Gold defies overbought signals as uncertainty drives demand

Gold price is experiencing a brief pause after a remarkable rally that pushed it above the $3,050 mark. Despite the slight pullback, the precious metal remains strong, driven by fundamental and technical factors. Traders are closely monitoring economic data and geopolitical developments that could influence the next move in gold prices.

Economic uncertainty and geopolitical risks fuel Gold rally

Gold prices continue to rise due to economic uncertainties and the Federal Reserve’s dovish stance. The rally gained strength after the Fed’s Dot Plot chart signaled two possible interest rate cuts this year. Lower interest rates weaken the US dollar, making gold a more attractive investment. Inflation concerns and slow economic growth have also boosted demand for gold as a safe-haven asset. The US economy faces challenges from higher tariffs imposed by President Donald Trump. These tariffs could lead to stagflation, a combination of stagnant growth and high inflation.

Rising geopolitical tensions continue to support higher gold prices. Ongoing conflicts and diplomatic uncertainties have increased global instability, prompting investors to seek safe-haven assets. Traders now focus on US jobless claims and other economic indicators for insights into the economy. Comments from Fed officials could also offer more clarity on future interest rate policies, impacting gold’s movement.

Gold faces overbought signals: Key levels and technical outlook

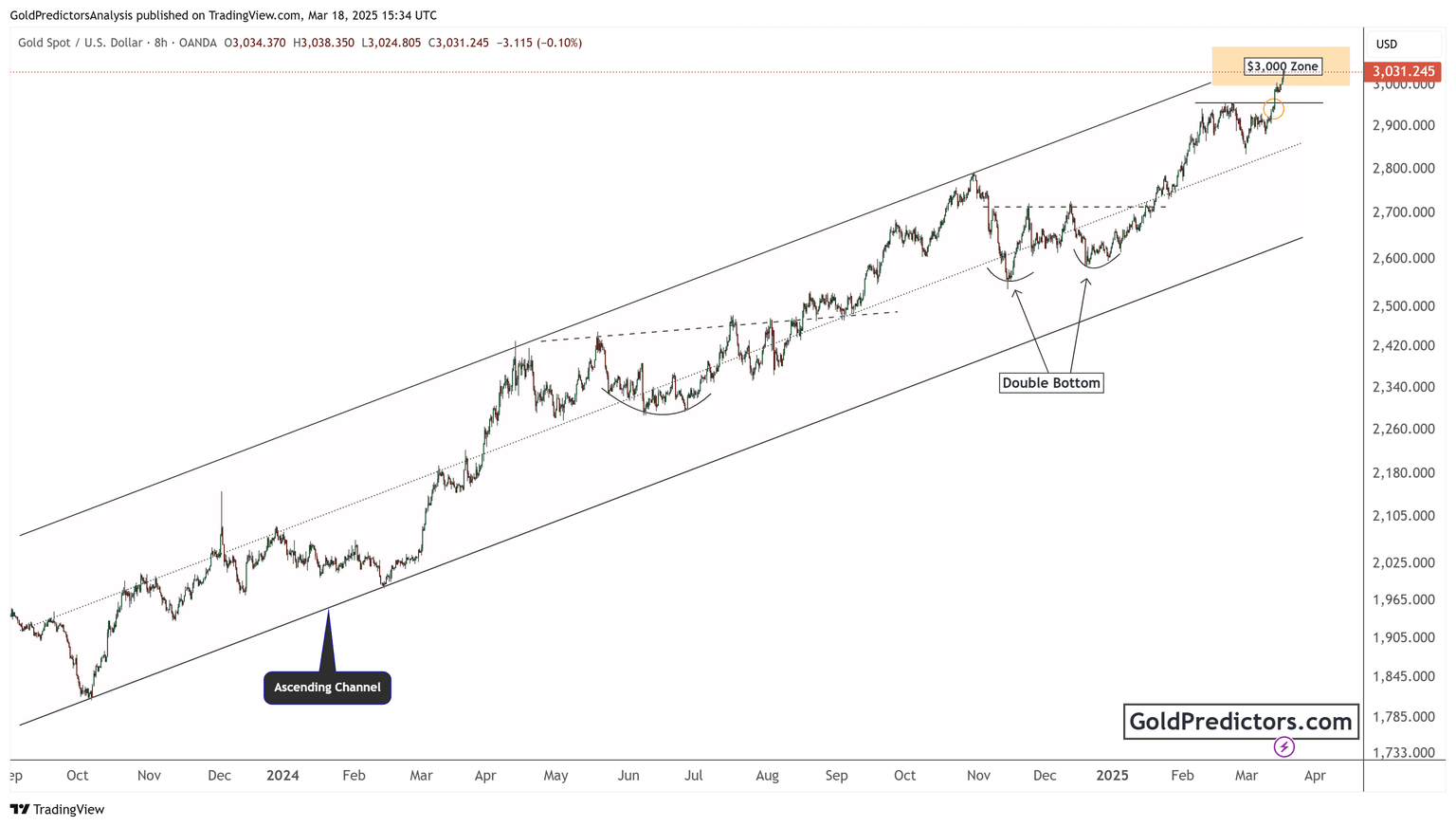

Gold has been trading within an ascending channel, as shown in the chart below. This channel shows a steady uptrend with higher highs and higher lows. The price recently approached the upper boundary of this channel near the $3,000-$3,050 zone, a key resistance level.

