Gold Elliott Wave analysis

Gold has continued its upward trajectory after breaking out of a two-month consolidation and is now ready to challenge new all-time highs. The bullish sentiment is strong across all time frames, presenting opportunities for traders to buy on dips, expecting a sustained rally.

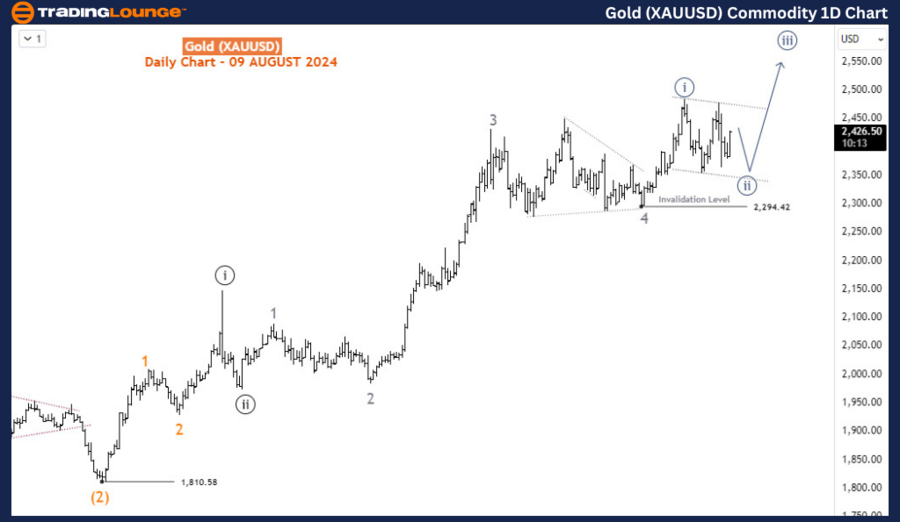

Daily chart analysis

On the daily chart, Gold completed the supercycle wave (IV) of the long-term bullish trend that began in December 2015. This completion paved the way for a new impulse wave (V). Within wave (V), waves I and II were finalized in May and October 2023, respectively. Gold is currently progressing in wave (3) of 3 (circled) of III, which has the potential to extend beyond the 2500 level before concluding. The consolidation phase observed between April 12th and June 26th corresponds to wave 4 of (3). The current upward movement is part of wave 5 of (3), which is expected to surpass previous highs and establish new records. The bullish outlook remains robust, offering traders opportunities to enter positions on pullbacks.

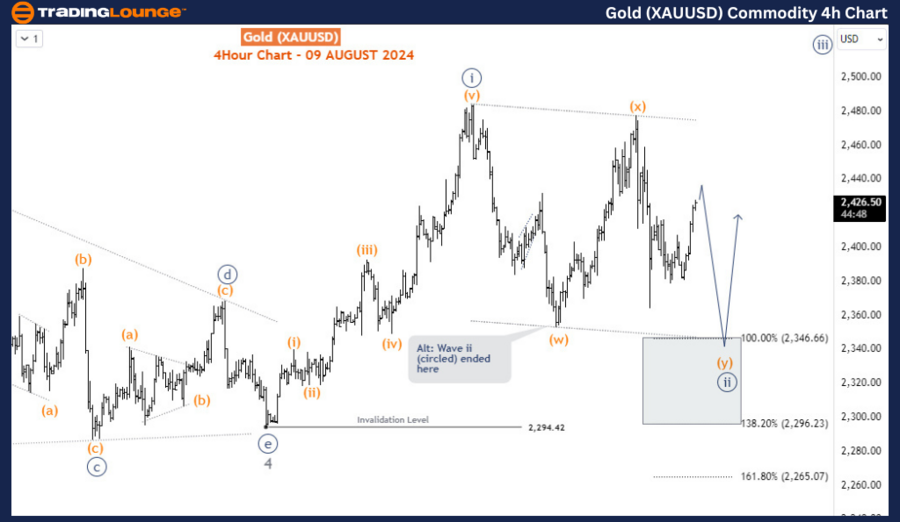

H4 chart analysis

The H4 chart provides a closer look at the sub-waves within wave 5 of (3). The price completed wave i (circled) of 5 on July 17th and is now in a pullback for wave ii (circled) of 5. This pullback could complete a double zigzag pattern within the 2346-2296 Fibonacci retracement zone, although it should remain above the 2294 invalidation level. Alternatively, if wave ii (circled) has already bottomed at the low of July 25th, the current recovery should gain momentum and break through the July 2nd high, continuing the advance into wave iii of 5. In either scenario, the upside is favored as long as the price remains above 2294.

Conclusion

Gold continues to show strong bullish momentum, with the potential for further gains and new all-time highs. Traders should watch for opportunities to enter on pullbacks, with key support levels to monitor around the 2346-2296 zone. The overall outlook remains positive, with the potential for significant upward movement in the coming weeks.

Technical analyst: Sanmi Adeagbo.

Gold Elliott Wave analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended Content

Editors’ Picks

EUR/USD drops toward 1.0850 as USD finds fresh buyers

EUR/USD inches lower to near 1.0850 in the European session on Monday. A renewed US Dollar uptick amid a slightly negative shift in risk sentiment and Trump trade optimism weigh on the pair. All eyes remain on the Fedspeak, in the absence of top-tier data releases.

GBP/USD falls below 1.3050 on resurgent US Dollar demand

GBP/USD falls back below 1.3050 in European trading on Monday, undermined by a modest USD strength. The fundamental backdrop supports prospects for a further depreciating mov, as markets remain risk-averse ahead of the upcoming Fedspeak.

Gold price sticks to gains near all-time peak, renewed USD buying caps gains

Gold price scales higher for the fifth straight day – also marking the seventh day of a positive move in the previous eight – and touches a fresh record high, around the $2,732-2,733 region on the first day of a new week.

Could BTC reach its all-time high of $73,777?

Bitcoin is approaching the resistance level of around $70,000. A firm close above this mark could trigger a rally to retest its all-time high. Ethereum is nearing its descending trendline, with a break and close above signaling a potential rally.

If at first you don’t succeed, keep trying, so the story goes in China

Asian stocks saw a solid lift today, riding the coattails of Wall Street’s rally, but a welcome spark came from China’s big banks slashing their benchmark lending rates. This move injected a fresh wave of optimism into markets, fueling the hope that China’s recent stimulus efforts might finally be gaining economic traction.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.