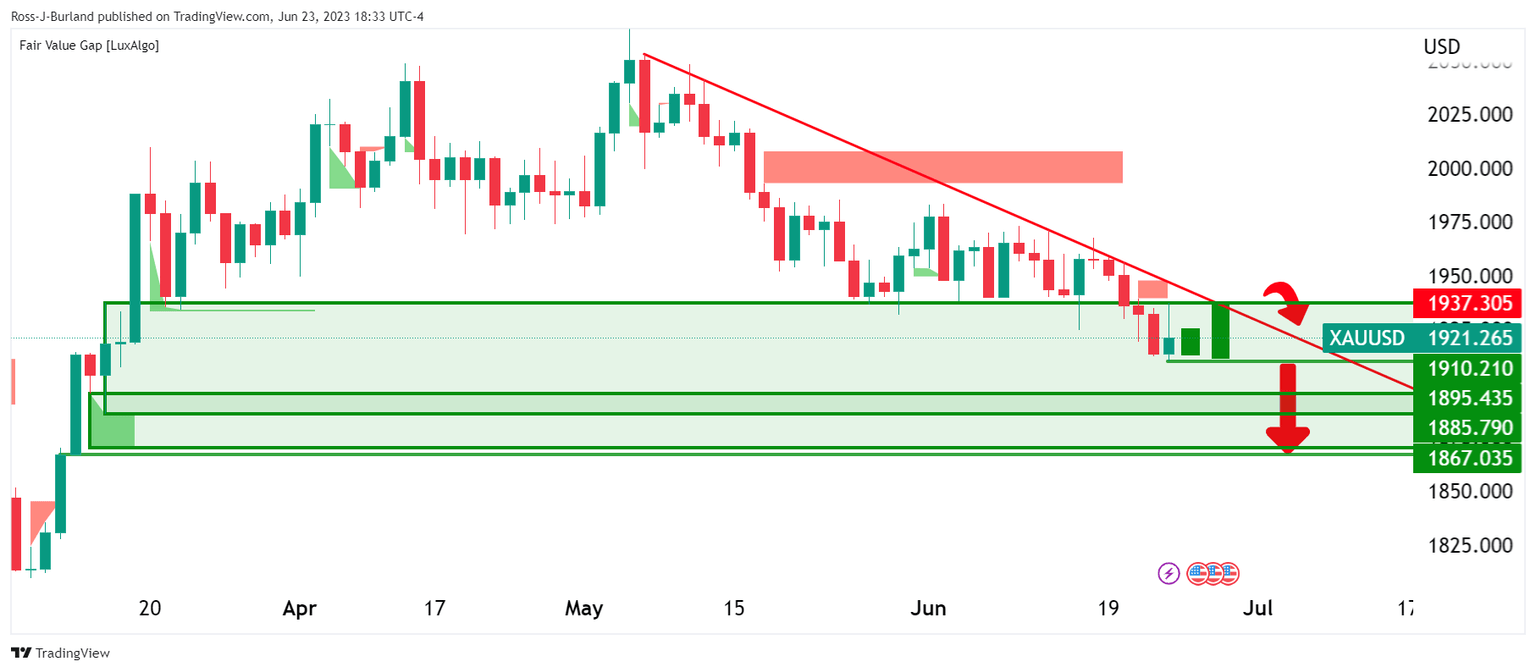

Gold, Chart of the Week: XAU/USD is making the case for a prolonged bullish grind

