Gold, Chart of the Week: XAU/USD bulls take charge to challenge critical resistance

- Gold bulls eye a break of the resistance near $1,860 and a 50% mean reversion target on the weekly chart after that.

- The daily W-formation is problematic in the near future.

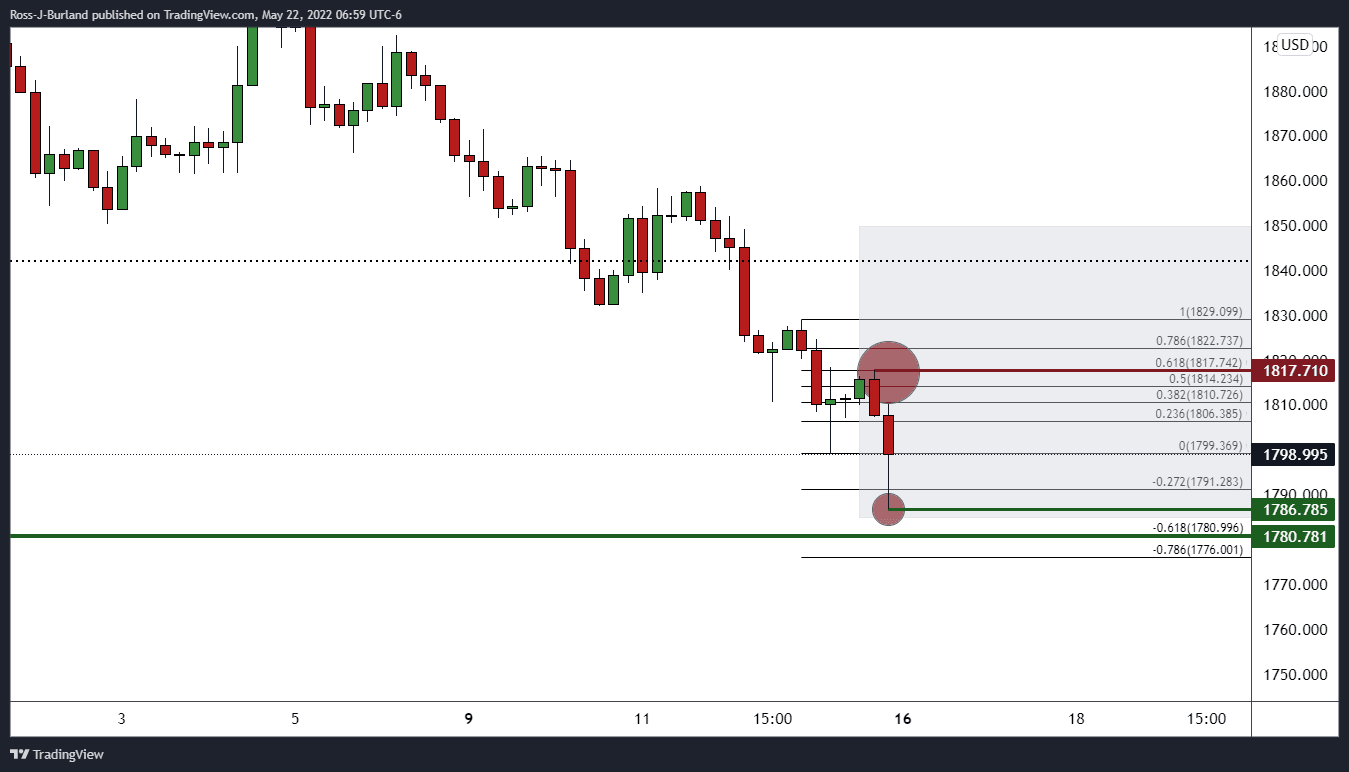

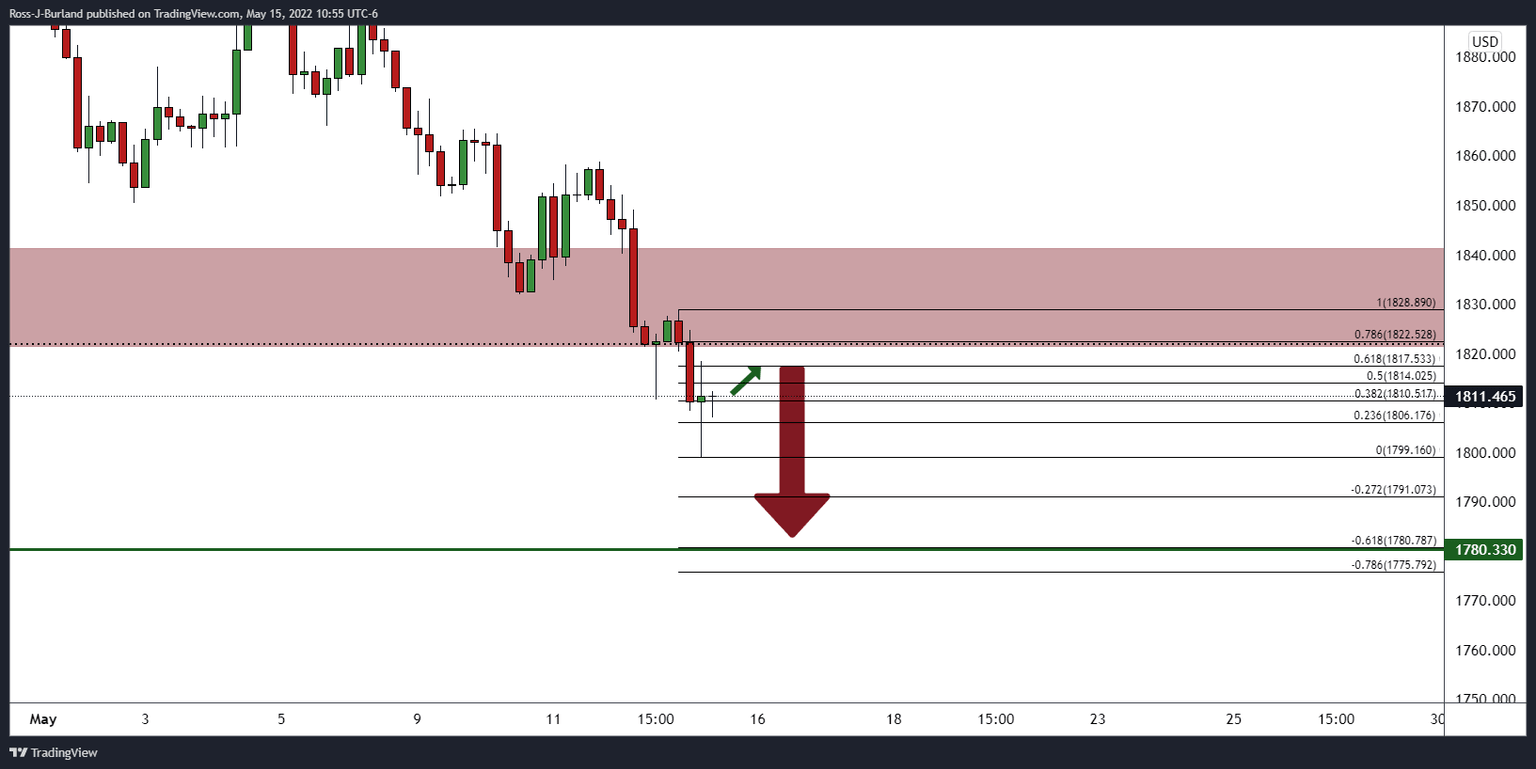

As per the prior week's analysis, the price moved in on a 61.8% Fibonacci retracement on the 4-hour time frame, but the weekly target of $1,780 remains elusive with the bulls moving on last week at $1,786.78.

Gold, prior analysis H4 chart

As illustrated, the price was forecasted to correct to the 61.8% ratio and then move lower towards the weekly $1,780 target. The outcome is as follows:

The price met the 61.8%-ratio for a perfect touch before melting towards the target. However, the bulls moved in $6.00 shy of the level. The price has since moved higher to test commitments in the vicinity of the $1,850 area:

