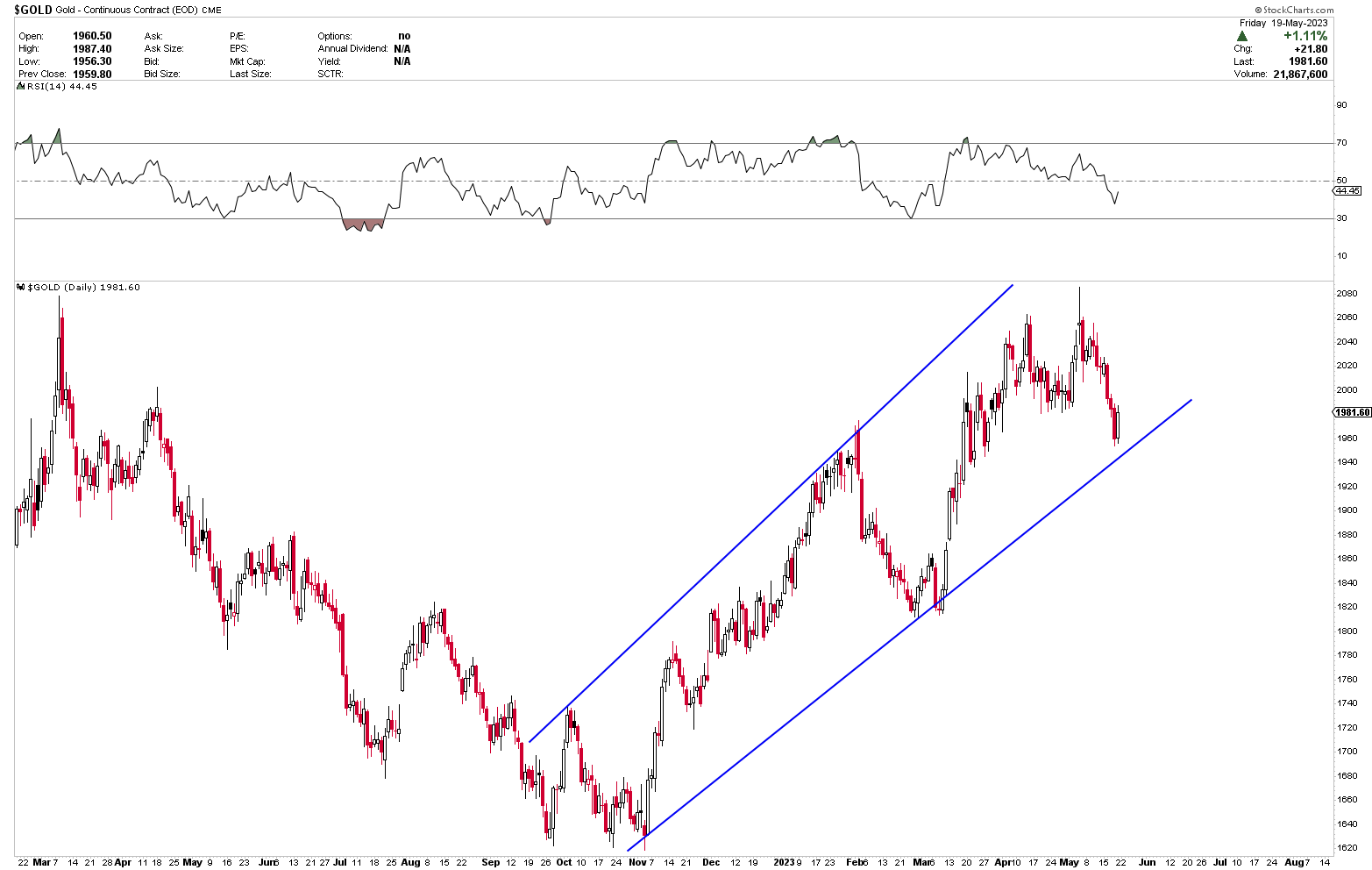

The Gold market has recently witnessed a retreat from its highs, as forecasted in our previous articles. This predictable correction is taking place within a region we had anticipated, a region known to be favorable for buyers to step in. The trading channel, as demonstrated in the chart below, suggests that this area of support is crucial for any potential upside.

