Gold corrects as Fed uncertainty overshadows global tensions

-

Geopolitical tensions have heightened market fears and driven haven demand for gold.

-

The uncertainty around Federal Reserve decisions has strengthened the US dollar and the upside in gold.

-

A significant drop from the ascending channel resistance could lead gold to test support regions.

The nomination of Scott Bessent as the US Treasury Secretary has significantly impacted the gold market. Additionally, the Israel-Hezbollah ceasefire agreement has also influenced market dynamics. Optimism surrounding Bessent’s approach to phased tariff adjustments has led to a sharp decline in US Treasury bond yields. However, limited expectations of a dovish Federal Reserve policy prevent bond yields from falling further. This has capped any significant downside in the gold market.

Moreover, the statements from Federal Reserve officials, including Austan Goolsbee and Neel Kashkari, have introduced mixed signals. These signals pertain to the possibility of future rate cuts. Goolsbee’s cautious stance on lowering rates presents one perspective. In contrast, Kashkari’s openness to considering another reduction at the December FOMC meeting offers a competing narrative. Some traders anticipate inflationary pressure from Trump’s proposed tariff policies. Meanwhile, others are scaling back their expectations for a December rate cut. This uncertainty supports the US Dollar and limits gold’s potential upside despite its safe-haven appeal.

On the other hand, geopolitical tensions and economic concerns continue to influence gold demand. Escalating Israeli operations in Gaza and threats of increased tariffs by the US have heightened market fears. These developments drive haven flows into gold while tempering investors’ appetite for riskier assets. Traders eagerly await the FOMC minutes, Q3 GDP revision, and the US PCE Price Index. These reports are expected to provide more precise insights into the Federal Reserve's policy trajectory. This week’s economic and geopolitical events will likely shape the near-term outlook for gold prices, keeping traders on edge.

Gold corrects from resistance

Gold has approached technical solid resistance at $2,790 and is consolidating around this level. The first support from the $2,790 resistance was identified at $2,560 (plus or minus $20). The low was formed within this support zone, leading to a rebound in price. The short-term outlook remains neutral since the price closed below $2,640 on Monday. The price is consolidating around this level before making its next move. If gold experiences a significant drop from the ascending channel resistance, it could move lower. The $2,400 price zone will be a strong support level. This area could potentially trigger the next upward move.

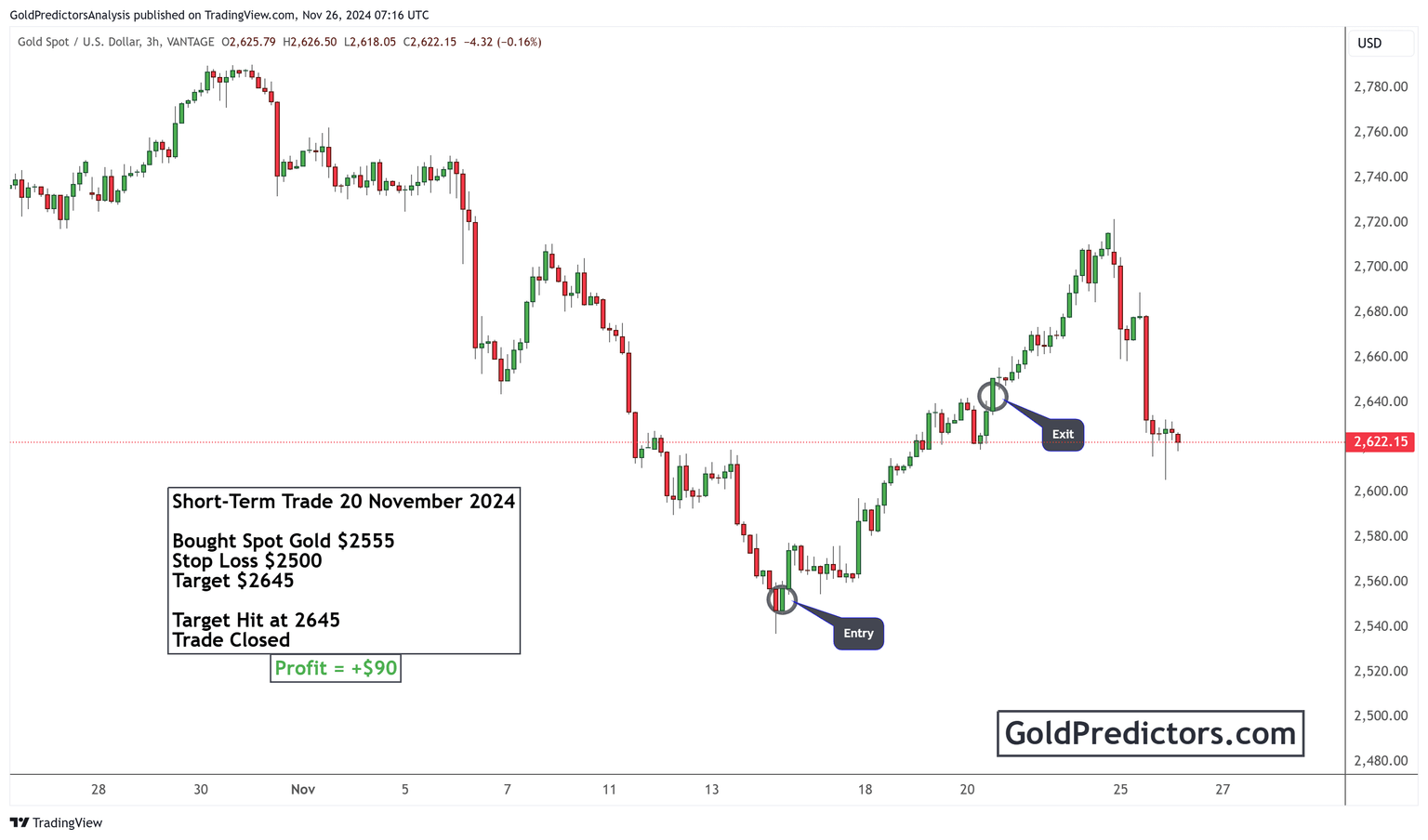

Trading the market during periods of economic and geopolitical uncertainty can be challenging. Therefore, executing positions only when the price aligns with cyclical timing and technical turning points is crucial. For example, Gold Predictors's premium members received a gold trading signal identifying key timing points. It was predicted that 1 November (plus or minus 72 hours) would likely mark a top around the $2,800 region. Similarly, 15 November (plus or minus 72 hours) was expected to mark a bottom around $2,560 (plus or minus $20). Remarkably, the price top and bottom occurred as predicted within the defined time and price points. Traders can consider buying gold when timing and levels intersect, producing a confirmed bottom or top.

Bottom line

In conclusion, the gold market remains influenced by a complex mix of economic policies, geopolitical tensions, and technical factors. The optimism surrounding Scott Bessent’s nomination and the Israel-Hezbollah ceasefire has shaped investor sentiment. At the same time, mixed signals from Federal Reserve officials continue to create uncertainty around future rate cuts.

Geopolitical risks and tariff threats have increased the demand for gold. However, technical resistance at $2,790 and support at $2,560 are critical in determining price movements. Traders must navigate these uncertainties by aligning trades with cyclical timing and technical turning points. A break below $2,400 or above $2,790 will likely dictate the next major trend in the gold market.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.