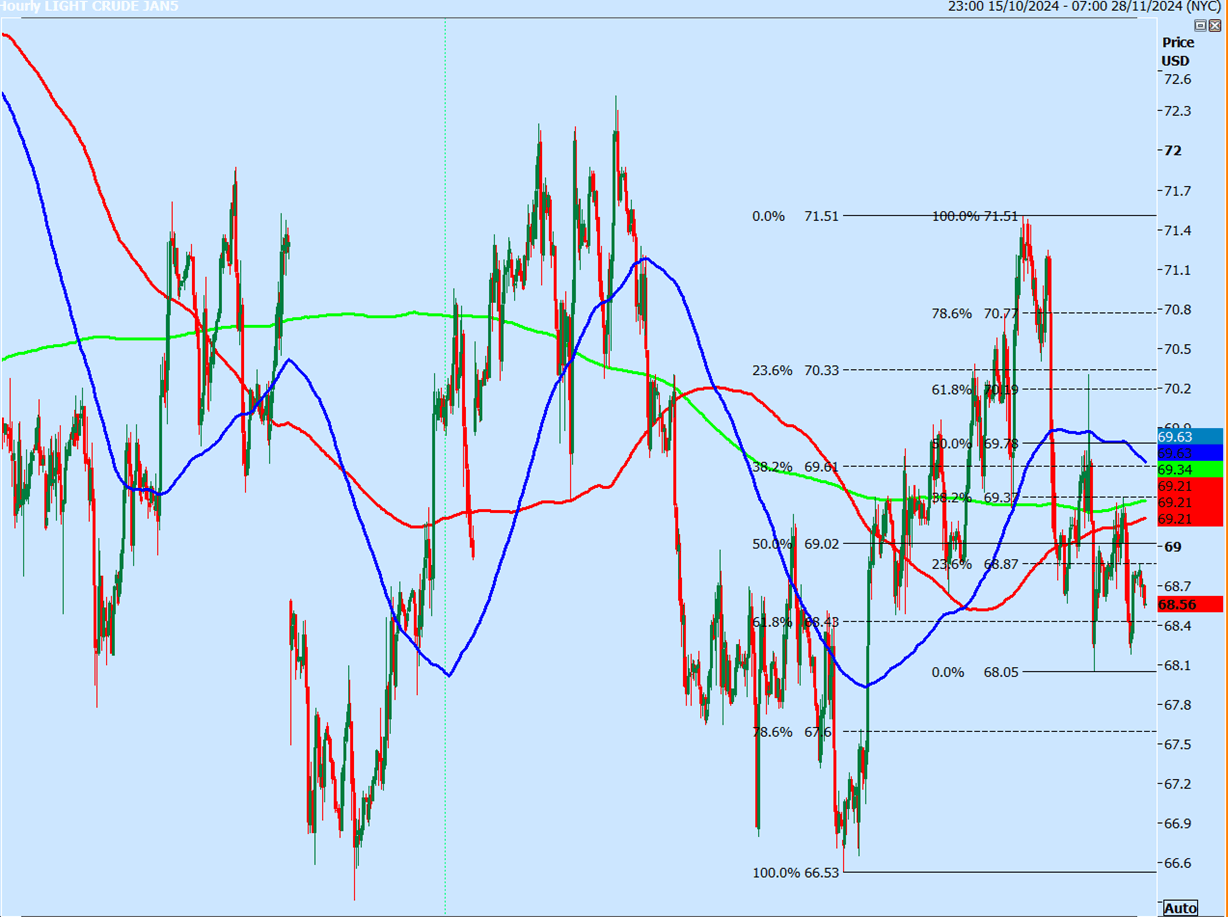

WTI Crude January future

Last session low & high for the December contract: 6818 - 6937.

(To compare the spread with the contract that you trade).

-

WTI Crude made a high for the day exactly at first resistance at 6940/70

-

A break higher today meets the next target & resistance at 7030/60. Shorts need stops above 7090 here again today.

-

Holding resistance at 6940/70 again today retests minor support at 6850/30.

-

We made a low for the day almost exactly here yesterday.

-

A break below 6800 suggests further losses towards 6775/55 & perhaps as far as the November low at 6680/50.

Author

Jason Sen

DayTradeIdeas.co.uk