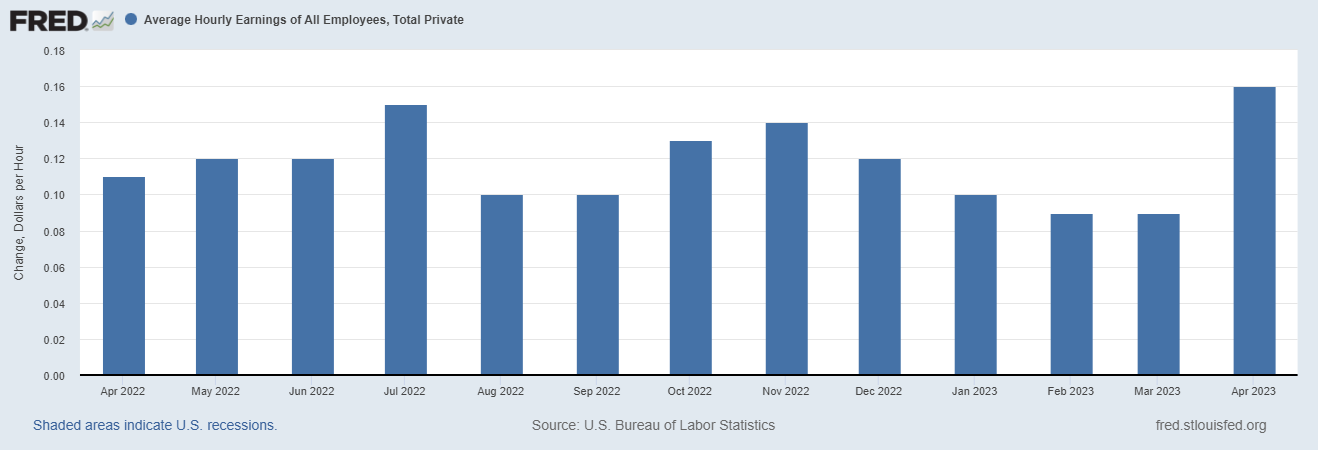

The Gold market is presently facing a critical juncture, hinging at the price range of $1,900 to $1,950. If the market manages to establish support within this region, we can expect prices to rebound higher. The potential for this bullish movement is attributed to increasing inflationary pressure, as evident through wage inflation growth.

There is considerable evidence suggesting that inflation is in a slowing phase, largely due to plummeting energy prices. However, average hourly earnings growth provides a lens into the intrinsic inflationary pressures. Alarmingly, monthly data indicate that wage growth is in a rebound phase, marked by a significant 0.48% increase in average hourly earnings in April, which annualizes to 5.76%.

This recent correction in the gold market is widely believed to present a strong buying opportunity for both long-term and medium-term investors. However, the confirmation of this key support region is still lacking, mainly due to the heightened volatility in the market. This volatility and uncertainty, largely tied to emergent crises, is fuelling worries of a potential recession, as evidenced by a significantly negative Treasury yield curve.

Historically, a recession is signaled when the Treasury yield curve rebounds above zero after falling to lower levels. If a recession is indeed looming, gold will likely emerge as a safe haven for investors, further bolstering strong buying scenarios.

Conclusion and implications for investors

In conclusion, the gold market has descended as per our forecasts and is now approaching the first support region, where a potential bounce back is possible. However, the current market volatility and potential recession threats demand a cautious approach. Therefore, investors are advised to watch closely for the confirmation of the support region between 1900 to 1950 price levels, along with developments in wage inflation and the treasury yield curve, to guide their investment decisions in the gold market. The coming weeks will be crucial in determining whether gold retains its luster as a safe haven amidst these turbulent economic times.

Articles/Trading signals/Newsletters distributed by GoldPredictors.com have no regard to the specific investment objectives, financial situation, or the particular needs of any visitor or subscriber. Any material distributed or published by GoldPredictors.com or its affiliates is solely for informational and educational purposes and is not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity, or related securities. Plan the strategy that is most suitable for your investment. No one knows tomorrow’s price or circumstance. The intention of the writer is only to mention his thoughts and ideas that may be used as a tool for the reader. Trading Options and futures have large potential rewards, but also large potential risks.

Recommended Content

Editors’ Picks

Gold sits at record highs above $3,100 amid tariff woes

Gold price holds its record-setting rally toward $3,150 in European trading on Monday. The bullion continues to capitalize on safe-haven flows amid intesifying global tariff war fears. US economic concerns weigh on the US Dollar and Treasury yields, aiding the Gold price upsurge.

EUR/USD holds steady below 1.0850 ahead of German inflation data

EUR/USD is holding steady below 1.0850 in early Europe on Monday. The pair draws some support from a broadly weaker US Dollar but buyers stay cautious ahead of Germany's prelim inflation data and Trump's reciprocal tariff announcement.

GBP/USD posts small gains near 1.2950 amid tariff woes

GBP/USD keeps the green near 1.2950 in the European morning on Monday. Concerns that US President Donald Trump's tariffs will ignite inflation and dampen economic growth weigh on the US Dollar and act as a tailwind for the pair.

Seven Fundamentals for the Week: “Liberation Day” tariffs and Nonfarm Payrolls to rock markets Premium

United States President Donald Trump is set to announce tariffs in the middle of the week; but reports, rumors, and counter-measures will likely dominate the headline. It is also a busy week on the economic data front, with a full buildup to the Nonfarm Payrolls (NFP) data for March.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.