Gold, Chart of the Week: XAU/USD at a crossroads ahead of Fed, short squeeze on the cards?

Gold prices slipped on Friday even as treasury yields eased as the dollar rose. However, the price ended higher for the third straight week:

Gold weekly and daily charts

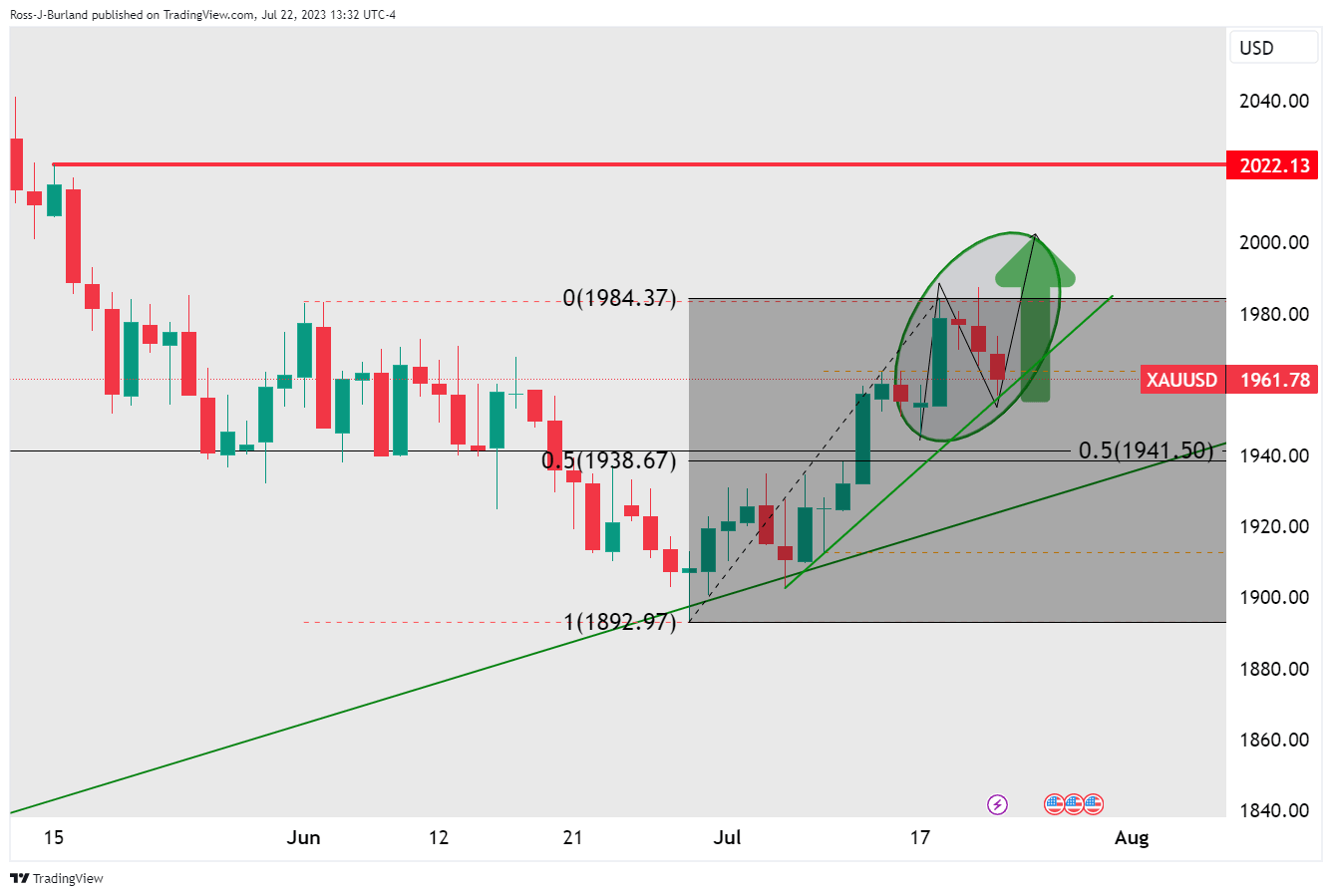

The wick leaves bullish prospects on the lower time frames as follows:

However, let's take a step back.

Firstly, the US Dollar rose, making gold more expensive for international buyers at the end of the week and the third day of lower closes in the Gold price comes ahead of next week's two-day meeting of the Federal Reserve's policy committee.