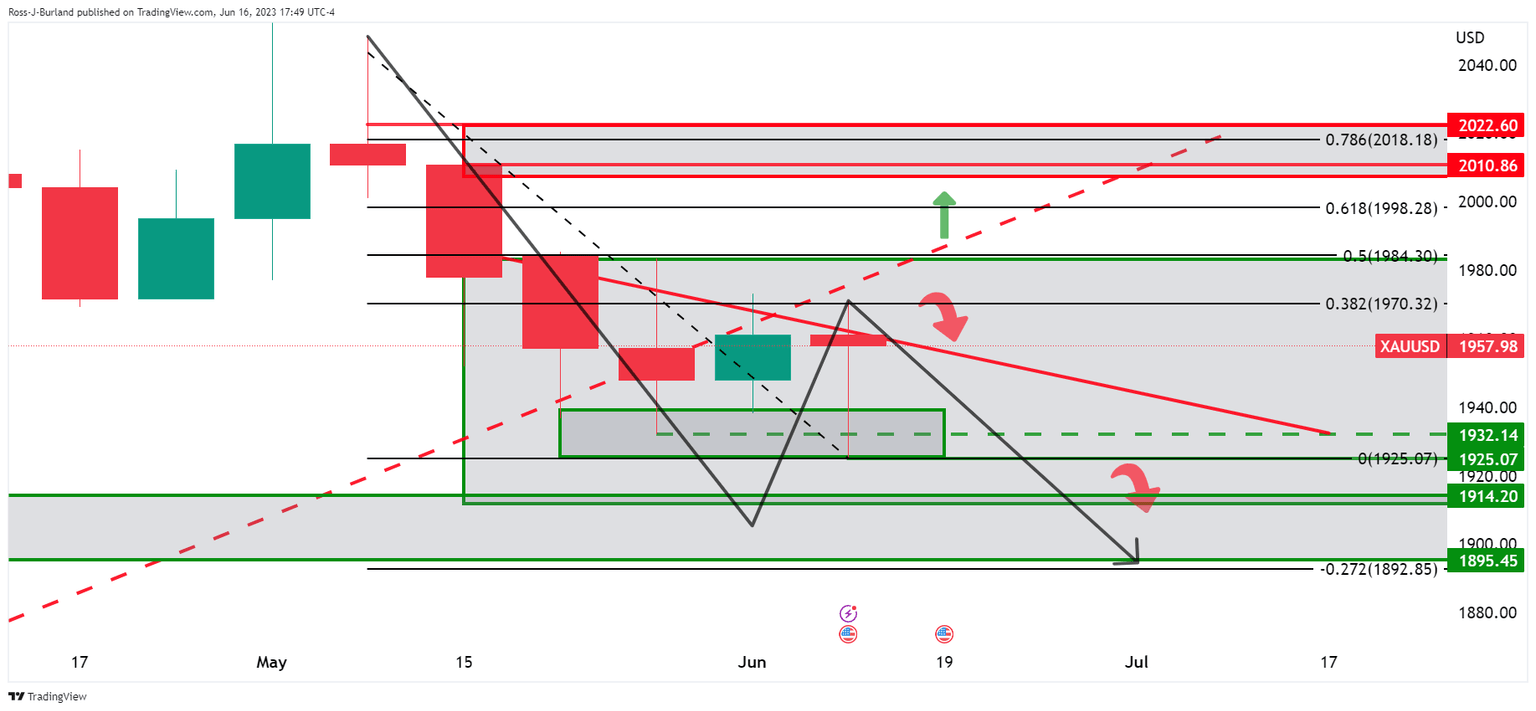

As per a series of analyses, including last week's Chart of the Week, Gold, the Chart of the Week: XAU/USD is coiled and breakout eyed, and Thursday's news article, Gold Price Analysis: Bulls eye a correction, US PMIs will be key, the price has behaved as poer the forecasting.

Gold price, before and after shots

Some key takeaways, before and after:

(Before)

It was stated that The monthly chart is bearish and bears eye the 61.8% Fibonacci target.

