- Gold is at a crossroads ahead of the US CPI event.

- Bulls look to fully test the commitments of the bears.

Gold rose to the highest in nearly three weeks on Friday despite a better-than-expected rise in US jobs in October. Counterintuitively, US bond yields and the US dollar fell even as the data likely firms the Federal Reserve's determination to slow the economy as inflation stays high. The Fed on Wednesday set its target interest rate another 75 basis points higher to a range between 3.75% and 4.00%. Chair Jerome Powell said later at a press conference that it was "very premature" to think about slowing the pace of monetary tightening.

However, investors' risk appetite was running reasonably high on Friday, following signals from China that the government could relax some of its stringent restrictions around COVID. ''Following this Friday's massive gold and commodity rally, driven by speculation China will moderate COVID restrictions and somewhat mixed payrolls, we look for specs to again grow the shorts they covered at the end of this week,'' analysts at TD Securities said.

''At $1,680/oz, the yellow metal is at a technical point that may easily see a sharp reversal. Indeed, with inflation still a big problem and the US economy running hot, rates on the front end will continue to rise, and the dollar will be firm, which prompts us to think that a correction is on the cards starting in the not-too-distant future.''

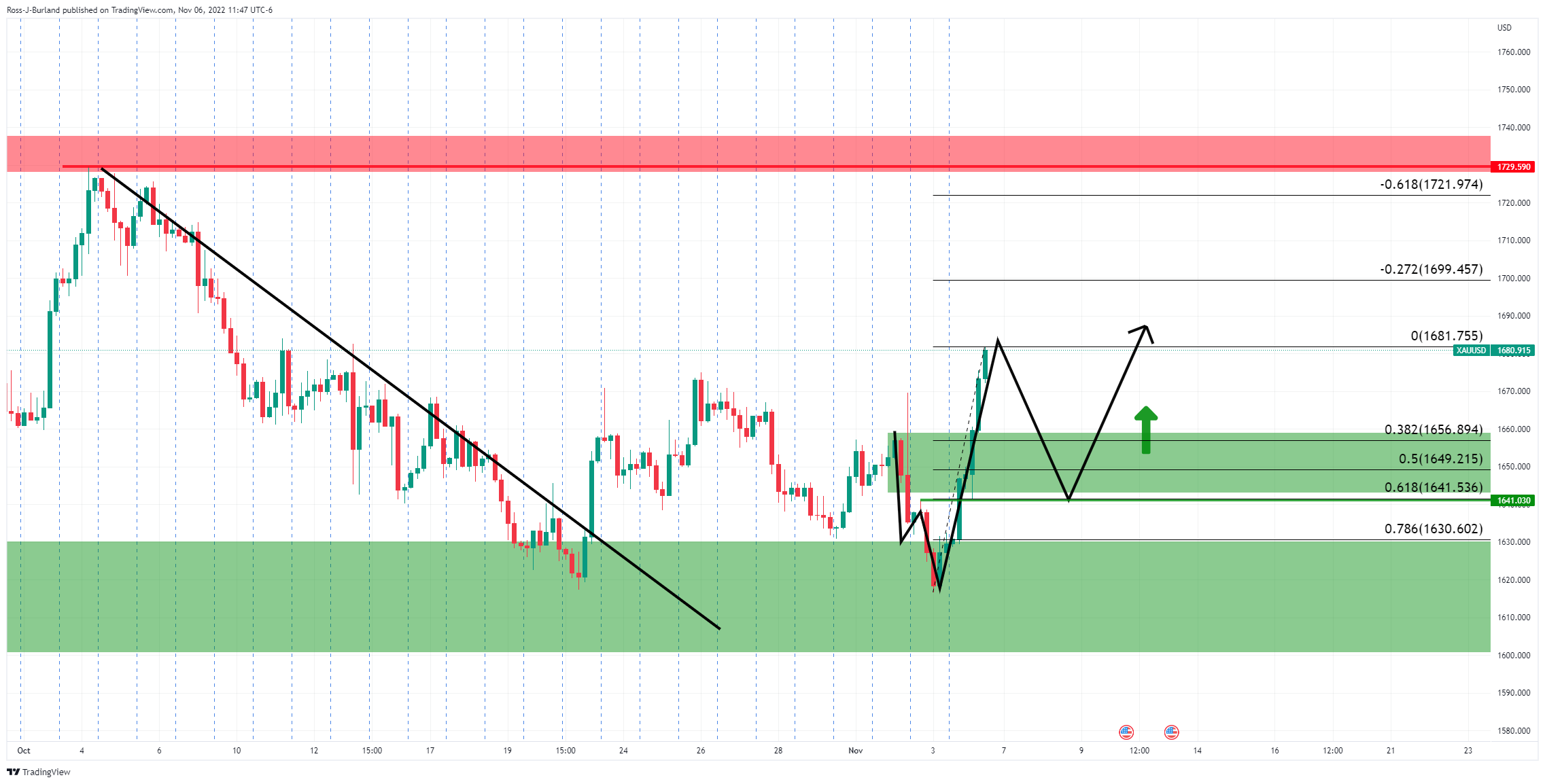

Meanwhile, the charts see the price pressured in a firm downtrend and there are prospects of a bull correction to fully test the bear's commitments ahead of the US Consumer Price Index data for the forthcoming week.

Gold weekly charts

The price is accumulating at a prior structure in three weekly bottoms.

That W-formation looks menacing for the week ahead with prospects of a push into the trendline and when coupled with the following Crab harmonic pattern on the daily chart:

Gold daily charts

The price slid out of a micro trendline and is now accumulating on the backside which opens risks of a move higher.

Gold H1 chart

The last leg of the W-formation is overextended giving rise to the risks of a correction prior to a sizeable push to the upside again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Next on the upside comes the 2025 peak

AUD/USD maintained its constructive outlook well and sound, advancing for the fourth day in a row and surpassing the key barrier at 0.6300 the figure with certain conviction.

EUR/USD: Further gains retarget 1.1470

EUR/USD alternated gains with losses around the 1.1350-1.1360 band in a context of further weakness in the US Dollar and a generalised improved mood in the risk-associated assets.

Gold trades with marked losses near $3,200

Gold seems to have met some daily contention around the $3,200 zone on Monday, coming under renewed downside pressure after hitting record highs near $3,250 earlier in the day, always amid alleviated trade concerns. Declining US yields, in the meantime, should keep the downside contained somehow.

Solana ETF to debut in Canada after approval from regulators

Solana ETF will go live in Canada this week after the Ontario Securities Commission greenlighted applications from Purpose, Evolve, CI and 3iQ. The products will allow staking, enabling investors to earn yield on their holdings.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.