The Fed is expected to end with a 25 basis point hike to US interest rates, although for most gold investors it is the medium to longer term that matters. But following reports that inflation and the economy are slowing, few expect the central bank to further raise rates this year and some have begun expecting it to begin rolling back its hikes in the new year.

''The Fed is widely expected to resume policy rate increases next week following its decision to pause in June. While we anticipate that July will bring the last rate hike of this cycle, we don't think the Committee is comfortable signalling that shift yet,'' analysts at TD Securities, however, argued. ''Indeed, Fed Chairman, Jerome Powell, will likely reiterate that an additional rate increase this year still holds.''

This leaves gold price at a crossroads on the charts and this can go either way.

Let's delve into the charts:

Gold, technical top-down analysis

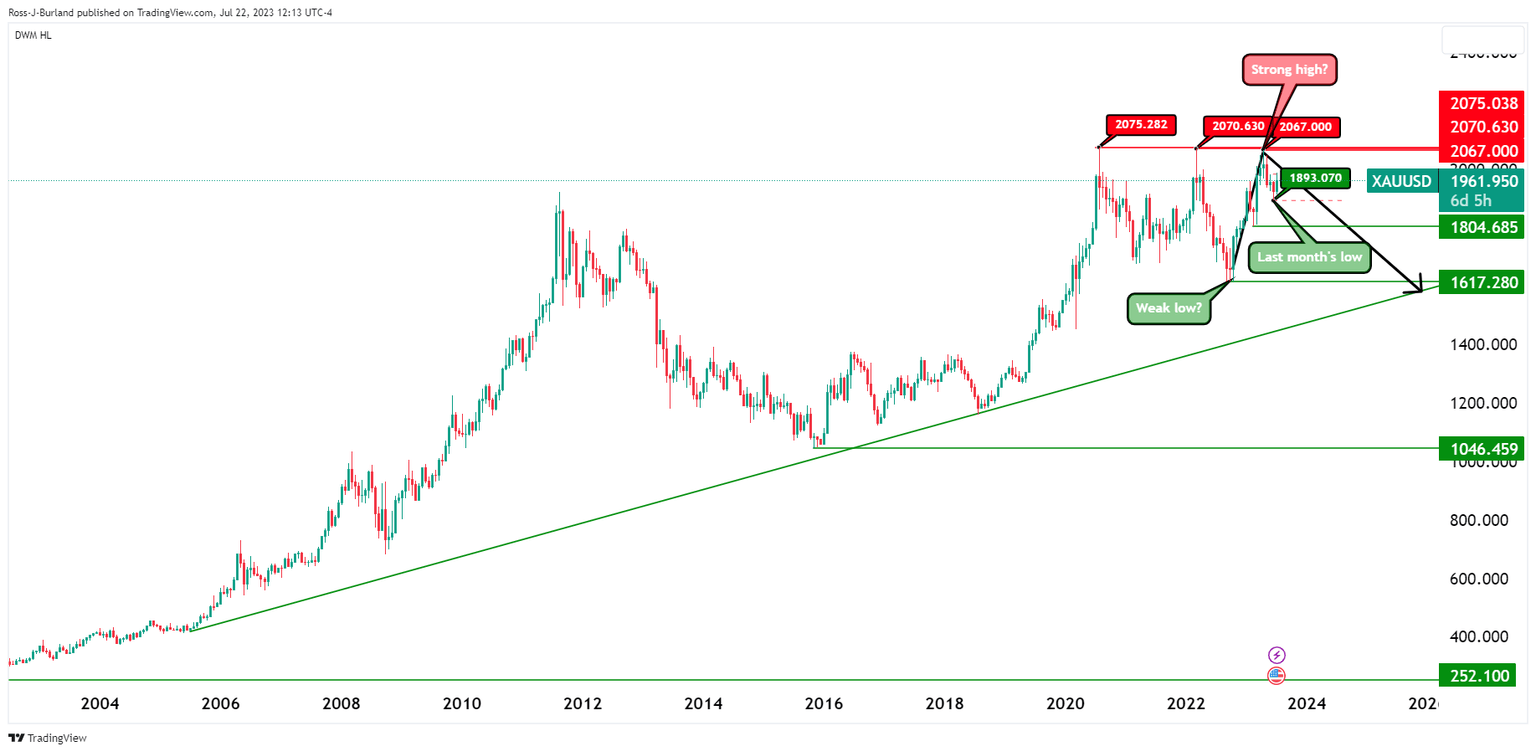

On the 3-week charts below, we can see that the gold price has failed to make a higher high within the bullish cycle, so far...

if bears commit, then there is a risk of a significant downturn in the Gold price towards the dominant trendline support and to break key structure near $1,617.

