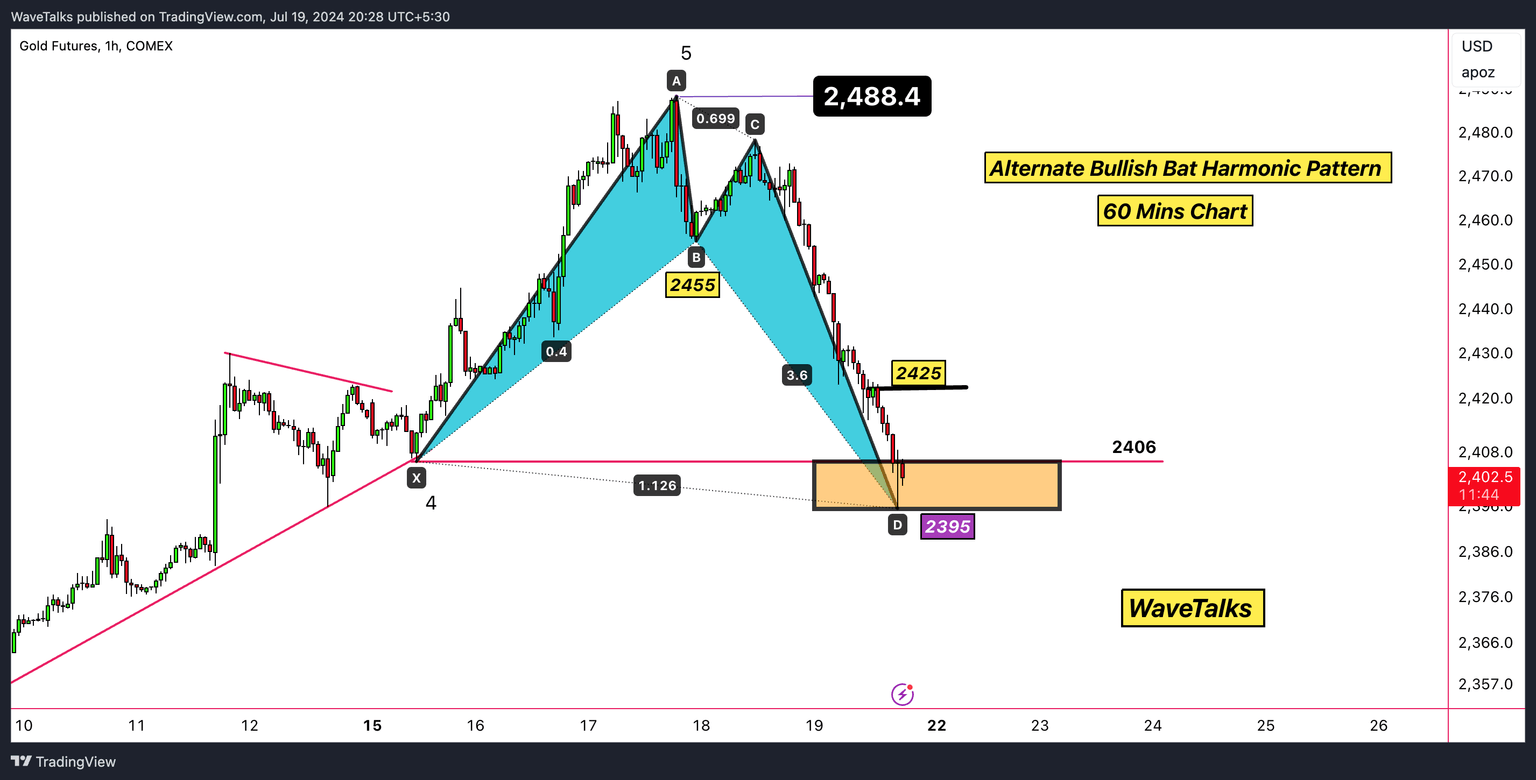

Gold Elliott Wave and harmonic: What a fall – Can it hold 2,395?

Gold's price decline from 2488 to 2406 aligns with our previous analysis in "Five Waves to the Top 2488 – Tower Top Candlestick Pattern," confirming the unfolding bearish trend after a clear 5-wave impulse unfolded as discussed. Let's celebrate the 5-wave impulse prediction and the subsequent decline.

Breakdown below key support

The breach of the 2465 support level indicated increased bearish momentum, leading to the next significant support at 2406. Gold has since slipped towards 2395 and is currently trading sideways.

Bearish tower top pattern impact

The Bearish Tower Top candlestick pattern predicted at the 2488 peak played out as expected, driving the price down sharply.

What next? - Bullish alternate bat harmonic pattern in 2,395-2,406

The Bullish Alternate Bat Harmonic Pattern has a Potential Reversal Zone (PRZ) at 2395-2406, aligning with key levels at 2400 and 2406. This could give bulls some confidence, especially with prices hovering close to the psychological level of 2400.

As long as gold holds within the 2395-2406 range, it could exhibit a bullish bias and bounce towards 2425. Holding above 2425, the price may move towards 2455, where it could face the next set of hurdles.

If the support zone at 2395-2406 is breached, continued bearish pressure could push the price towards key levels of 2355 and 2305, which are important support levels from where the last 5-wave impulse started.

Next key levels to watch

Below 2395, the next key levels to watch are 2355 and 2305. Holding above the PRZ of the Alternate Bullish Bat, important levels to watch upside are 2425 and 2455.

Market implications

Traders should remain cautious and monitor for further bearish signals if the support zone at 2406-2395 is breached. Otherwise, some partial bounce-back could unfold next.

Don’t forget to check out the next update from WaveTalks - Market Whispers! Can you hear them?

Have a nice weekend ahead.

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.