(After)

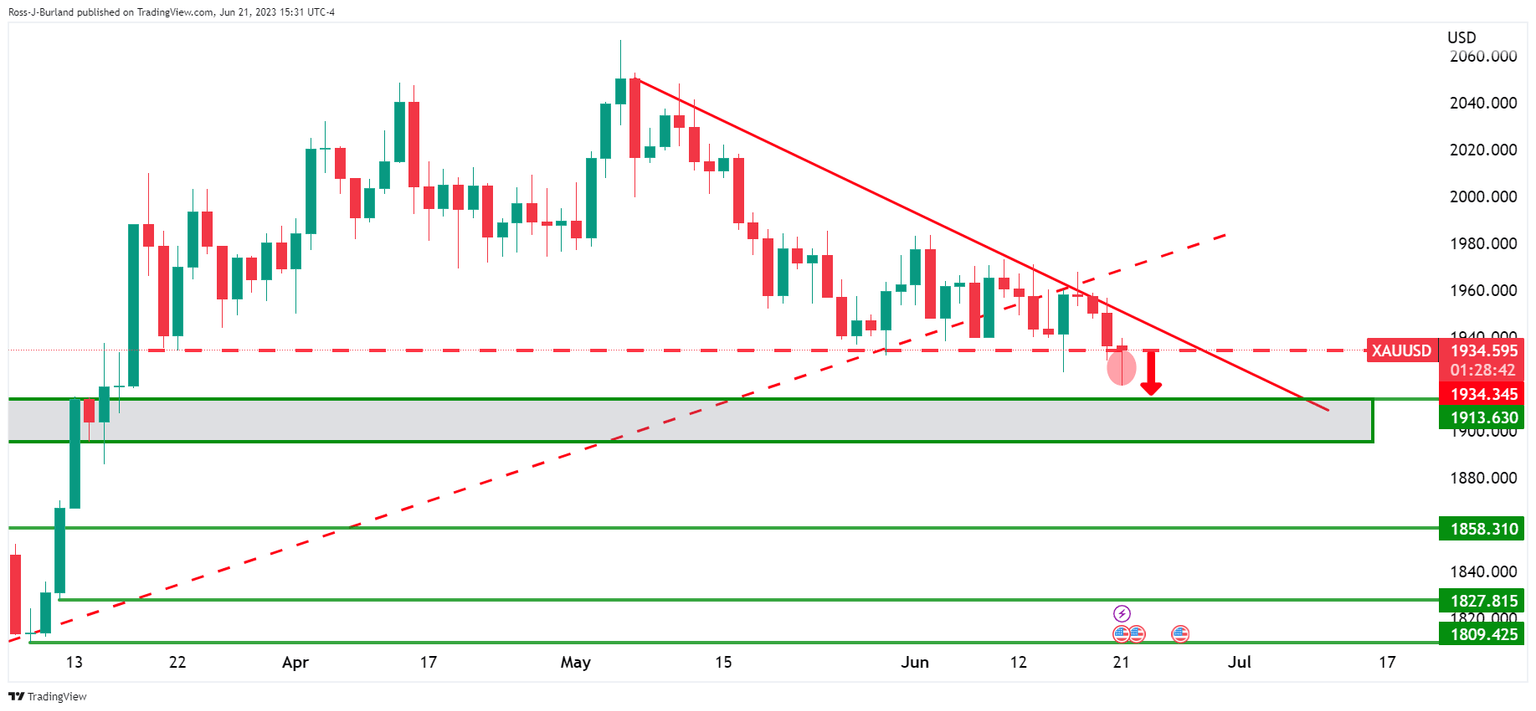

$1,910 was flagged as a target for the month and as we draw into the last week of the month, we have already achieved the level. Good job!

(Before)

The weekly chart was shown to favour a move lower.

(After)

So far, so good.

(Before)

It was stated, ''From a daily perspective, we are moving into testing the lows while on the front side of the bearish trend. The wick on the chart could've filled in the coming session and this could be the catalyst for a selling programme into support in and around $1,913.''

(After)

As illustrated, the weekly and daily chart analysis played out.

(Before)

It was then suggested that ''we might see a reversion at this point, into the M-formation's neckline.