Gold price at a crossroads

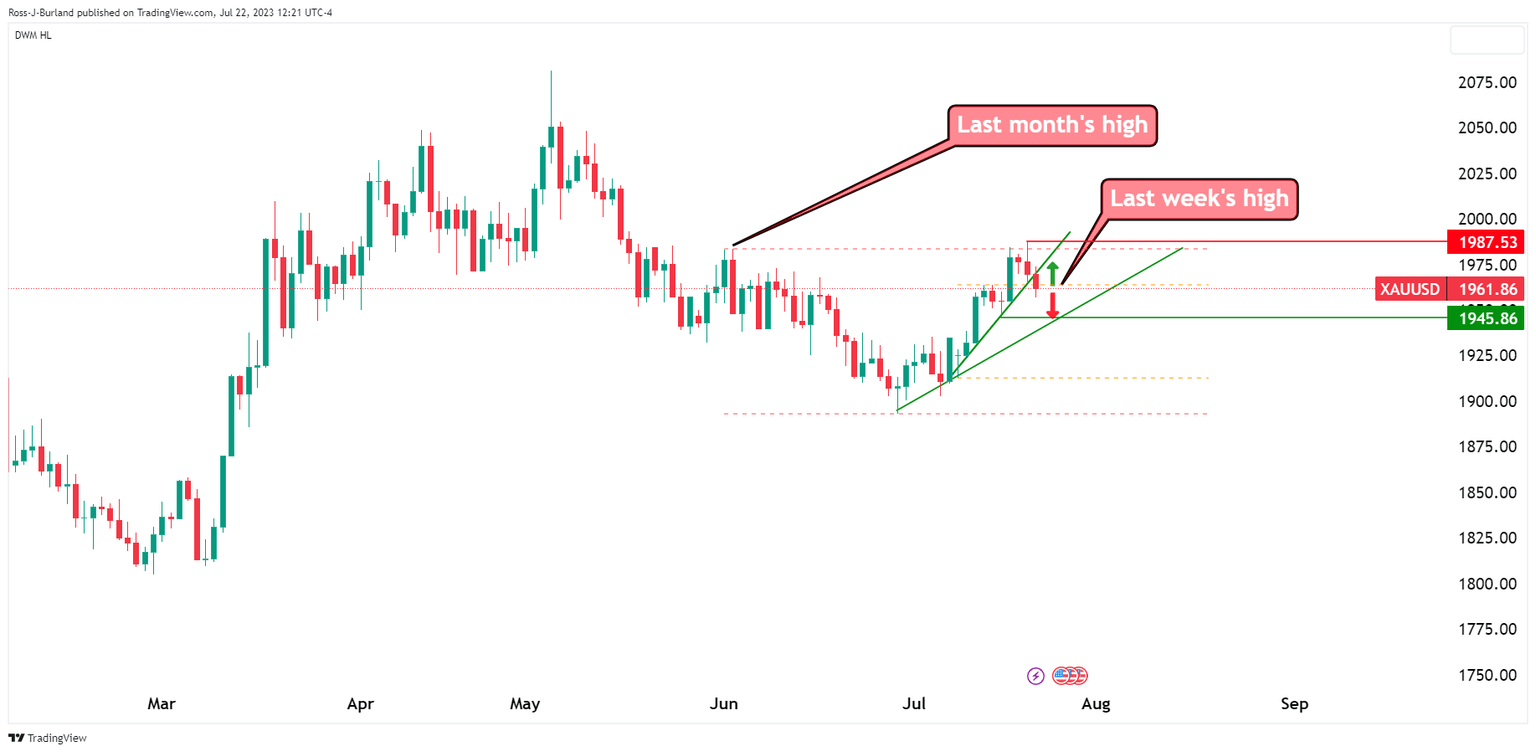

Meanwhile, and coming back to the near-term outlook, we can see that the Gold price is at a crossroads:

The price broke last week's and month's highs but is failing to convince as the bears move in. the correction could be headed towards a test of the recent structural lows near $1,945:

Gold price, bearish outlook

Gold price bullish outlook

On the other hand, we could see the price regain its northerly trajectory and break to close above last month's highs.

