Gold, Chart of The Week: XAU/USD meeting critical resistance near $1,830

- Gold is pressing against a critical resistance for the open this week.

- A break of $1,830 opens risk towards $1,850 while a move lower will target $1,820 and then $1,805.

The price of gold surged during the holidays from around the $1,800 psychological level into the $1,830 area which would be expected to act as a resistance on initial tests. The following is a snapshot of the market's structure from a weekly, daily and 4-hour perspective:

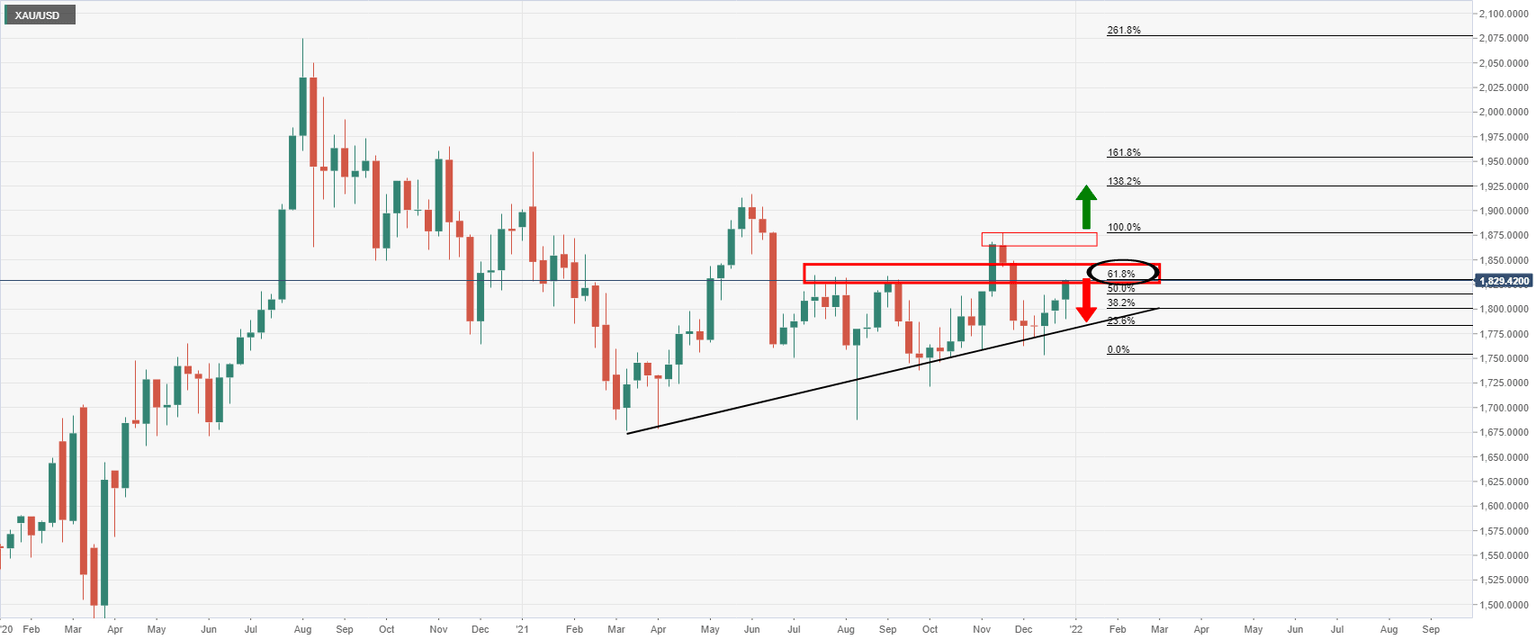

Gold, weekly chart

As illustrated, the price is heading higher following another test of the weekly trendline support. The price has made a 61.8% Fibonacci retracement of the prior bearish impulse.

The 61.8% ratio is regarded as a significant prospect for a pivot in price action. In this scenario, bears could be looking for the area to hold and potentially result in an opportunity on the downside on lower time frames. However, should the resistance area give way, then bulls would be encouraged and the price would be expected to move towards the $1,850s.

