Gold: Direction to be determined by Fed policy

Gold has two very strong, but contradictory price actions signals on the monthly chart. There are two simultaneous Harami inside bar fans' break patterns.

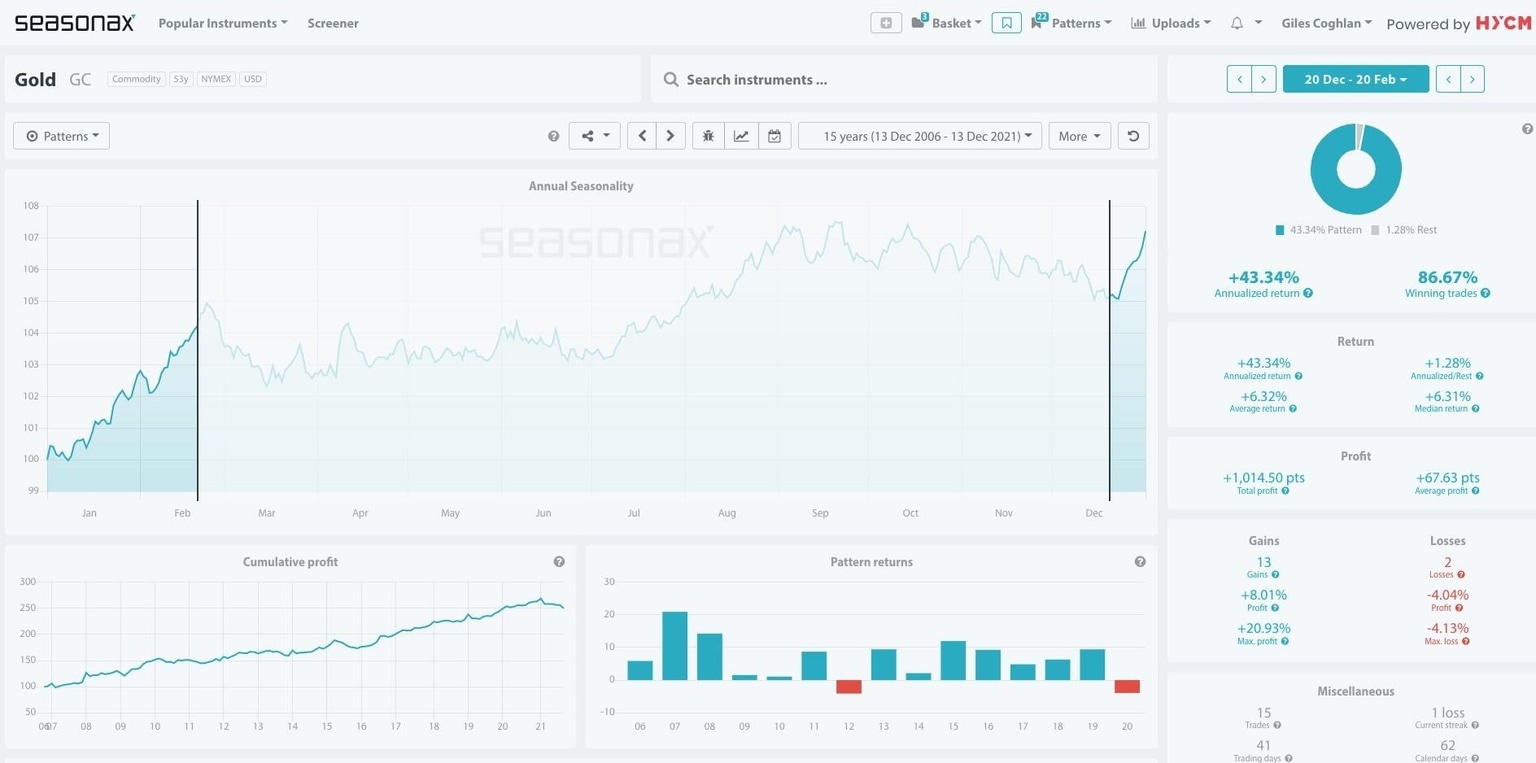

Gold also has some excellent seasonal around the turn of the year. Starting from December 20 – February 20 gold has risen 13 times in the last 15 years. That’s nearly a 90% strike rate. So, these seasonals are very strong and largely based around physical demand at this time of year. Check out the strong seasonals here where you can search the pattern in more detail.

But, in an ideal world, we want the fundamentals, the technicals, and seasonals to all match up. This is where the Fed’s meeting comes in.

The Fed’s communication is key

If the Fed signal that they will be hiking rates more quickly that will send yields surging. That will also send the USD higher and this will be negative for gold. Also, if the ECB is dovish on Thursday then gold could really accelerate lower on a stronger USD. Now, a sharp move lower in gold may be an opportunity for seasonal buyers. However, it would be far superior if the Fed signals a dovish scenario. That would be the signal that gold buyers should be jumping all over. The most dovish scenario would be if the Fed doesn’t speed up the tapering process (Powell has already said they would). If Powell re-opens the idea of inflation being ‘transitory’ and pushed back expectations from the current two hikes next year then that will be a very decent catalyst to send gold higher and will be In line with the fundamentals.

In order to get a handle on gold’s direction, it is not only real yields and the USD moving together but good reasons for that to continue. When both of these other markets align, that makes gold’s direction much more predictable.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.