Gold price opening range expectations

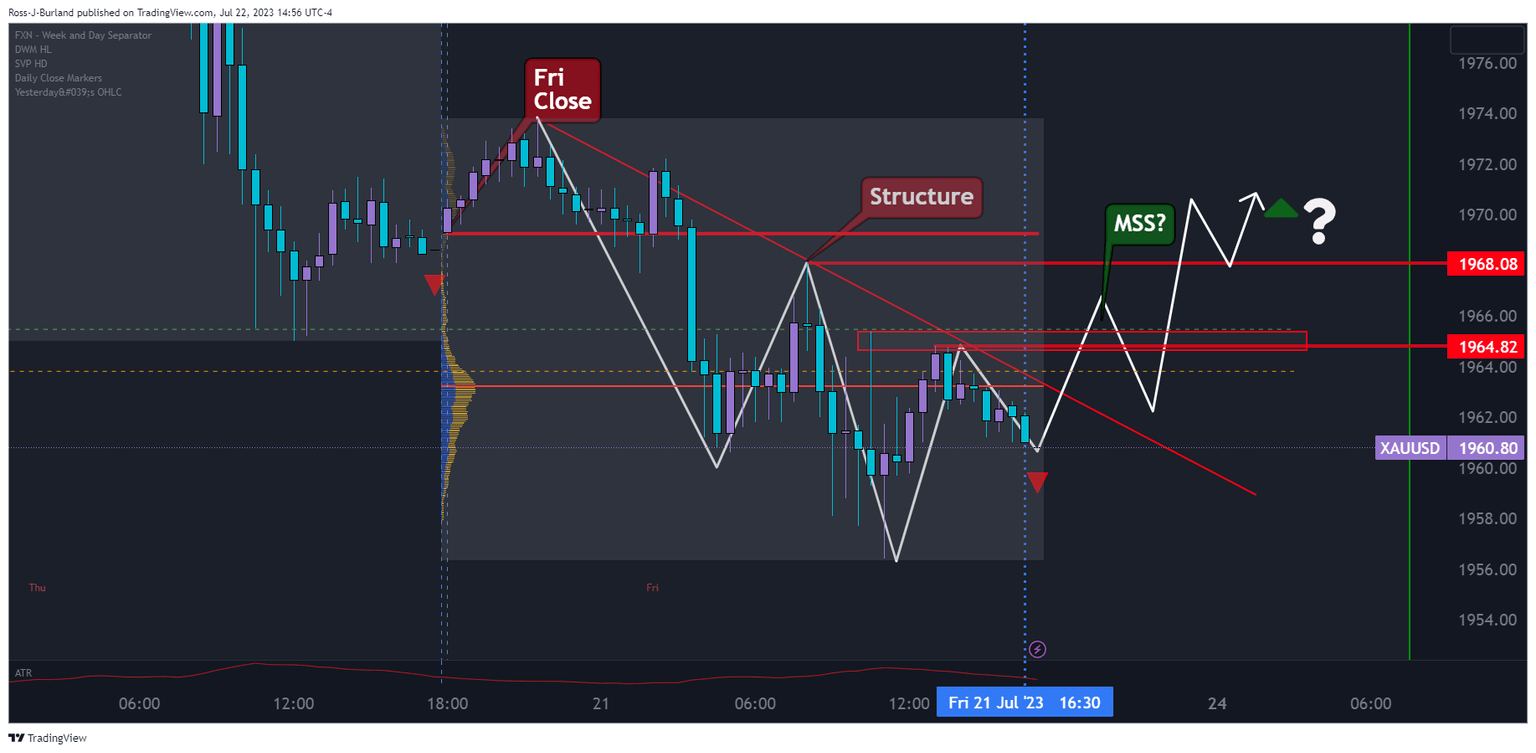

To start the week on Monday, it is worth noting that we had a failed break of the week's and last month's highs on Thursday. This then resulted in two consecutive days of shorts and lower lows on the third day of lower closes. we also went on to break the prior day's and week's lows on Friday. All of this is giving us information:

1) Longs are trapped up high;

2) Shorts are in the money;

3) We had three sessions of drop on Friday that broke the prior week's lows.

This all points towards a short squeeze to trap bears for the initial balance from beneath the prior week's and Thursday's lows:

(15 and 30 min charts, above and below)

A break above $1,964 would create a market structure shift, MSS, and add conviction to the bullish bias for next week's opening.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.