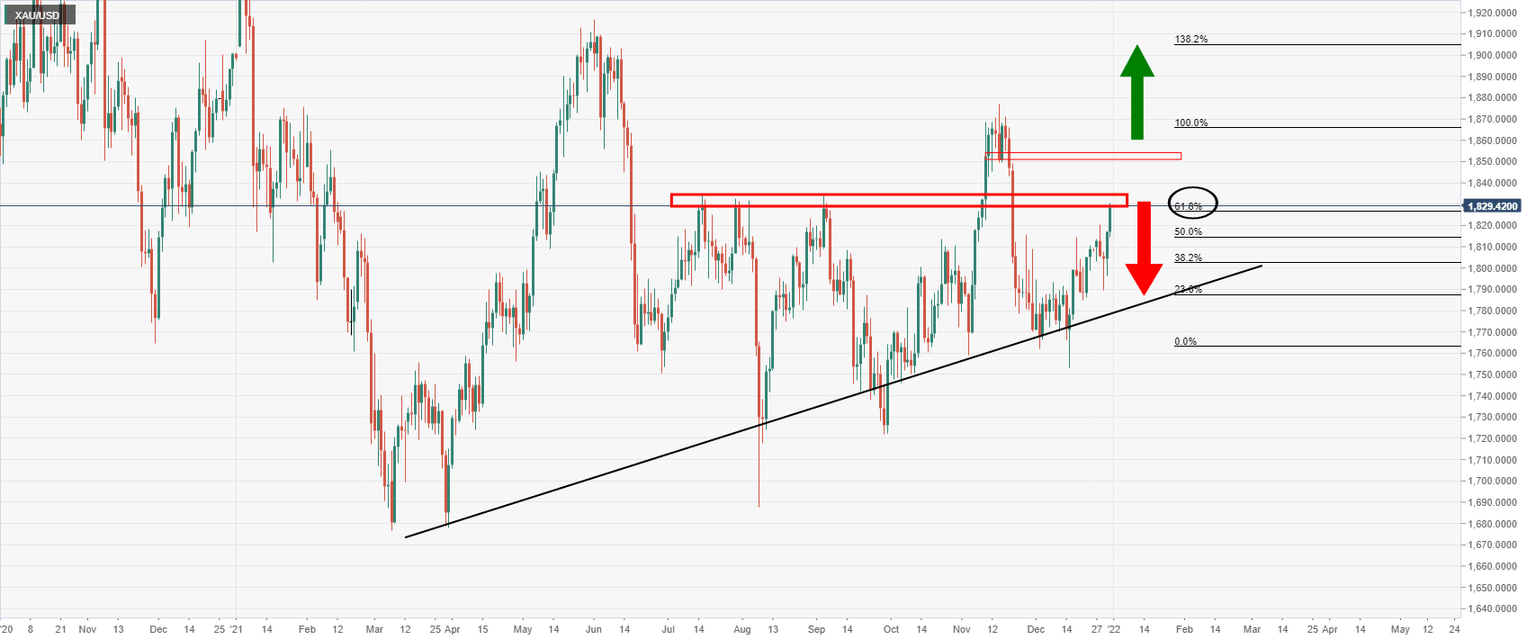

Gold, daily chart

Again, the daily chart shows the same bias as the weekly chart.

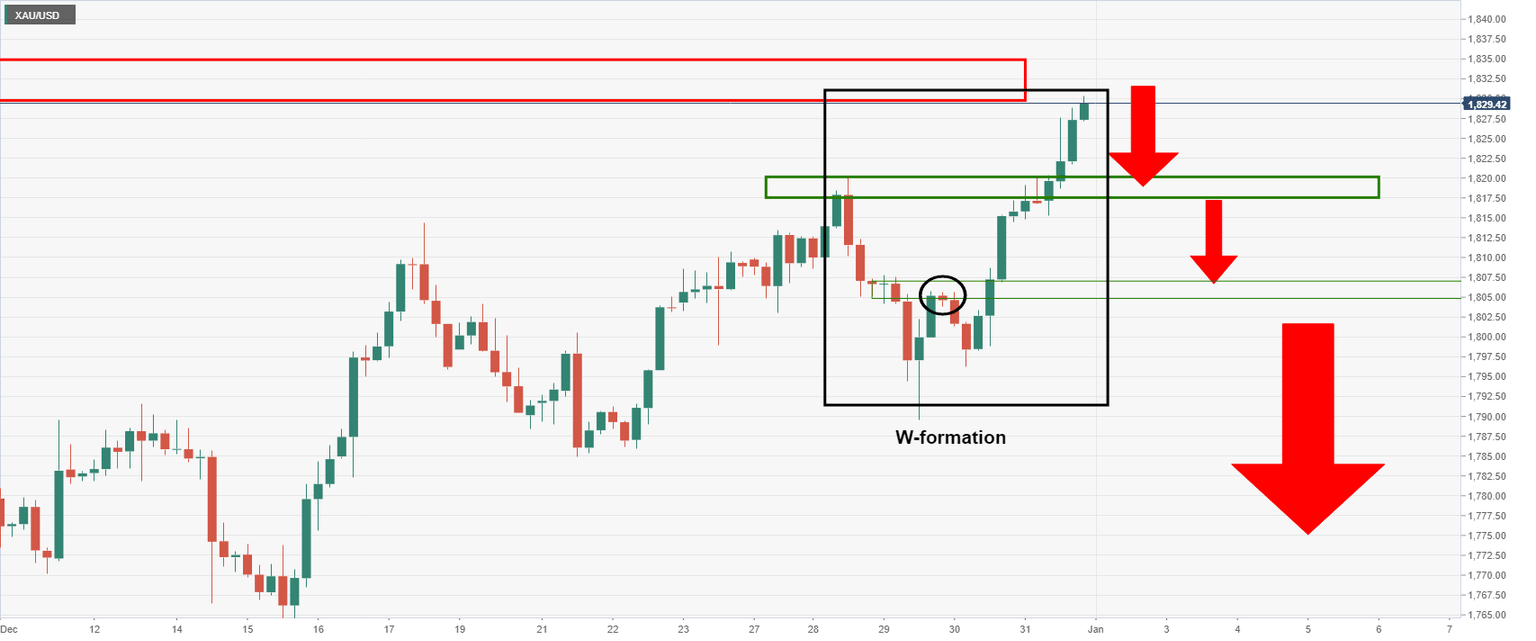

Gold, H4 chart

From a 4-hour perspective, the bulls are in charge although the resistance could see the price fail at first attempts for the open this week. In doing so, then $1,820 would be expected to act as support before $1,805 below there as per the neckline of the W-formation:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.