Gold consolidates ahead of key NFP report: Bullish growth ahead?

-

Gold prices have consistently shown a pattern of consolidation followed by strong growth over the past two years.

-

Each breakout reflects bullish market sentiment and aligns with key economic events.

-

Investors await the US Nonfarm Payroll report, which could impact the macroeconomic landscape.

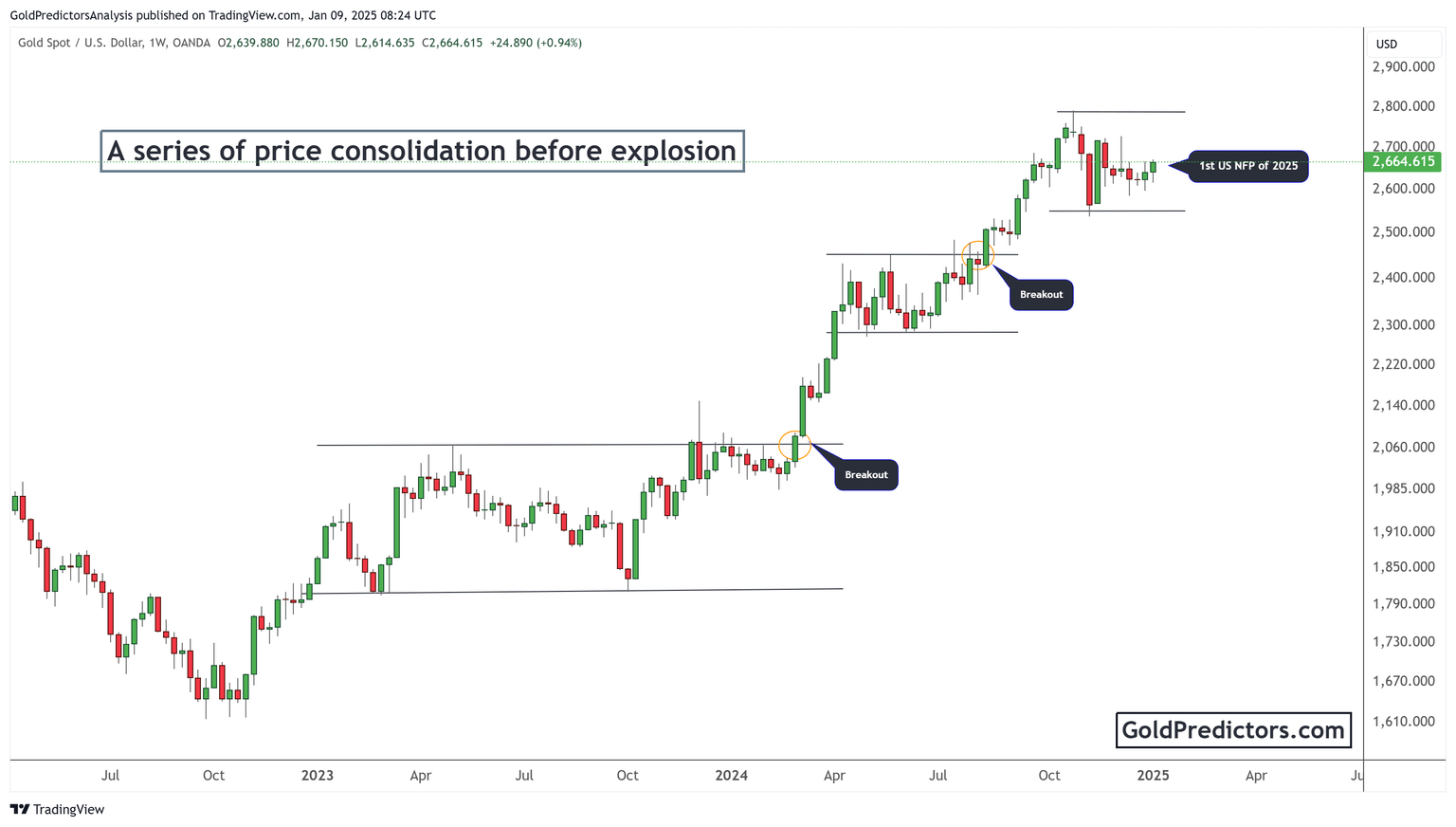

Gold prices have shown a clear pattern of consolidation followed by strong growth over the last two years. Each breakout reflects bullish market sentiment and aligns with key economic events. In mid-2023, prices surged past $2,400 after a long consolidation phase. By late 2024, prices climbed above $2,600, supported by global and economic developments. The current consolidation near $2,665 signals a potential move as investors await key US economic data. Gold remains a safe-haven asset, benefiting from geopolitical tensions and softer risk tones. This positions gold for more growth in 2025.

Gold price consolidation before explosive growth

The gold chart below highlights a consistent trend of price breakouts from consolidation phases, reflecting strong bullish sentiment in the market. The initial breakout occurred in mid-2023, with gold prices climbing from the $1,900 level to surpass $2,400. This rally followed a prolonged period of consolidation, where the market built a strong base. The next breakout was even more significant, propelling prices past $2,600 in late 2024. These breakouts align with key economic events, such as softer US economic data, labor market updates, and Federal Reserve policy shifts.

The most recent consolidation is around $2,665, with gold holding steady ahead of the first US Nonfarm Payroll (NFP) release for 2025. This consolidation suggests that gold continues to find support amid a softer risk tone and retreating US bond yields.

Economic indicators, including a weaker-than-expected ADP employment report and lower initial jobless claims, highlight mixed signals in the labor market. Meanwhile, the Federal Reserve minutes reveal policymakers’ cautious approach to rate cuts due to persistent inflation concerns. These factors have kept the US Dollar strong but have also limited gold's downside, providing support at key levels.

Global geopolitical tensions further contribute to gold's appeal as a safe-haven asset. Ongoing conflicts, such as Russia’s offensive in Ukraine and unrest in the Middle East, create uncertainty, driving investors toward gold. As bond yields retreat from recent highs, gold prices remain well-supported, maintaining their bullish trajectory.

Conclusion

Gold prices are positioned for continued growth in 2025, driven by a combination of economic and geopolitical factors. The chart underscores the importance of consolidation phases, which serve as a launchpad for price rallies.

The market is waiting for the US Nonfarm Payroll report on Friday, which could shift the macroeconomic landscape. The current price consolidation of around $2,665 indicates that the market is preparing for another significant move. Whether fueled by softer US economic data, easing inflation, or global tensions, gold remains a strong contender for bullish performance in the new year. On the other hand, a break below $2,580 could trigger a further price drop.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.