Gold consolidation continues ahead of US jobs data

-

Gold prices have continued to consolidate despite weak US manufacturing data and negative market sentiment.

-

Upcoming US employment data could impact gold prices by influencing market sentiment and expectations for US interest rates.

-

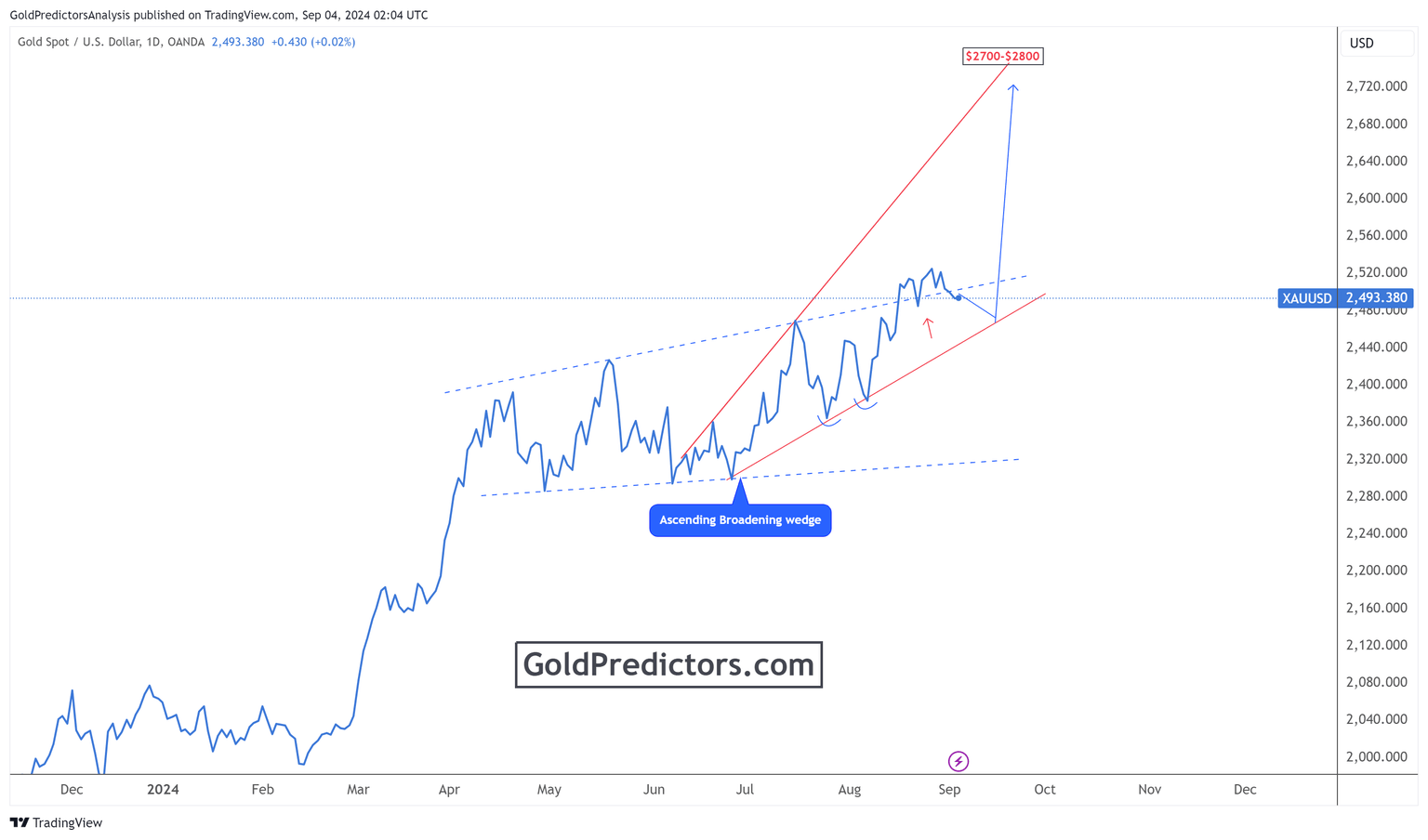

Technical analysis shows a potential for gold prices to rise as long as the support of the broadening wedge holds.

Despite the traditionally negative sentiment in the markets due to weak US manufacturing data, gold prices have continued to consolidate around 2500-2480 levels. The negative economic indicators like a downturn in manufacturing would drive investors towards safe-haven assets like gold. However, the overcrowded long positioning among Commodity Trading Advisors (CTAs) and institutional investors appears to be limiting the upside potential for gold. This excess long positioning suggests that many investors have already placed their bets on gold rising, and there might not be enough new buying interest to push prices higher.

Moreover, gold has not responded as expected to the rising probabilities of a significant interest rate cut by the US Federal Reserve, which typically would have supported gold prices. The CME FedWatch Tool shows an increased likelihood of a 0.59% rate cut at the upcoming September meeting. The upcoming US employment data could further influence market sentiment and the outlook for US interest rates, potentially affecting gold prices depending on whether the data supports a larger rate cut.

The chart below shows ascending broadening wedge pattern, indicating the consolidation of gold prices following the breakout from the blue dotted trend line. Despite the current weakness and downward correction in gold prices, the chart suggests that prices are likely to surge higher once this correction is complete. The blue arrow points to the $2,700-$2,800 level, assuming prices hold above the ascending broadening wedge support line. Therefore, investors may consider buying on dips as gold corrects lower. The overall price structure before the jobs data is bullish.

Bottom line

In conclusion, gold prices have continued to fall despite negative market sentiment and the increasing likelihood of a interest rate cut by the US Federal Reserve, which would typically support higher gold prices. The technical analysis suggests a potential surge in prices if the current correction completes and the ascending broadening wedge support line holds. Investors may consider buying on dips as gold corrects lower, anticipating a rebound towards the $2,700-$2,800 level. The overall direction for gold remains bullish as these consolidations are bullish signs.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.