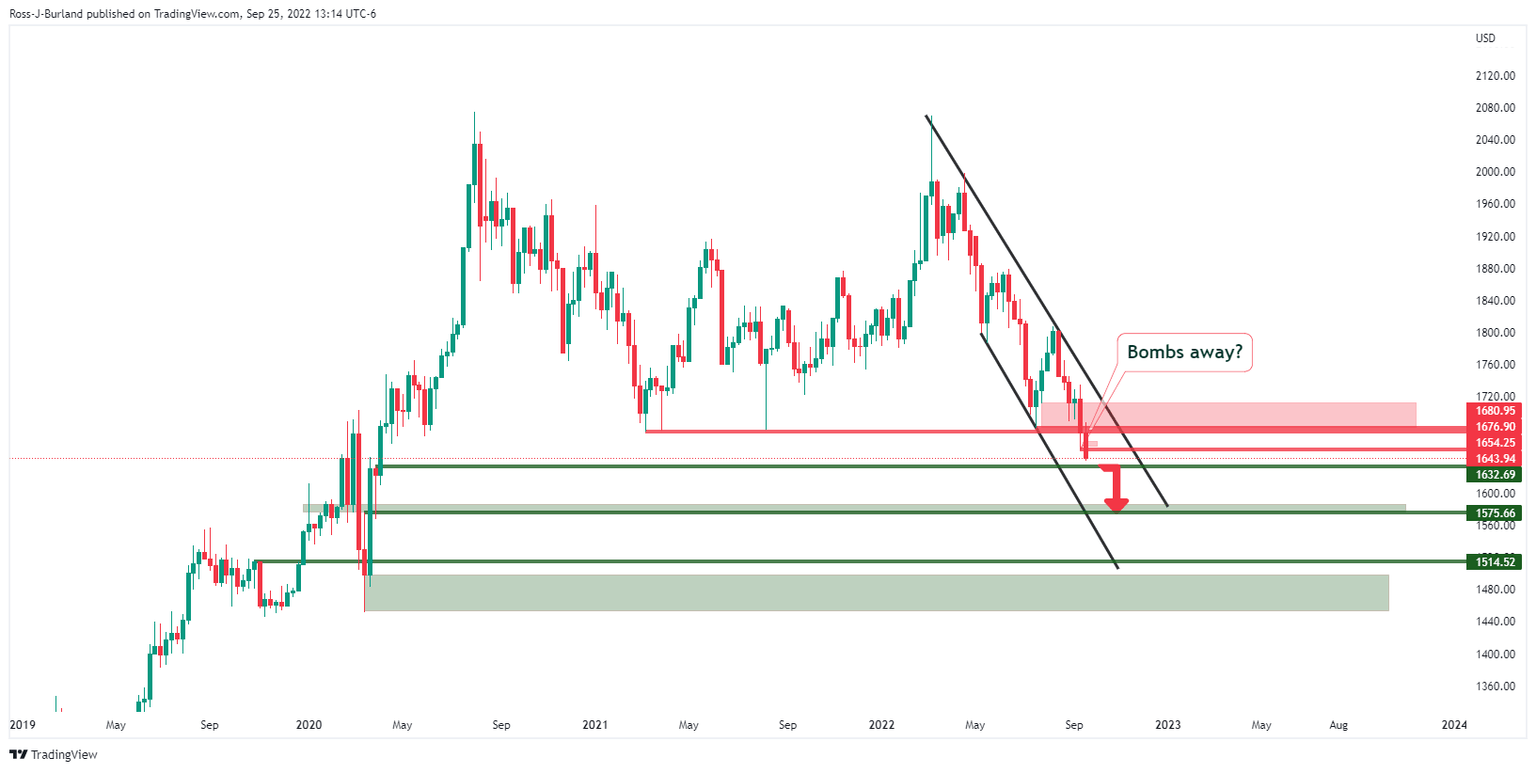

Gold, Chart of the Week: XAU/USD thrown to the bears at the edge of the abyss

- Gold is pressured below critical multi-timeframe structures.

- The following is an MTF frame analysis of the gold price.

The gold price remains well embedded below its 200-week moving average due to the expectations that the US central bank will keep on raising rates at historically large clips in the face of strong inflationary headwinds. Closing at its lowest in more than two years on Friday as the dollar rose to a two-decade high following the Federal Reserve's latest hike to US interest rates last week, gold could be at a point of no return, at least for the immediate future should the USD and rates continue to move higher keeping pressure on the precious metals complex.

''We see the potential for continued outflows from money managers and ETF holdings to weigh on prices moving forward, which ultimately raises the probability of a pending capitulation from the small number of family offices and proprietary trading shops that hold complacent length in gold,'' the analysts at TD Securities argued.

''In this context, while prices are certainly weak, precious metals' price action could still have further to fall as the restrictive rates regime is set to last for longer.''

Let's move to the technical landscape:

Gold monthly chart

The price is extending lower and lower on a monthly basis and has just taken out some critical levels on the lower time frames as well as the monthly structures. A break of $1,577 opens risk to $1,512.

Gold weekly chart

We have a similar scenario on the weekly chart towards the support of $1,632 following a break of key structure.

Gold daily and H1 charts

The daily chart is a little more clouded with the M-formation, a reversion pattern that could pull in the price prior to the next move to the downside.

On the other hand, the hourly chart has already seen a correction and if the bears commit to below 1,650, then the downside could play out a lot sooner, leaving the opening sessions as prospective bearish plays to start the week off.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.