(Before)

On the other hand, it also was pointed out that should the bears sink in their teeth, the $1,880s will be vulnerable:

(Before)

In any case, $1,937 was earmarked:

(After)

Target achieved.

Gold price, what next?

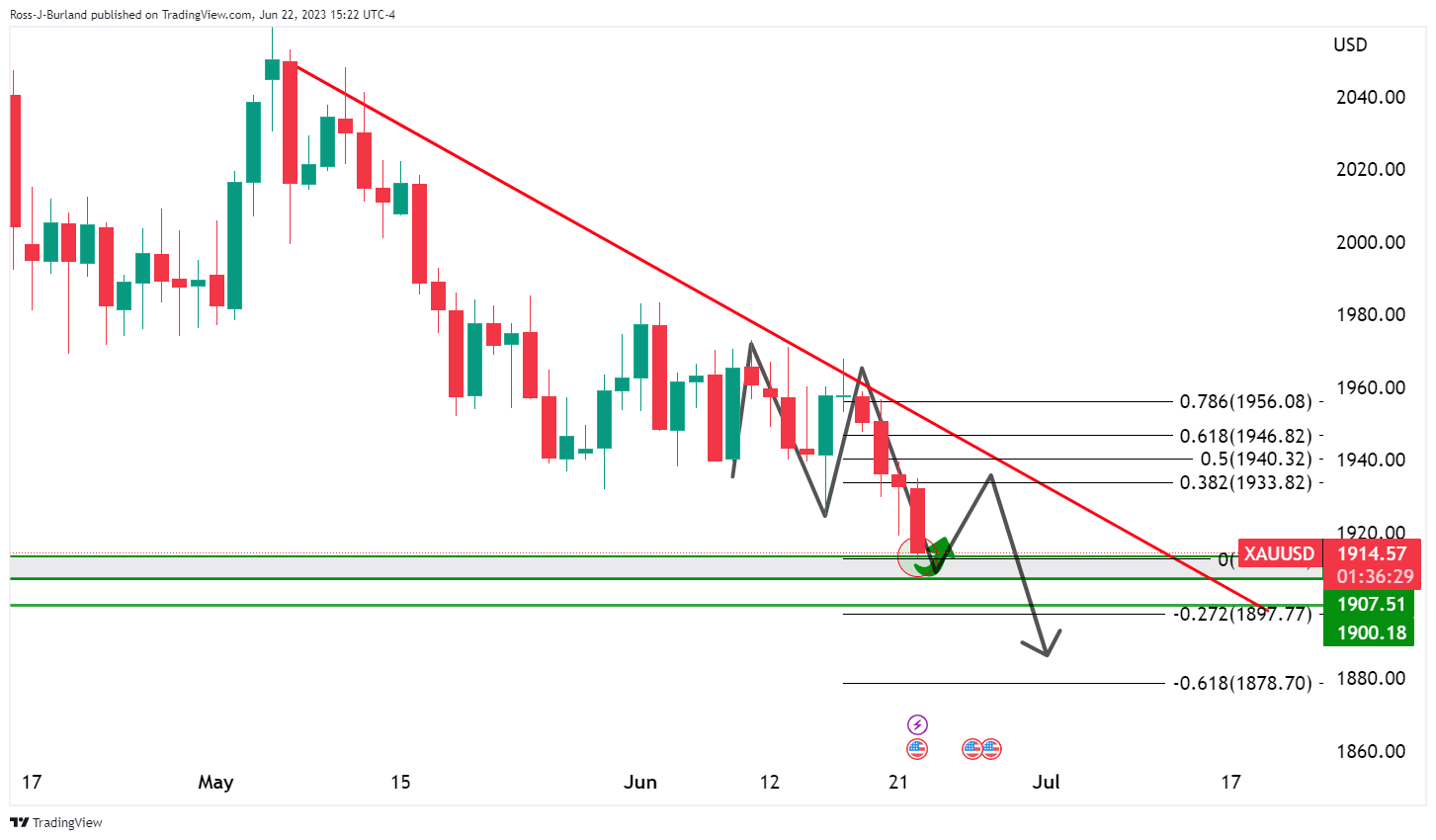

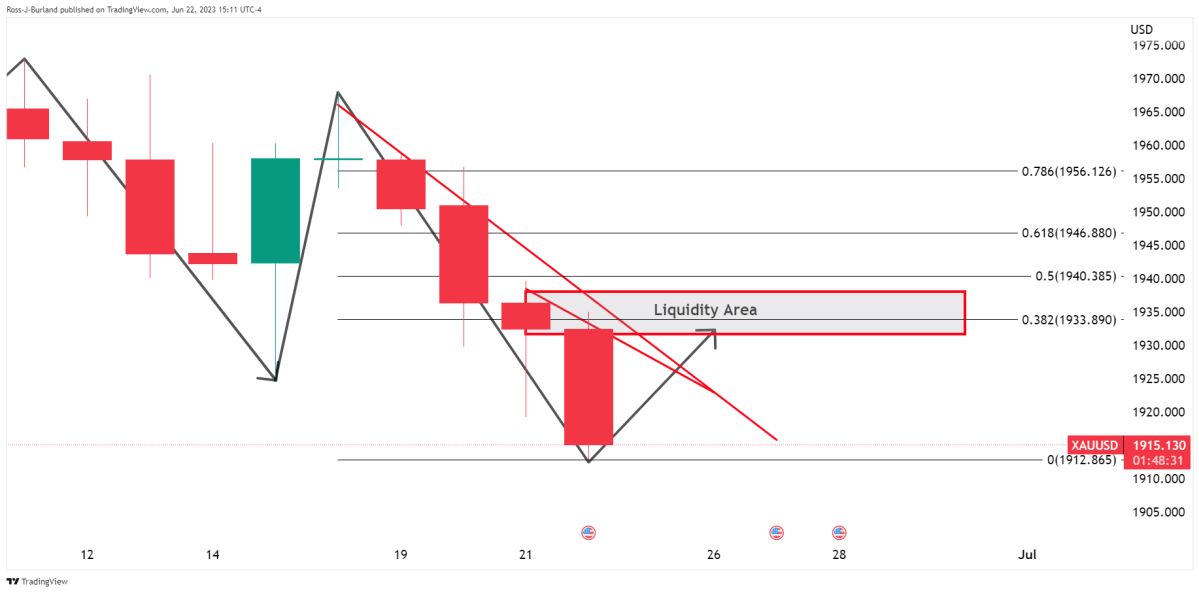

I think the Gold price will remain supported in the meanwhile and some more upside can be had, filling in Friday's wick, at least. The opening balance will play a key role in this regard. An inside day, for instance, on Monday and/or Tuesday could lead to a significant move higher from around Friday's lows with a view to take out the lower time trendline resistance with a firm daily close.

(Hourly chart)

(Daily chart)

In doing so, we could see a fuller test of the M-formations' neckline, soaking up sell-side liquidity as the fuel for the downside(longer-term bearish, see chart below), as markets digest the mixed sentiment surrounding the Federal Reserve and the Global/US economy.

Analysts at TD Securities had this to say about the Gold price:

Investors remain bearish the precious metals complex amid a hawkish tilt from global central banks, particularly after the latest increase in interest rates from the BoE. Indeed, price action in the yellow metal following the Fed decision suggests traders aren't as skeptical about the Fed's hawkish communication as originally anticipated, and rates pricing has also held fairly steady at just over 70% probability of a return to hikes in July. With that said, economic data will be key to the gold outlook moving forward, and as such, we still expect gold to do quite well in the months ahead.

The analysts are of the view that global data will continue to deteriorate enough to keep the Gold bears caged. This is where the focus will lie - Economic data!

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.