A double-bottom pattern formed earlier in the trend provided a strong bullish signal, leading to further price appreciation. This pattern confirmed a reversal from previous declines, reinforcing the long-term bullish outlook. The breakout above key resistance levels has encouraged further buying pressure.

Currently, gold is facing some resistance, around $3,050. A successful breakout above this zone could push prices towards new all-time highs. However, overbought conditions on the daily chart suggest that a temporary pullback is possible before the next leg higher.

If gold retraces, key support levels are $2,900 and $2,800, which align with the lower boundary of the ascending channel. A breakdown below these levels could signal a deeper correction. On the upside, if gold closed the week above $3,000, the next target could be $3,100 or higher.

How to trade Gold during economic uncertainty

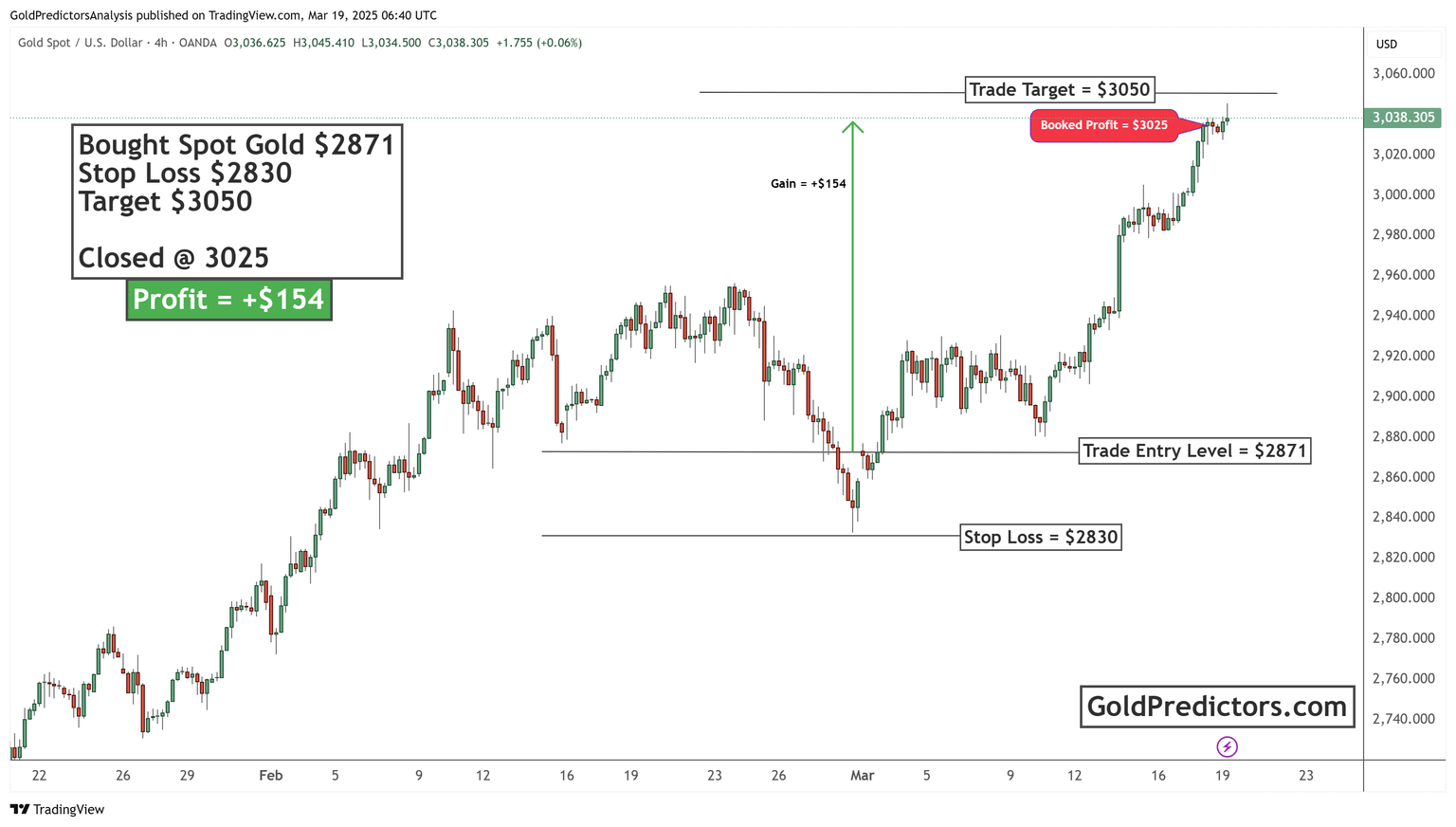

The chart below illustrates a successful gold trade. The trade was entered at $2,871, with a stop loss set at $2,830 and a target of $3,050. The position was eventually closed at $3,025, securing a profit of $154 per unit. This setup demonstrates the importance of strategic entry and exit points. By setting a stop loss, the risk was controlled, and by taking profit near the target, gains were maximized. This trade was sent via WhatsApp to subscribers and resulted in a profitable outcome.

Conclusion

Gold remains in a strong uptrend, supported by a dovish Fed, economic uncertainties, and geopolitical tensions. While the price is currently consolidating near the $3,050 zone, technical analysis suggests that the long-term trend is still bullish. However, a short term pullback may develop due to the overbought conditions. Short-term pullbacks could offer buying opportunities before the next potential rally. Traders should closely watch market trends and geopolitical developments to gauge the next move in gold prices.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.