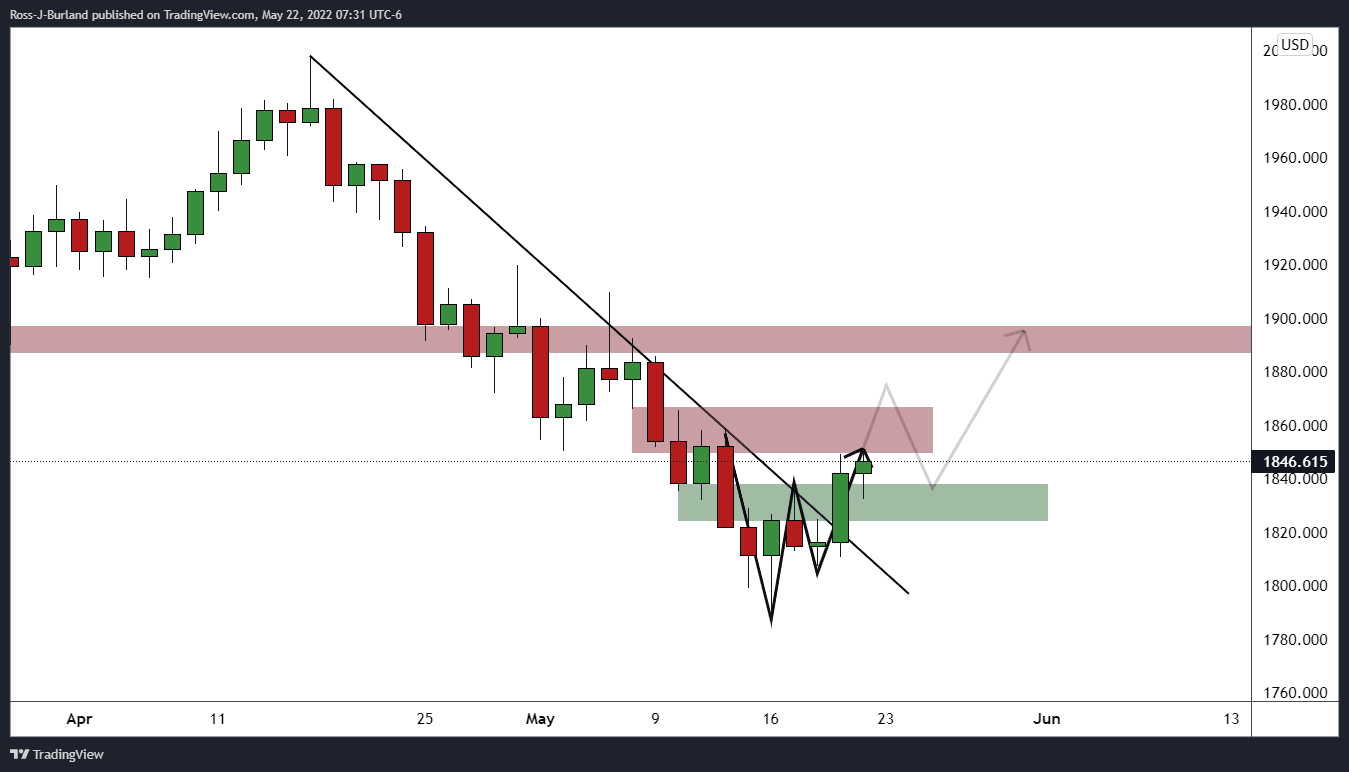

Gold, live H4 chart

The price has met resistance but the test of the 38.2% ratio has attracted the bulls. There are now prospects for a deeper correction of the weekly bearish impulse in order to mitigate the price imbalance on the four-hour chart towards $1,858. Thereafter, a 38.2% Fibo of the weekly impulse is located at 1,867:

