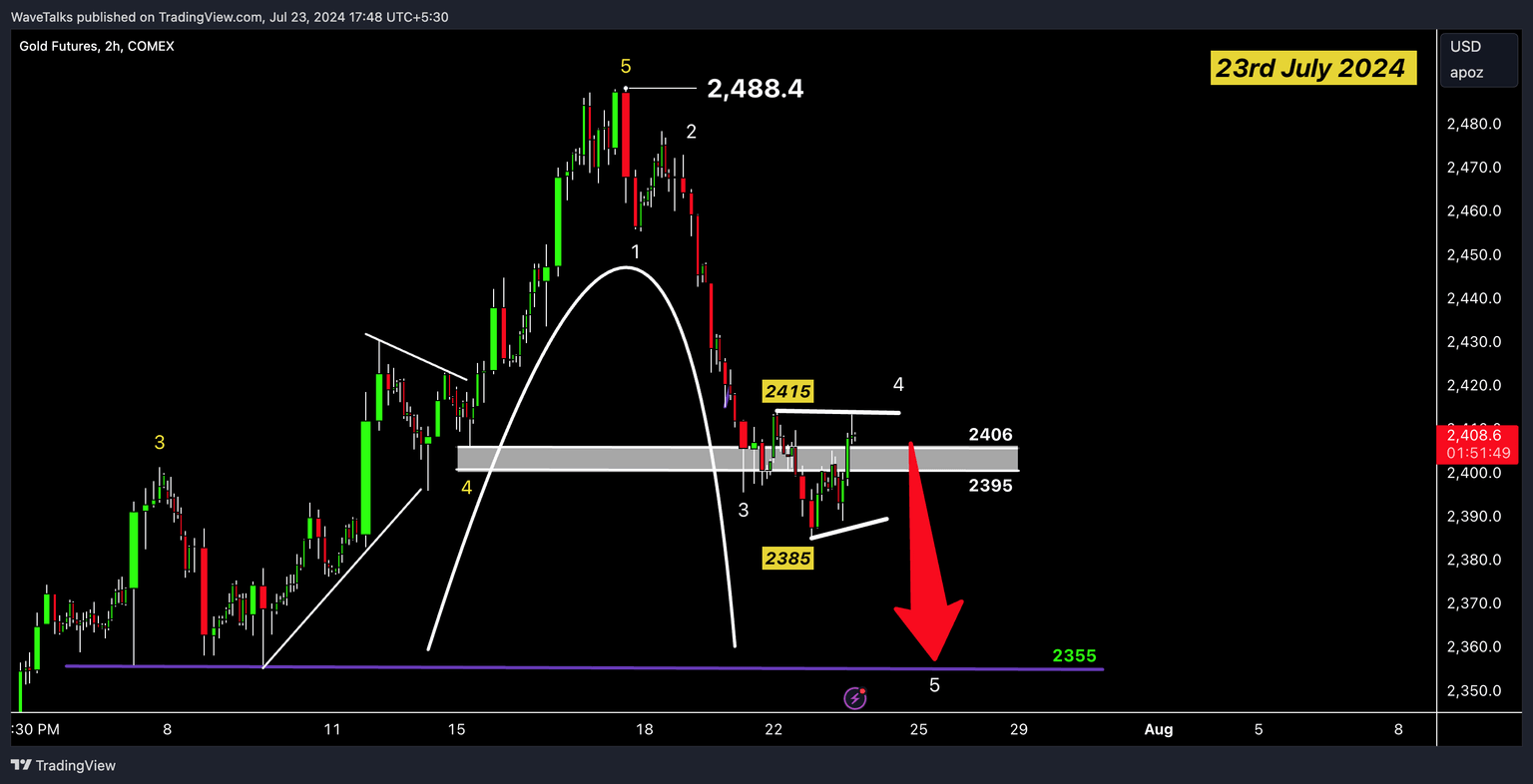

Gold Elliott Wave – A classic V-shape five waves top scenario

Sideways range

The Potential Reversal Zone (PRZ) between 2395-2406 as discussed in the last idea has been breached several times, leading to a broader sideways range between 2415 and 2385. Gold is expected to stay within this range unless it breaks above 2415 or below 2385.

Bullish bias

Near 2385 Support.

When gold approaches 2385, it can have a short-term bullish bias, potentially moving towards the 2410-2415 zone. The level of 2385 could act as a support, providing buying opportunities.

Bearish bias

Near 2415 Resistance.

When gold reaches close to 2415, which is below the key level of 2425, a short-term negative bias is likely. This level acts as resistance, providing selling opportunities.

Breaking Below 2385.

A breach of the 2385 level could confirm the unfolding of another 5-wave pattern in the downside direction. Bears may become aggressive, pushing the price towards the next important level of 2355, which marks the start of the irregular triangular structure as discussed in the last idea- 5 waves to the top 2488 earlier.

Two hour chart

If the decline continues below 2355, the next key support level would be 2305.

Alternate scenario

Move Beyond 2415.

Any move beyond 2415 will force a reevaluation, considering that the 5 waves might have completed at 2385 lows. This would imply a continuation of the downtrend after some sideways movement in the short term.

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.