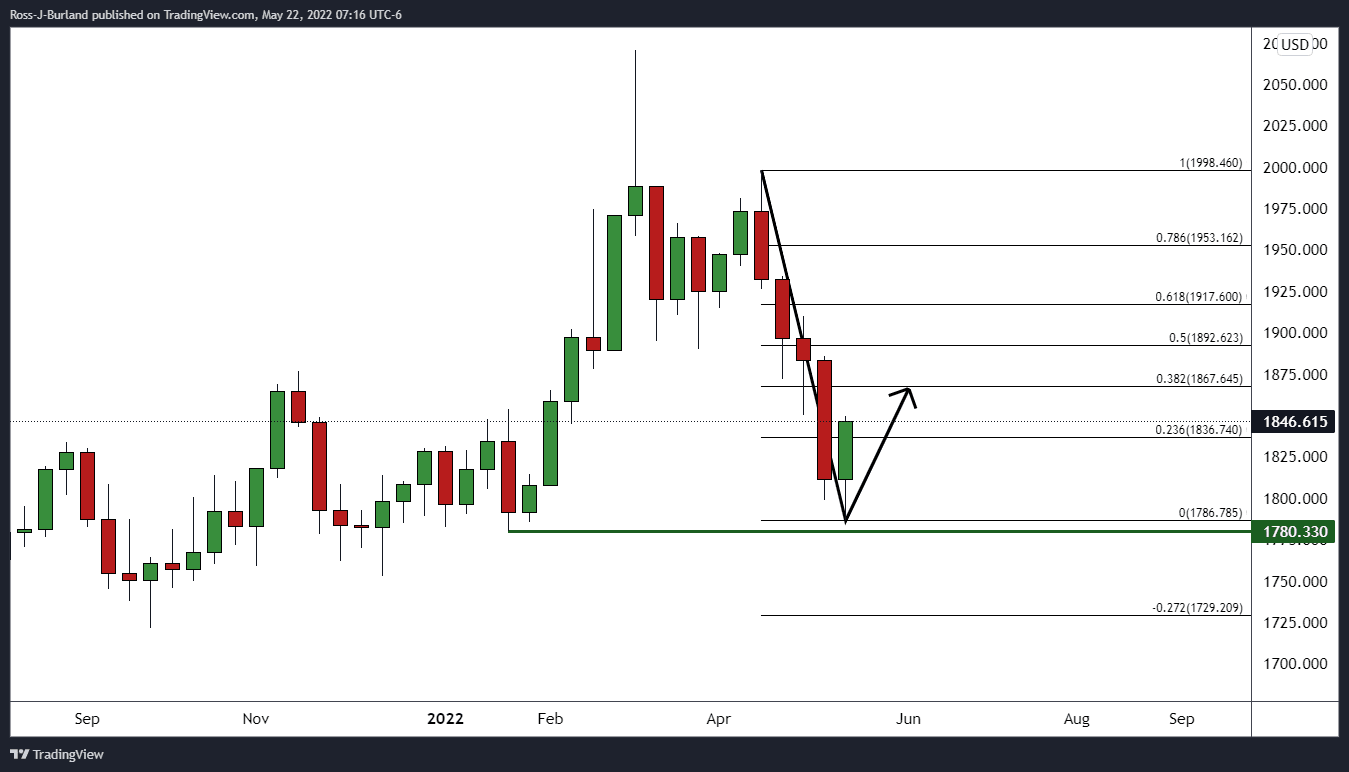

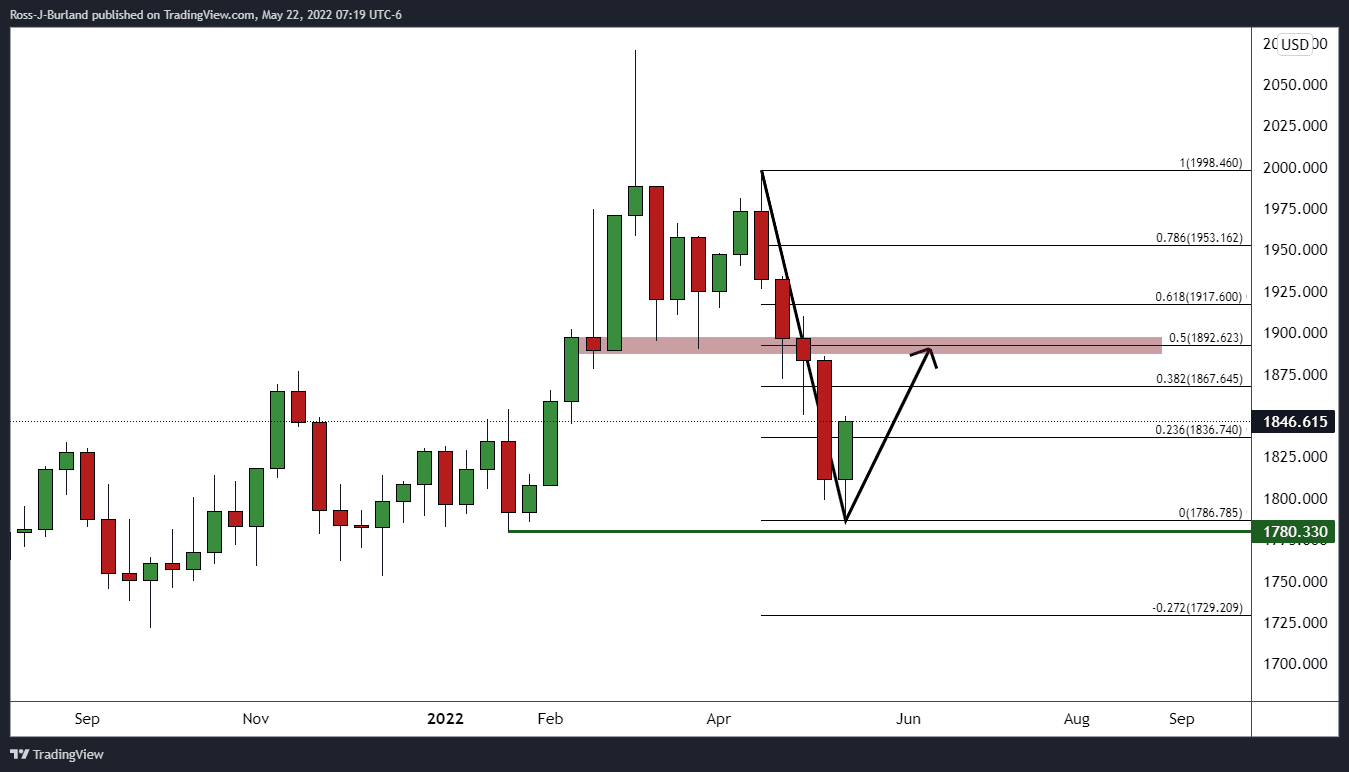

Gold weekly chart

If the bulls commit to the cause, then there will be prospects of a move higher in a 50% mean reversion:

Gold daily chart

For the meantime, the daily chart is compelling as well.

The price has carved out a W-formation. This is a reversion pattern and the price would be expected to restest the neckline in due course. However, a break of the resistance near $1,860 will be needed to open the pathway toward the 50% mean reversion target on the weekly chart for the days ahead.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.